Chengdu Huasun Technology Group Inc. , LTD.'s (SZSE:000790) Business Is Trailing The Industry But Its Shares Aren't

Chengdu Huasun Technology Group Inc. , LTD.'s (SZSE:000790) Business Is Trailing The Industry But Its Shares Aren't

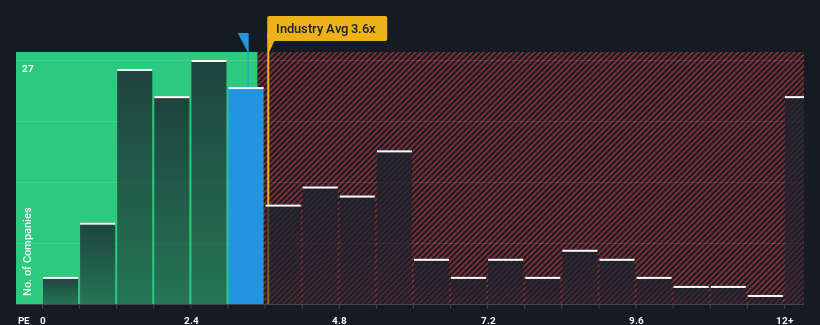

With a median price-to-sales (or "P/S") ratio of close to 3.6x in the Pharmaceuticals industry in China, you could be forgiven for feeling indifferent about Chengdu huasun technology group Inc. , LTD.'s (SZSE:000790) P/S ratio of 3.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

中國制藥行業的市銷率中值接近3.6倍,你對此漠不關心也是情有可原的成都華勝科技集團有限公司S(SZSE:000790)P/S比率為3.3倍。儘管這可能不會令人驚訝,但如果P/S比率不合理,投資者可能會錯過潛在的機會,或者忽視迫在眉睫的失望情緒。

View our latest analysis for Chengdu huasun technology group

查看我們對成都華順科技集團的最新分析

What Does Chengdu huasun technology group's P/S Mean For Shareholders?

成都華順科技集團P/S對股東意味著什麼?

For example, consider that Chengdu huasun technology group's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

例如,考慮到成都華順科技集團最近的財務表現一直很差,因為它的收入一直在下降。一種可能性是,S的本益比是溫和的,因為投資者認為,該公司在不久的將來可能仍會採取足夠的措施,與更廣泛的行業保持一致。如果你喜歡這家公司,你至少會希望情況是這樣的,這樣你就可以在它不太受歡迎的時候買入一些股票。

What Are Revenue Growth Metrics Telling Us About The P/S?

收入增長指標告訴我們有關本益比的哪些資訊?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chengdu huasun technology group's to be considered reasonable.

有一個固有的假設,即一家公司的本益比與S的本益比應該與行業持平,就像成都華順科技集團的本益比被認為是合理的。

Retrospectively, the last year delivered a frustrating 7.4% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 33% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

回顧過去一年,該公司的營收令人沮喪地下降了7.4%。然而,在此之前的幾年非常強勁,這意味著它仍然能夠在過去三年中實現令人印象深刻的33%的總收入增長。儘管這是一段坎坷的旅程,但公平地說,最近的收入增長對公司來說已經綽綽有餘。

Comparing that to the industry, which is predicted to deliver 178% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

與預計在未來12個月內實現178%增長的行業相比,根據最近的中期年化收入結果,該公司的增長勢頭較弱。

In light of this, it's curious that Chengdu huasun technology group's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

有鑒於此,令人好奇的是,成都華順科技集團的P/S與大多數其他公司坐在一起。顯然,該公司的許多投資者並不像最近的情況所顯示的那樣悲觀,他們現在不願拋售自己的股票。維持這些價格將很難實現,因為最近的收入趨勢可能最終會拖累股價。

The Final Word

最後的結論

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

通常情況下,在做出投資決策時,我們會告誡不要過度解讀本益比,儘管它可以充分揭示其他市場參與者對該公司的看法。

Our examination of Chengdu huasun technology group revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

我們對成都華順科技集團的調查顯示,其糟糕的三年營收趨勢並沒有像我們預期的那樣導致本益比下降,因為它們看起來比當前的行業前景更糟糕。當我們看到營收疲軟且增長慢於行業增長時,我們懷疑該公司股價有下跌的風險,使本益比/S重新符合預期。除非近期的中期狀況有所改善,否則很難接受當前股價為公允價值。

And what about other risks? Every company has them, and we've spotted 1 warning sign for Chengdu huasun technology group you should know about.

還有其他風險呢?每家公司都有它們,我們已經發現成都華勝科技集團的1個警示標誌你應該知道。

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果過去收益增長穩健的公司符合你的胃口,你可能想看看這個免費其他盈利增長強勁、本益比較低的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chengdu huasun technology group's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chengdu huasun technology group's to be considered reasonable.