Why Investors Shouldn't Be Surprised By Exagen Inc.'s (NASDAQ:XGN) 31% Share Price Plunge

Why Investors Shouldn't Be Surprised By Exagen Inc.'s (NASDAQ:XGN) 31% Share Price Plunge

Exagen Inc. (NASDAQ:XGN) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

Exagen Inc.納斯達克(Sequoia Capital:XGN)上個月股價下跌31%,等待著什麼事情發生的股東受到了打擊。過去30天的下跌為股東們艱難的一年畫上了句號,股價在此期間下跌了32%。

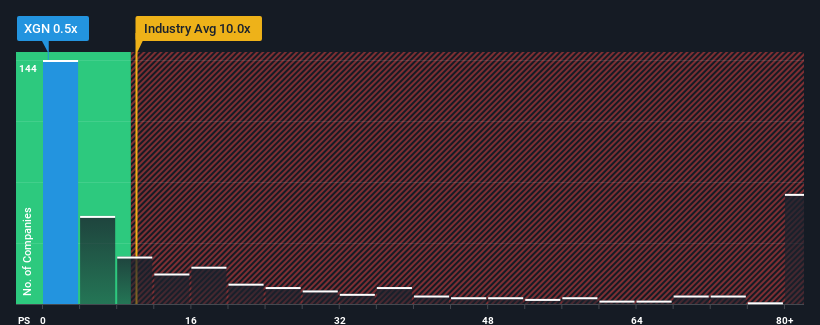

After such a large drop in price, Exagen may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 10x and even P/S higher than 40x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

在經歷瞭如此大的價格下跌後,埃克森美孚目前可能正在發出非常看漲的信號,其市售比(或稱“P/S”)為0.5倍,因為在美國生物科技行業,幾乎一半的公司的P/S比率超過10倍,甚至P/S高於40倍的情況也並不少見。然而,僅僅從表面上看待P/S是不明智的,因為可能會有一個解釋為什麼它如此有限。

See our latest analysis for Exagen

查看我們對Exagen的最新分析

What Does Exagen's Recent Performance Look Like?

埃克森美孚最近的表現如何?

Exagen certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

埃克森美孚最近肯定做得很好,因為它的收入增長速度超過了大多數其他公司。或許市場預期未來營收表現將跳水,這令本益比/S受到壓制。如果該公司設法堅持到底,那麼投資者應該得到與其收入數位相匹配的股價回報。

How Is Exagen's Revenue Growth Trending?

埃克森美孚的收入增長趨勢如何?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Exagen's to be considered reasonable.

有一個固有的假設,即一家公司的表現應該遠遠遜於行業,才能讓埃克森美孚這樣的P/S比率被認為是合理的。

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The latest three year period has also seen an excellent 35% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

回顧過去一年,該公司營收實現了23%的不同尋常的增長。在最近三年中,得益於其短期表現,該公司的整體收入也實現了35%的出色增長。因此,我們可以從確認該公司在這段時間內在收入增長方面做得很好開始。

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 12% each year over the next three years. With the industry predicted to deliver 103% growth per year, the company is positioned for a weaker revenue result.

展望未來,跟蹤該公司的六位分析師的預測顯示,未來三年,該公司的收入將以每年12%的速度增長。由於該行業預計每年將實現103%的增長,該公司將面臨較弱的收入結果。

With this in consideration, its clear as to why Exagen's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

考慮到這一點,很明顯,為什麼埃克森美孚的P/S落後於行業同行。顯然,當該公司可能著眼於一個不那麼繁榮的未來時,許多股東並不願意繼續持有。

The Final Word

最後的結論

Exagen's P/S looks about as weak as its stock price lately. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

埃克森美孚的P/S最近看起來和它的股價一樣疲軟。雖然市銷率不應該成為你是否買入一隻股票的決定性因素,但它是一個很好的收入預期晴雨錶。

As we suspected, our examination of Exagen's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

正如我們所懷疑的那樣,我們對埃克森美孚分析師預測的研究顯示,其糟糕的營收前景是導致其低本益比的原因之一。目前,投資者認為營收改善的潛力還不夠大,不足以證明更高的本益比是合理的。除非這些條件得到改善,否則它們將繼續對股價在這些水準附近形成障礙。

It is also worth noting that we have found 5 warning signs for Exagen that you need to take into consideration.

同樣值得注意的是,我們發現埃克森的5個警告信號這是你需要考慮的。

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是確保你尋找的是一家偉大的公司,而不僅僅是你遇到的第一個想法。因此,如果不斷增長的盈利能力符合你對一家偉大公司的看法,不妨看看這一點免費近期收益增長強勁(本益比較低)的有趣公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

Exagen certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Exagen certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.