Here's Why China State Construction Development Holdings (HKG:830) Has Caught The Eye Of Investors

Here's Why China State Construction Development Holdings (HKG:830) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

投資一家能夠扭轉命運的公司所帶來的興奮,對一些投機者來說是一個巨大的吸引力,因此,即使是沒有收入、沒有利潤、業績不佳的公司,也能設法找到投資者。但正如彼得·林奇在華爾街上的一位“遠投幾乎永遠不會有回報。”虧損的公司可能會像海綿一樣吸收資本,因此投資者應該謹慎,不要把錢一筆接一筆地往上扔。

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like China State Construction Development Holdings (HKG:830). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

因此,如果這種高風險和高回報的想法不適合,你可能會對盈利的、成長型的公司更感興趣,比如中國國建發展控股有限公司(HKG:830)。雖然利潤不是投資時應該考慮的唯一指標,但值得表彰能夠持續產生利潤的企業。

Check out our latest analysis for China State Construction Development Holdings

查看我們對中國國家建設發展控股公司的最新分析

How Quickly Is China State Construction Development Holdings Increasing Earnings Per Share?

中國國建發展控股公司每股收益增長速度有多快?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that China State Construction Development Holdings has grown EPS by 43% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

市場在短期內是一臺投票機,但從長期來看是一臺稱重機,所以你可以預期股價最終會跟隨每股收益(EPS)的結果。因此,有經驗的投資者在進行投資研究時密切關注公司每股收益是合理的。必須承認,在過去的三年裡,中國國家建設發展控股公司的每股收益以每年43%的速度增長。儘管這種增長速度不會持續很長時間,但它肯定會吸引潛在投資者的目光。

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for China State Construction Development Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 16% to HK$8.6b. That's encouraging news for the company!

要複核一家公司的增長,一種方法是觀察其收入和息稅前利潤(EBIT)的變化情況。中國國家建設發展控股有限公司的息稅前利潤與去年持平,但該公司應樂於報告其收入增長16%至86億港元。這對公司來說是個鼓舞人心的消息!

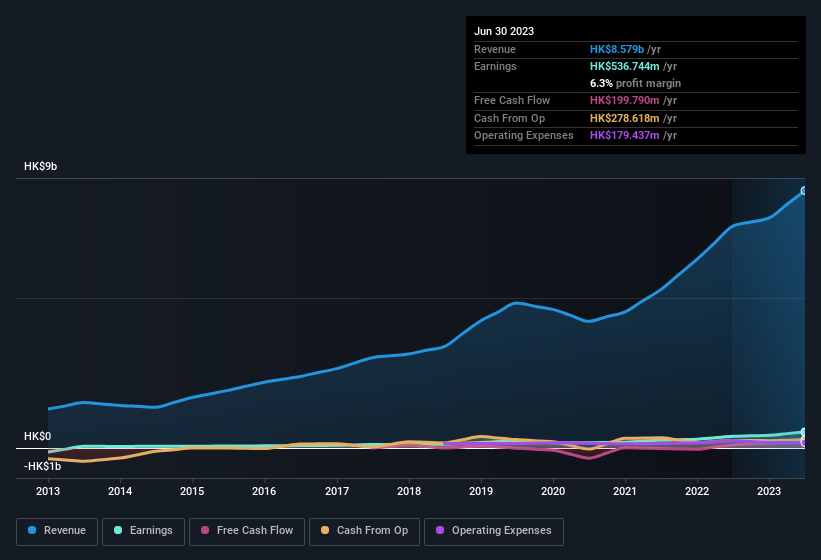

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

下面的圖表顯示了該公司的利潤和收入是如何隨著時間的推移而變化的。要查看實際數位,請點擊圖表。

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for China State Construction Development Holdings?

雖然我們活在當下,但毫無疑問,在投資決策過程中,未來是最重要的。那麼,為什麼不查看這張描繪中國國家建設發展控股公司未來每股收益估計的互動圖表呢?

Are China State Construction Development Holdings Insiders Aligned With All Shareholders?

中國國建控股內部人士是否與全體股東一致?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

有人說,無風不起浪。對於投資者來說,內幕購買往往是表明哪些股票可能點燃市場的煙霧。這是因為內幕收購往往表明,那些與公司關係最密切的人相信股價會有良好的表現。當然,我們永遠無法確定內部人士在想什麼,我們只能判斷他們的行為。

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the real excitement comes from the HK$835k that Executive Vice Chairman & CEO Mingqing Wu spent buying shares (at an average price of about HK$1.67). Purchases like this clue us in to the to the faith management has in the business' future.

內部人士對該公司的信心仍然很高,因為管理層或董事會成員沒有出售過一股股票。但真正令人興奮的是執行副主席兼首席執行官吳明清購買股票的83.5萬港元(平均價格約為1.67港元)。像這樣的購買讓我們瞭解到管理層對企業未來的信心。

Is China State Construction Development Holdings Worth Keeping An Eye On?

中國國建控股值得關注嗎?

China State Construction Development Holdings' earnings have taken off in quite an impressive fashion. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put China State Construction Development Holdings on your watchlist. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for China State Construction Development Holdings that you should be aware of.

中國國家建設發展控股公司的盈利增長令人印象深刻。大多數尋求增長的投資者將發現,很難忽視這種爆炸性的每股收益增長。事實上,這可能是一個跡象,表明該業務正處於拐點。如果是這樣的話,你可能會後悔沒有把中國國家建設發展控股公司列入你的觀察名單。別忘了,可能還會有風險。例如,我們已經確定中國國家建設發展控股公司的1個警告標誌這一點你應該知道.

The good news is that China State Construction Development Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

好消息是,中國國建控股並不是唯一一隻有內幕買入的成長股。這是他們的名單。在過去的三個月裡有內幕交易!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文中討論的內幕交易指的是相關司法管轄區內的應報告交易.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that China State Construction Development Holdings has grown EPS by 43% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that China State Construction Development Holdings has grown EPS by 43% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.