Jinling Pharmaceutical Company Limited's (SZSE:000919) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Jinling Pharmaceutical Company Limited's (SZSE:000919) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Jinling Pharmaceutical's (SZSE:000919) stock is up by a considerable 9.5% over the past week. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Specifically, we decided to study Jinling Pharmaceutical's ROE in this article.

金陵藥業(SZSE:000919)的股票在過去一週上漲了9.5%。然而,我們決定關注該公司的基本面,因為這些基本面似乎沒有給出有關該公司財務健康狀況的明確跡象。具體而言,本文選擇金陵藥業的淨資產收益率作為研究對象。

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

股本回報率(ROE)是對一家公司增值和管理投資者資金的效率的測試。換句話說,這是一個衡量公司股東提供的資本回報率的盈利比率。

Check out our latest analysis for Jinling Pharmaceutical

查看我們對金陵藥業的最新分析

How To Calculate Return On Equity?

如何計算股本回報率?

The formula for ROE is:

這個淨資產收益率公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

股本回報率=(持續經營的)淨利潤?股東權益

So, based on the above formula, the ROE for Jinling Pharmaceutical is:

因此,根據上述公式,金陵藥業的淨資產收益率為:

3.5% = CN¥131m ÷ CN¥3.7b (Based on the trailing twelve months to June 2023).

3.5% = 1.31億人民幣兌37億人民幣(基於截至2023年6月的過去12個月)。

The 'return' is the income the business earned over the last year. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.04 in profit.

“回報”指的是企業在過去一年中獲得的收入。這意味著,股東權益每增加1元,公司就會產生0.04元的利潤。

Why Is ROE Important For Earnings Growth?

為什麼淨資產收益率對收益增長很重要?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

到目前為止,我們瞭解到淨資產收益率是衡量一家公司盈利能力的指標。根據公司選擇再投資或“保留”多少利潤,我們就能夠評估一家公司未來產生利潤的能力。假設其他條件不變,淨資產收益率和利潤保留率越高,與不一定具有這些特徵的公司相比,公司的增長率就越高。

Jinling Pharmaceutical's Earnings Growth And 3.5% ROE

金陵藥業盈利增長,ROE達3.5%

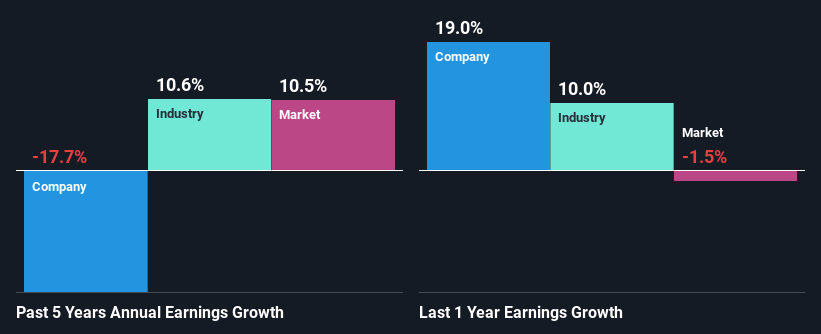

As you can see, Jinling Pharmaceutical's ROE looks pretty weak. Even when compared to the industry average of 8.7%, the ROE figure is pretty disappointing. Given the circumstances, the significant decline in net income by 18% seen by Jinling Pharmaceutical over the last five years is not surprising. However, there could also be other factors causing the earnings to decline. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

大家可以看到,金陵藥業的淨資產收益率看起來相當弱。即使與8.7%的行業平均水準相比,ROE數位也相當令人失望。在這種情況下,金陵藥業過去五年淨利潤大幅下降18%並不奇怪。然而,也可能有其他因素導致收入下降。例如,公司的派息率很高,或者面臨競爭壓力。

That being said, we compared Jinling Pharmaceutical's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 11% in the same 5-year period.

儘管如此,我們將金陵藥業的業績與行業進行了比較,當我們發現該公司的盈利縮水時,我們感到擔憂,在同一5年期間,行業的盈利增長率為11%。

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Jinling Pharmaceutical is trading on a high P/E or a low P/E, relative to its industry.

在很大程度上,賦予一家公司價值的基礎與其盈利增長有關。投資者接下來需要確定的是,預期的盈利增長,或者缺乏預期的盈利增長,是否已經融入了股價。然後,這有助於他們確定股票是否被放置在光明或黯淡的未來。預期收益增長的一個很好的指標是本益比,它決定了市場願意根據其收益前景為股票支付的價格。所以,你可能想看看金陵藥業相對於其行業的本益比是高還是低。

Is Jinling Pharmaceutical Efficiently Re-investing Its Profits?

金陵藥業是否在有效地進行利潤再投資?

Despite having a normal three-year median payout ratio of 43% (where it is retaining 57% of its profits), Jinling Pharmaceutical has seen a decline in earnings as we saw above. So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

儘管金陵藥業正常的三年派息率中位數為43%(保留57%的利潤),但正如我們上面看到的那樣,該公司的盈利出現了下降。所以在這方面可能有其他的解釋。例如,該公司的業務可能正在惡化。

Additionally, Jinling Pharmaceutical has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

此外,金陵藥業已經支付了至少十年的股息,這意味著該公司的管理層決心支付股息,即使這意味著很少或沒有盈利增長。

Summary

摘要

Overall, we have mixed feelings about Jinling Pharmaceutical. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. You can see the 3 risks we have identified for Jinling Pharmaceutical by visiting our risks dashboard for free on our platform here.

總的來說,我們對金陵藥業百感交集。雖然該公司確實有很高的利潤留存率,但其低迴報率可能阻礙了其盈利增長。最後,我們將謹慎對待這家公司,其中一種方法是研究該公司的風險狀況。您可以通過訪問我們的風險控制面板在我們的平臺上是免費的。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.