Huazhang Technology Holding Limited (HKG:1673) Looks Just Right With A 28% Price Jump

Huazhang Technology Holding Limited (HKG:1673) Looks Just Right With A 28% Price Jump

Huazhang Technology Holding Limited (HKG:1673) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

華章科技控股有限公司(HKG:1673)股東們會很高興看到股價經歷了一個偉大的月份,上漲了28%,並從之前的疲軟中恢復過來。長期股東將感謝股價的回升,因為在最近的反彈之後,今年的股價幾乎持平。

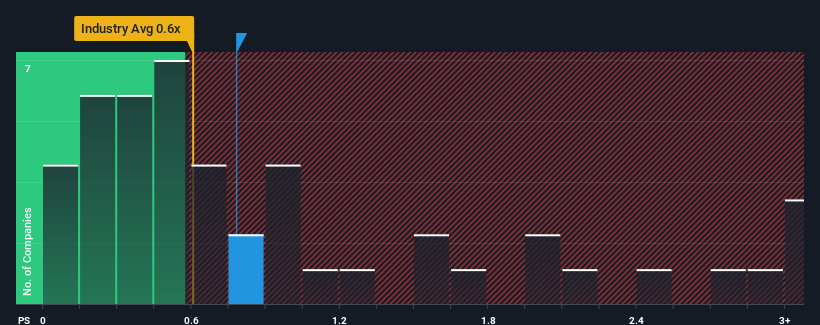

Although its price has surged higher, it's still not a stretch to say that Huazhang Technology Holding's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Machinery industry in Hong Kong, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

雖然其價格已經飆升,但與香港機械行業相比,華章科技控股目前0.8倍的本益比(或“P/S”)似乎相當“中間道路”,而香港機械行業的本益比中位數約為0.6倍。儘管如此,在沒有解釋的情況下簡單地忽略P/S是不明智的,因為投資者可能會忽視一個獨特的機會或一個代價高昂的錯誤。

View our latest analysis for Huazhang Technology Holding

查看我們對華章科技控股的最新分析

How Has Huazhang Technology Holding Performed Recently?

華章科技控股近期表現如何?

Recent times have been quite advantageous for Huazhang Technology Holding as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

華章科技控股最近一段時間相當有利,因為其收入增長非常迅速。也許市場預計未來的收入表現將逐漸減弱,這使得P/S沒有上升。如果這種情況沒有發生,那麼現有股東有理由對股價的未來走向感到樂觀。

Is There Some Revenue Growth Forecasted For Huazhang Technology Holding?

華章科技控股的收入是否有增長預測?

Huazhang Technology Holding's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

華章科技控股的本益比對於一家預計僅能實現適度增長的公司來說是典型的,重要的是,它的表現與行業一致。

If we review the last year of revenue growth, the company posted a terrific increase of 63%. The latest three year period has also seen an excellent 44% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

如果我們回顧去年的收入增長,該公司公佈了63%的驚人增長。在最近三年期間,由於其短期業績的幫助,收入整體增長了44%。因此,我們可以從確認該公司在這段時間內在收入增長方面做得很好開始。

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 14% shows it's about the same on an annualised basis.

將最近的中期收入軌跡與更廣泛的行業一年增長14%的預測進行權衡,顯示出按年率計算大致相同。

With this in consideration, it's clear to see why Huazhang Technology Holding's P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

考慮到這一點,很明顯,為什麼華章科技控股的P/S匹配密切,其行業同行。顯然,股東們樂於簡單地堅持認為公司將繼續保持低調。

The Key Takeaway

關鍵的外賣

Huazhang Technology Holding's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

華章科技控股的股票最近有很大的動力,這使得它的本益比水準與其他行業相同。雖然本益比不應該是決定你是否購買股票的決定性因素,但它是衡量收入預期的一個非常有效的晴雨錶。

It appears to us that Huazhang Technology Holding maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

在我們看來,華章科技控股保持其溫和的P/S的背後,其最近三年的增長是符合更廣泛的行業預測。目前,由於過去的收入趨勢與行業前景密切相關,股東們相信公司未來的收入前景不會有任何重大意外。如果近期的中期收入趨勢持續下去,在這種情況下,股價在近期內很難出現強勁的走勢。

Plus, you should also learn about these 3 warning signs we've spotted with Huazhang Technology Holding (including 1 which is significant).

另外,你還應該瞭解這些我們在華章科技控股公司發現的3個警告信號(包括有意義的1)。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

當然了,利潤豐厚、盈利增長迅速的公司通常是更安全的押注那就是。所以你可能想看看這個免費其他本益比合理、盈利增長強勁的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.