Investors Continue Waiting On Sidelines For Fujian Aonong Biological Technology Group Incorporation Limited (SHSE:603363)

Investors Continue Waiting On Sidelines For Fujian Aonong Biological Technology Group Incorporation Limited (SHSE:603363)

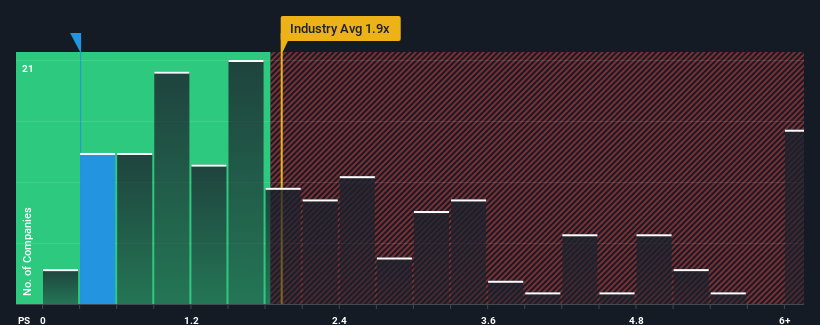

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Fujian Aonong Biological Technology Group Incorporation Limited (SHSE:603363) is a stock worth checking out, seeing as almost half of all the Food companies in China have P/S ratios greater than 1.9x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

你可能會認為,以0.3倍的市銷率(或“P/S”)福建奧農生物科技集團有限公司上海證券交易所股票代碼:603363)是一隻值得一看的股票,因為中國幾乎一半的食品公司的本益比都超過1.9倍,即使是本益比高於4倍的S也不是不尋常。儘管如此,我們需要更深入地挖掘,以確定P/S降低是否有合理的基礎。

View our latest analysis for Fujian Aonong Biological Technology Group Incorporation

查看我們對福建奧農生物科技集團有限公司的最新分析

How Fujian Aonong Biological Technology Group Incorporation Has Been Performing

福建奧農生物科技集團公司如何表現

Recent times have been advantageous for Fujian Aonong Biological Technology Group Incorporation as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

最近對福建奧農生物科技集團有限公司來說是有利的,因為它的收入增長速度比大多數其他公司都快。一種可能性是,本益比/S比率較低,因為投資者認為,未來這種強勁的營收表現可能不那麼令人印象深刻。如果你喜歡這家公司,你會希望情況並非如此,這樣你就可以在它不再受青睞的時候買入一些股票。

How Is Fujian Aonong Biological Technology Group Incorporation's Revenue Growth Trending?

福建奧農生物科技集團營收增長趨勢如何?

In order to justify its P/S ratio, Fujian Aonong Biological Technology Group Incorporation would need to produce sluggish growth that's trailing the industry.

為了證明其本益比與S的比率是合理的,福建奧農生物科技集團有限公司需要創造出落後於行業的低迷增長。

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The latest three year period has also seen an excellent 219% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

回顧過去一年,該公司營收實現了23%的不同尋常的增長。在最近三年中,得益於其短期表現,該公司的整體收入也實現了219%的出色增長。因此,股東肯定會歡迎這些中期收入增長率。

Looking ahead now, revenue is anticipated to climb by 28% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

根據唯一一位跟蹤該公司的分析師的說法,展望未來一年,收入預計將增長28%。與此同時,該行業的其他行業預計只會增長15%,這顯然不那麼有吸引力。

With this information, we find it odd that Fujian Aonong Biological Technology Group Incorporation is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

有了這些資訊,我們發現奇怪的是,福建奧農生物科技集團的本益比低於行業。看起來大多數投資者根本不相信該公司能夠實現未來的增長預期。

The Bottom Line On Fujian Aonong Biological Technology Group Incorporation's P/S

福建奧農生物科技集團有限公司P/S的底線

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

通常情況下,在做出投資決策時,我們會告誡不要過度解讀本益比,儘管它可以充分揭示其他市場參與者對該公司的看法。

A look at Fujian Aonong Biological Technology Group Incorporation's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

看看福建奧農生物科技集團的收入就會發現,儘管未來的增長預期很高,但其本益比S比我們預期的要低得多。本益比低迷的原因可能在於市場價格反映出的風險。儘管由於該公司預計將實現高增長,股價暴跌的可能性似乎不大,但市場似乎確實有一些猶豫。

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Fujian Aonong Biological Technology Group Incorporation with six simple checks.

在該公司的資產負債表上可以找到許多其他重要的風險因素。您可以通過我們的免費福建奧農生物科技集團公司資產負債表分析

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果強大的盈利公司激起了你的想像力,那麼你就會想要看看這個。免費本益比較低(但已證明它們可以增加收益)的有趣公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

In order to justify its P/S ratio, Fujian Aonong Biological Technology Group Incorporation would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Fujian Aonong Biological Technology Group Incorporation would need to produce sluggish growth that's trailing the industry.