Time To Worry? Analysts Just Downgraded Their G-bits Network Technology (Xiamen) Co., Ltd. (SHSE:603444) Outlook

Time To Worry? Analysts Just Downgraded Their G-bits Network Technology (Xiamen) Co., Ltd. (SHSE:603444) Outlook

Today is shaping up negative for G-bits Network Technology (Xiamen) Co., Ltd. (SHSE:603444) shareholders, with the analysts delivering a substantial negative revision to next year's forecasts. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

今天對我們來說是負面的G-BITS網路科技(廈門)有限公司(上交所:603444)股東,分析師對明年的預測進行了大幅負面修訂。他們的營收預期下調得相當嚴厲,或許是含蓄地承認之前的預測過於樂觀。

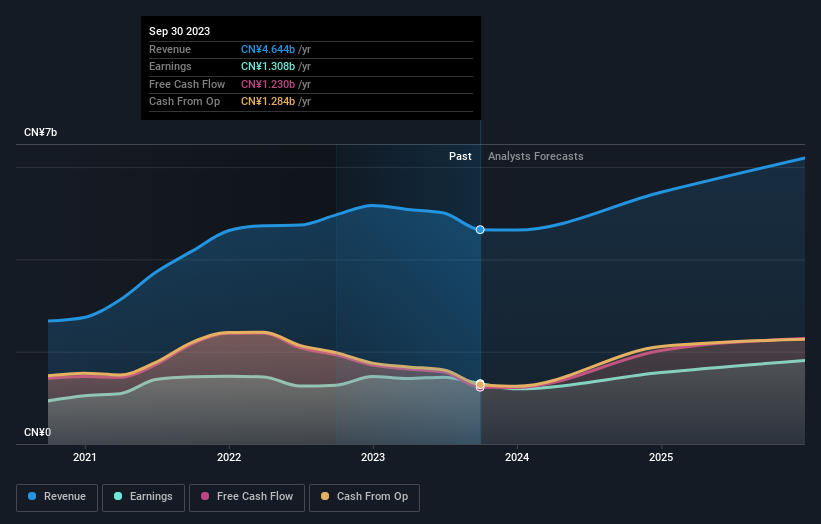

Following the downgrade, the most recent consensus for G-bits Network Technology (Xiamen) from its 15 analysts is for revenues of CN¥5.5b in 2024 which, if met, would be a solid 17% increase on its sales over the past 12 months. Statutory earnings per share are presumed to climb 20% to CN¥21.78. Previously, the analysts had been modelling revenues of CN¥6.1b and earnings per share (EPS) of CN¥24.10 in 2024. It looks like analyst sentiment has fallen somewhat in this update, with a measurable cut to revenue estimates and a small dip in earnings per share numbers as well.

在評級下調後,15位分析師對G-Bits Network Technology(廈門)的最新共識是,2024年收入將達到55億元人民幣,如果實現這一目標,將比過去12個月的銷售額穩健增長17%。預計法定每股收益將攀升20%,至21.78加元。此前,分析師一直預測2024年的收入為人民幣61億元,每股收益(EPS)為人民幣24.10元。在這一更新中,分析師的信心似乎有所下降,營收預期大幅下調,每股收益數位也略有下降。

Check out our latest analysis for G-bits Network Technology (Xiamen)

查看我們對G-BITS網路技術的最新分析(廈門)

It'll come as no surprise then, to learn that the analysts have cut their price target 16% to CN¥399.

如果分析師將目標股價下調16%,至399加元,也就不足為奇了。

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that G-bits Network Technology (Xiamen)'s revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 14% growth on an annualised basis. This is compared to a historical growth rate of 24% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 19% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than G-bits Network Technology (Xiamen).

我們看待這些估計的另一種方式是放在更大的背景下,比如預測與過去的表現如何比較,以及預測相對於行業內的其他公司是更樂觀還是更樂觀。很明顯,人們預計千兆網路科技(廈門)S的收入增長將大幅放緩,截至2024年底的收入年化增長率預計為14%。相比之下,過去五年的歷史增長率為24%。相比之下,分析師覆蓋的該行業其他公司的年收入增長率預計為19%。因此,很明顯,儘管收入增長預計將放緩,但整個行業的增長速度預計也將快於千兆網路科技(廈門)。

The Bottom Line

底線

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for G-bits Network Technology (Xiamen). Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that G-bits Network Technology (Xiamen)'s revenues are expected to grow slower than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on G-bits Network Technology (Xiamen) after today.

新的預估中最大的問題是,分析師下調了每股收益預估,這表明G-BITS網路科技(廈門)的業務逆風即將到來。不幸的是,分析師也下調了他們的營收預期,行業數據顯示,高位元網路科技(廈門)S的營收增速預計將低於大盤。此外,目標價被下調,這表明最新的消息導致人們對該業務的內在價值更加悲觀。通常情況下,一個評級下調可能會引發一連串的下調,尤其是在一個行業正在下滑的情況下。因此,如果市場在今天之後對高位元網路科技(廈門)的態度變得更加謹慎,我們也不會感到意外。

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple G-bits Network Technology (Xiamen) analysts - going out to 2025, and you can see them free on our platform here.

話雖如此,該公司盈利的長期軌跡比明年重要得多。我們有來自多位G-Bits網路技術(廈門)分析師的預測-到2025年,你可以在我們的平臺上免費看到它們。

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

當然,看到公司管理層投資大筆資金投資一隻股票,就像知道分析師是否在下調他們的預期一樣有用。所以你可能也想蒐索一下這個免費內部人士正在買入的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

It'll come as no surprise then, to learn that the analysts have cut their price target 16% to CN¥399.

It'll come as no surprise then, to learn that the analysts have cut their price target 16% to CN¥399.