Lacklustre Performance Is Driving Hubei Kailong Chemical Group Co., Ltd.'s (SZSE:002783) Low P/S

Lacklustre Performance Is Driving Hubei Kailong Chemical Group Co., Ltd.'s (SZSE:002783) Low P/S

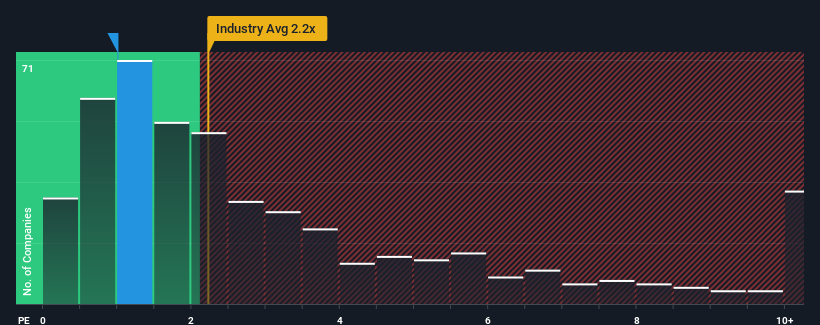

With a price-to-sales (or "P/S") ratio of 1x Hubei Kailong Chemical Group Co., Ltd. (SZSE:002783) may be sending bullish signals at the moment, given that almost half of all the Chemicals companies in China have P/S ratios greater than 2.2x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

以1倍的價格銷售比(或“P/S”)湖北凱龍化工集團有限公司。深交所(SZSE:002783)目前可能正在發出看漲信號,因為中國幾乎一半的化工公司的本益比高於S的2.2倍,即使本益比高於S的5倍也並不罕見。然而,P/S可能是有原因的,需要進一步調查才能確定是否合理。

View our latest analysis for Hubei Kailong Chemical Group

查看我們對湖北凱龍化工集團的最新分析

What Does Hubei Kailong Chemical Group's P/S Mean For Shareholders?

湖北凱龍化工集團P/S對股東意味著什麼?

Revenue has risen firmly for Hubei Kailong Chemical Group recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

湖北凱龍化工集團最近收入穩步增長,這是令人欣慰的。或許市場預期這一可接受的營收表現將大幅跳水,這令本益比/S受到壓制。如果這一點沒有實現,那麼現有股東有理由對未來股價的走勢持樂觀態度。

What Are Revenue Growth Metrics Telling Us About The Low P/S?

收入增長指標告訴我們關於低本益比的哪些資訊?

In order to justify its P/S ratio, Hubei Kailong Chemical Group would need to produce sluggish growth that's trailing the industry.

為了證明其本益比與S的比率是合理的,湖北凱龍化工集團需要實現落後於行業的低迷增長。

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Pleasingly, revenue has also lifted 107% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

如果我們回顧去年的收入增長,該公司公佈了12%的合理增長。令人欣喜的是,營收也較三年前增長了107%,這在一定程度上要歸功於過去12個月的增長。因此,公平地說,最近的收入增長對公司來說是一流的。

This is in contrast to the rest of the industry, which is expected to grow by 31% over the next year, materially higher than the company's recent medium-term annualised growth rates.

這與其他行業形成鮮明對比,預計明年該行業將增長31%,大大高於該公司最近的中期年化增長率。

With this in consideration, it's easy to understand why Hubei Kailong Chemical Group's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

考慮到這一點,就不難理解為什麼湖北凱龍化工集團的P/S沒有達到行業同行的標準。顯然,許多股東對持有他們認為將繼續落後於整個行業的股票感到不舒服。

The Final Word

最後的結論

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

一般來說,我們傾向於將市銷率的使用限制在確定市場對公司整體健康狀況的看法上。

As we suspected, our examination of Hubei Kailong Chemical Group revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

正如我們懷疑的那樣,我們對湖北凱龍化工集團的調查顯示,該集團三年的營收趨勢是導致其低本益比的原因之一,因為它們看起來比當前行業預期的要差。目前,股東們正在接受S的低本益比,因為他們承認,未來的收入可能不會帶來任何令人愉快的驚喜。如果近期的中期營收趨勢持續下去,很難看到該公司股價在短期內出現逆轉。

It is also worth noting that we have found 4 warning signs for Hubei Kailong Chemical Group (2 make us uncomfortable!) that you need to take into consideration.

同樣值得注意的是,我們發現湖北凱龍化工集團的4個警示標誌(2讓我們感到不舒服!)這是你需要考慮的。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

當然了,利潤豐厚、盈利增長迅速的公司通常是更安全的押注那就是。所以你可能想看看這個免費其他本益比合理、盈利增長強勁的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

In order to justify its P/S ratio, Hubei Kailong Chemical Group would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Hubei Kailong Chemical Group would need to produce sluggish growth that's trailing the industry.