It's Probably Less Likely That Unifi, Inc.'s (NYSE:UFI) CEO Will See A Huge Pay Rise This Year

It's Probably Less Likely That Unifi, Inc.'s (NYSE:UFI) CEO Will See A Huge Pay Rise This Year

Key Insights

主要見解

- Unifi will host its Annual General Meeting on 31st of October

- Salary of US$775.0k is part of CEO Eddie Ingle's total remuneration

- The total compensation is similar to the average for the industry

- Unifi's EPS grew by 21% over the past three years while total shareholder loss over the past three years was 56%

- Unifi將於10月31日主持其年度大會

- 775.0K美元的薪水是首席執行官埃迪·英格爾總薪酬的一部分

- 總薪酬與該行業的平均水準相似

- Unifi的每股收益在過去三年中增長了21%,而股東在過去三年中的總虧損為56%

The underwhelming share price performance of Unifi, Inc. (NYSE:UFI) in the past three years would have disappointed many shareholders. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 31st of October could be an opportunity for shareholders to bring these concerns to the board's attention. They could also influence management through voting on resolutions such as executive remuneration. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

平淡無奇的股價表現Unifi,Inc.(紐約證券交易所股票代碼:UFI)在過去的三年裡,可能會讓很多股東失望。令人擔憂的是,儘管每股收益出現正增長,但股價並未跟隨基本面的趨勢。即將於10月31日舉行的年度股東大會可能是股東們提請董事會注意這些問題的機會。他們還可以通過對高管薪酬等決議進行投票來影響管理層。以下是我們認為股東目前可能對批准CEO加薪持謹慎態度的原因。

See our latest analysis for Unifi

查看我們對Unifi的最新分析

How Does Total Compensation For Eddie Ingle Compare With Other Companies In The Industry?

埃迪·英格爾的總薪酬與行業內其他公司相比如何?

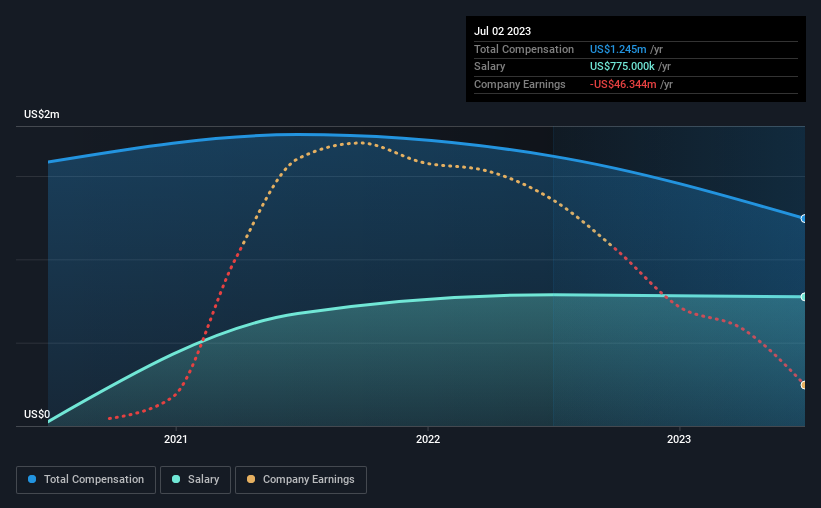

Our data indicates that Unifi, Inc. has a market capitalization of US$120m, and total annual CEO compensation was reported as US$1.2m for the year to July 2023. That's a notable decrease of 23% on last year. In particular, the salary of US$775.0k, makes up a huge portion of the total compensation being paid to the CEO.

我們的數據顯示,Unifi,Inc.的市值為1.2億美元,截至2023年7月的一年,首席執行官的年度薪酬總額為120萬美元。與去年相比,這一數位顯著下降了23%。特別是,775.0萬美元的工資,在支付給首席執行官的總薪酬中佔了很大一部分。

For comparison, other companies in the American Luxury industry with market capitalizations below US$200m, reported a median total CEO compensation of US$1.1m. From this we gather that Eddie Ingle is paid around the median for CEOs in the industry. Moreover, Eddie Ingle also holds US$629k worth of Unifi stock directly under their own name.

相比之下,美國奢侈品行業其他市值低於2億美元的公司公佈的首席執行官總薪酬中值為110萬美元。由此我們可以推斷,埃迪·英格爾的薪酬大約是業內CEO的中位數。此外,埃迪·英格爾還直接以自己的名義持有價值629K美元的Unifi股票。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$775k | US$788k | 62% |

| Other | US$470k | US$830k | 38% |

| Total Compensation | US$1.2m | US$1.6m | 100% |

| 元件 | 2023年年 | 2022 | 比例(2023年) |

| 薪金 | 7.75億美元 | 78.8億美元 | 62% |

| 其他 | 4.7億美元 | 8.3億美元 | 百分之三十八 |

| 全額補償 | 120萬美元 | 160萬美元 | 100% |

Speaking on an industry level, nearly 24% of total compensation represents salary, while the remainder of 76% is other remuneration. Unifi is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

從行業層面來看,近24%的薪酬是工資,其餘的76%是其他薪酬。與整個行業相比,Unifi通過工資支付的薪酬份額更高。如果薪酬佔總薪酬的主導地位,這表明CEO薪酬較少傾向於可變部分,而可變部分通常與業績掛鉤。

A Look at Unifi, Inc.'s Growth Numbers

看Unifi,Inc.的S增長數位

Unifi, Inc.'s earnings per share (EPS) grew 21% per year over the last three years. It saw its revenue drop 24% over the last year.

Unifi,Inc.的S每股收益在過去三年裡每年增長21%,但收入在過去一年裡下降了24%。

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

股東們會很高興地知道,該公司在過去幾年裡有所改進。雖然收入增長是好事,但利潤最終更重要。暫時離開當前的形式,檢查一下這一免費的視覺描述可能很重要分析師的預期是什麼為未來做準備。

Has Unifi, Inc. Been A Good Investment?

Unifi,Inc.是一筆好投資嗎?

The return of -56% over three years would not have pleased Unifi, Inc. shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

三年內-56%的回報率不會讓Unifi,Inc.的股東滿意。因此,股東們可能希望公司在CEO薪酬方面不那麼慷慨。

In Summary...

總結一下..。

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

過去幾年,股東們的股票價值出現了虧損,這一事實當然令人不安。該股的走勢與公司的收益增長脫節,理想情況下,收益增長應該是同一個方向。股東們可能會熱衷於找出其他可能拖累該股的因素。即將舉行的年度股東大會將是股東就關鍵問題向董事會提問的機會,例如CEO薪酬或他們可能存在的任何其他問題,並重新審視他們對公司的投資主題。

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Unifi (free visualization of insider trades).

CEO薪酬是一回事,但檢查CEO是在買入還是賣出Unifi(內部交易的免費可視化)也是一件有趣的事情。

Switching gears from Unifi, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

從Unifi轉向,如果你正在尋找原始的資產負債表和溢價回報,這一點免費高回報、低負債的公司名單是一個很好的地方。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

For comparison, other companies in the American Luxury industry with market capitalizations below US$200m, reported a median total CEO compensation of US$1.1m. From this we gather that Eddie Ingle is paid around the median for CEOs in the industry. Moreover, Eddie Ingle also holds US$629k worth of Unifi stock directly under their own name.

For comparison, other companies in the American Luxury industry with market capitalizations below US$200m, reported a median total CEO compensation of US$1.1m. From this we gather that Eddie Ingle is paid around the median for CEOs in the industry. Moreover, Eddie Ingle also holds US$629k worth of Unifi stock directly under their own name.