One Cetc Potevio Science&Technology Co.,Ltd. (SZSE:002544) Analyst Just Cut Their EPS Forecasts

One Cetc Potevio Science&Technology Co.,Ltd. (SZSE:002544) Analyst Just Cut Their EPS Forecasts

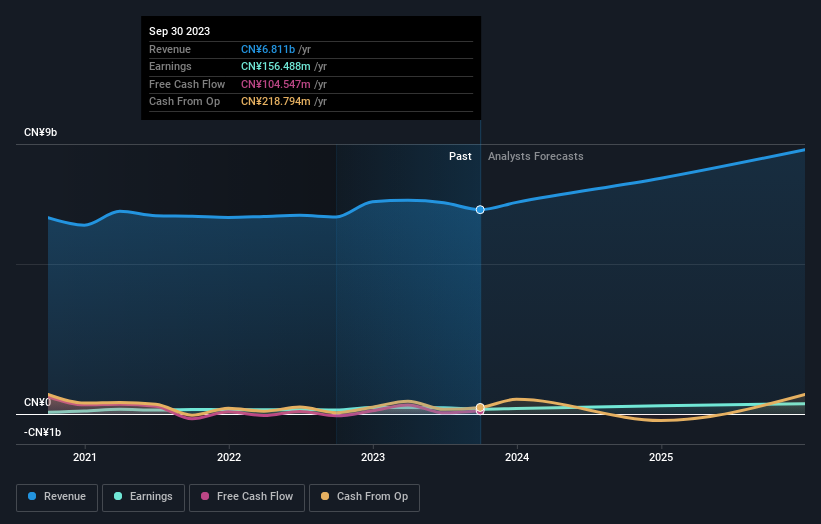

Today is shaping up negative for Cetc Potevio Science&Technology Co.,Ltd. (SZSE:002544) shareholders, with the covering analyst delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as the analyst factored in the latest outlook for the business, concluding that they were too optimistic previously.

今天對我們來說是負面的中電普特維奧科技有限公司(SZSE:002544)股東,跟蹤分析師對今年的預測進行了大幅負面修訂。營收和每股收益(EPS)預期均大幅下調,因為分析師將最新的業務前景考慮在內,得出結論認為它們之前過於樂觀。

Following the downgrade, the most recent consensus for Cetc Potevio Science&TechnologyLtd from its one analyst is for revenues of CN¥7.1b in 2023 which, if met, would be an okay 3.6% increase on its sales over the past 12 months. Per-share earnings are expected to step up 18% to CN¥0.27. Previously, the analyst had been modelling revenues of CN¥8.0b and earnings per share (EPS) of CN¥0.36 in 2023. Indeed, we can see that the analyst is a lot more bearish about Cetc Potevio Science&TechnologyLtd's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

在評級下調後,CETC Potevio Science&TechnologyLtd從One分析師那裡獲得的最新共識是,2023年收入將達到人民幣71億元,如果實現這一目標,將比過去12個月的銷售額增長3.6%。每股收益預計將增長18%,至0.27加元。此前,該分析師一直在預測2023年收入為人民幣80億元,每股收益(EPS)為人民幣0.36元。事實上,我們可以看到,分析師對CETC Potevio Science&Technology Ltd的前景更為悲觀,大幅下調了收入預期,並大幅下調了每股收益預期。

Check out our latest analysis for Cetc Potevio Science&TechnologyLtd

查看我們對CETC Potevio科技有限公司的最新分析

The analyst made no major changes to their price target of CN¥24.33, suggesting the downgrades are not expected to have a long-term impact on Cetc Potevio Science&TechnologyLtd's valuation.

這位分析師沒有對其24.33元的目標價做出重大調整,這表明評級下調預計不會對中電科技有限公司的估值產生長期影響。

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that Cetc Potevio Science&TechnologyLtd's rate of growth is expected to accelerate meaningfully, with the forecast 3.6% annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 2.8% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to see revenue growth of 23% annually. It seems obvious that, while the future growth outlook is brighter than the recent past, Cetc Potevio Science&TechnologyLtd is expected to grow slower than the wider industry.

瞭解這些預測的更多背景資訊的一種方法是,看看它們與過去的表現如何比較,以及同行業的其他公司的表現如何。從最新的估計中可以清楚地看到,CETC Potevio Science&Technology Ltd的增長率預計將大幅加快,截至2023年底的3.6%的年化收入增長預測明顯快於其歷史上2.8%的年增長率。在過去的五年裡。相比之下,同行業的其他公司預計收入將以每年23%的速度增長。很明顯,儘管未來的增長前景比最近的過去更光明,但CETC Potevio科技有限公司的增長速度預計將慢於整個行業。

The Bottom Line

底線

The biggest issue in the new estimates is that the analyst has reduced their earnings per share estimates, suggesting business headwinds lay ahead for Cetc Potevio Science&TechnologyLtd. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on Cetc Potevio Science&TechnologyLtd after the downgrade.

新預估中最大的問題是,分析師下調了每股收益預估,這表明CETC Potevio Science&TechnologyLtd.將面臨業務逆風。令人遺憾的是,他們還下調了收入預期,最新預測表明,該業務的銷售增長將低於更廣泛的市場。我們還驚訝地看到,目標價格沒有變化。不過,不斷惡化的商業環境(假設預測準確!)可能是股價的領先指標,所以我們不會責怪投資者在評級下調後對CETC Potevio Science&Technology Ltd更加謹慎。

Uncomfortably, our automated valuation tool also suggests that Cetc Potevio Science&TechnologyLtd stock could be overvalued following the downgrade. Shareholders could be left disappointed if these estimates play out. Find out why, and see how we estimate the valuation for free on our platform here.

令人不安的是,我們的自動估值工具還表明,在評級下調後,CETC Potevio Science&Technology Ltd.的股票可能被高估了。如果這些估計成為現實,股東們可能會感到失望。找出原因,並在我們的平臺上查看我們如何免費評估估值。

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

當然,看到公司管理層投資大筆資金投資一隻股票,就像知道分析師是否在下調他們的預期一樣有用。所以你可能也想蒐索一下這個免費內部人士正在買入的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

The analyst made no major changes to their price target of CN¥24.33, suggesting the downgrades are not expected to have a long-term impact on Cetc Potevio Science&TechnologyLtd's valuation.

The analyst made no major changes to their price target of CN¥24.33, suggesting the downgrades are not expected to have a long-term impact on Cetc Potevio Science&TechnologyLtd's valuation.