Shenzhen InfoGem Technologies (SZSE:300085 Shareholders Incur Further Losses as Stock Declines 5.6% This Week, Taking Three-year Losses to 45%

Shenzhen InfoGem Technologies (SZSE:300085 Shareholders Incur Further Losses as Stock Declines 5.6% This Week, Taking Three-year Losses to 45%

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Shenzhen InfoGem Technologies Co., Ltd. (SZSE:300085) shareholders, since the share price is down 45% in the last three years, falling well short of the market decline of around 12%. On top of that, the share price is down 5.6% in the last week.

對於許多投資者來說,選股的主要著眼點是產生高於整體市場的回報。但如果你試著選股,你的風險回報就會低於市場。不幸的是,從長遠來看,情況就是這樣深圳市英福寶石科技有限公司。(SZSE:300085)股東,因為股價在過去三年裡下跌了45%,遠遠低於市場約12%的跌幅。最重要的是,該公司股價在上週下跌了5.6%。

Since Shenzhen InfoGem Technologies has shed CN¥509m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

由於深圳資訊寶石科技在過去7天裡市值縮水5.09億元人民幣,讓我們看看長期下跌是否受到了企業經濟的推動。

View our latest analysis for Shenzhen InfoGem Technologies

查看我們對深圳資訊寶石科技的最新分析

Given that Shenzhen InfoGem Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

鑑於深圳InfoGem科技在過去12個月中沒有盈利,我們將重點關注收入增長,以快速瞭解其業務發展。當一家公司沒有盈利時,我們通常預計會看到良好的收入增長。一些公司願意推遲盈利以更快地增長收入,但在這種情況下,人們確實預計營收會有良好的增長。

Over the last three years, Shenzhen InfoGem Technologies' revenue dropped 8.1% per year. That is not a good result. The stock has disappointed holders over the last three years, falling 13%, annualized. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

在過去的三年裡,深圳InfoGem Technologies的收入每年下降8.1%。這不是一個好結果。過去三年,該股令持股者失望,摺合成年率下跌了13%。在沒有利潤、收入疲軟的情況下,你會感到驚訝嗎?當然,市場情緒可能會變得過於負面,該公司實際上可能正在盈利方面取得進展。

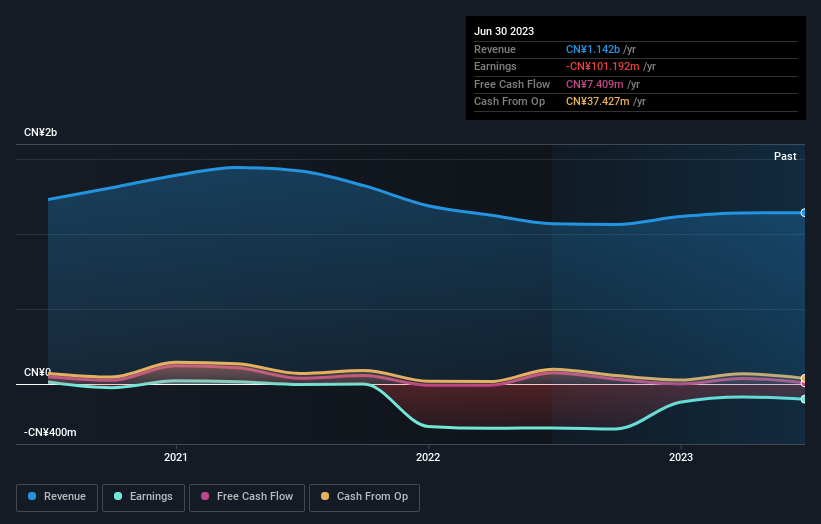

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

下圖顯示了收益和收入隨時間的變化情況(如果您點擊該圖,您可以看到更多詳細資訊)。

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

可能值得注意的是,首席執行官的薪酬低於類似規模公司的中位數。但是,儘管CEO的薪酬總是值得檢查的,但真正重要的問題是,公司能否在未來實現收益增長。在買賣股票之前,我們總是建議仔細檢查一下歷史增長趨勢,可在此處找到。

A Different Perspective

不同的視角

It's nice to see that Shenzhen InfoGem Technologies shareholders have received a total shareholder return of 30% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 6% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Shenzhen InfoGem Technologies that you should be aware of.

很高興看到深圳英寶科技的股東在過去一年中獲得了30%的總股東回報。由於一年期的TSR好於五年期的TSR(後者的年收益率為6%),看起來該股的表現最近有所改善。持樂觀觀點的人可能會認為,最近TSR的改善表明,業務本身正在隨著時間的推移而變得更好。我發現,把股價作為衡量企業業績的長期指標是非常有趣的。但為了真正獲得洞察力,我們還需要考慮其他資訊。例如,我們已經確定深圳InfoGem科技的2個警告標誌這一點你應該知道.

Of course Shenzhen InfoGem Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

當然了深圳InfoGem科技可能不是買入的最佳股票那就是。所以你可能想看看這個免費成長型股票的集合。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所交易的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

Given that Shenzhen InfoGem Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Given that Shenzhen InfoGem Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.