Optimistic Investors Push Apex Ace Holding Limited (HKG:6036) Shares Up 27% But Growth Is Lacking

Optimistic Investors Push Apex Ace Holding Limited (HKG:6036) Shares Up 27% But Growth Is Lacking

Apex Ace Holding Limited (HKG:6036) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

頂峰王牌控股有限公司(HKG:6036)股東無疑很高興看到股價在過去一個月反彈了27%,儘管它仍在努力收復最近的失地。再往前看,過去12個月16%的漲幅並不算太糟糕,儘管過去30天的漲勢很強勁。

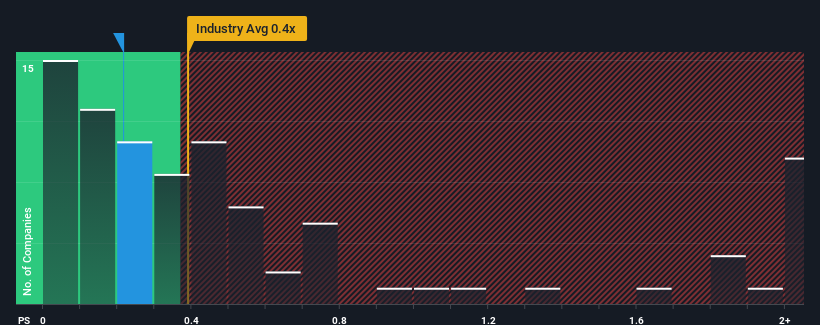

Even after such a large jump in price, it's still not a stretch to say that Apex Ace Holding's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Electronic industry in Hong Kong, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

即使在股價大幅上漲之後,可以毫不誇張地說,Apex Ace Holding目前0.2倍的市售比(P/S)與香港電子行業的市售比(P/S)中值約為0.4倍,似乎相當“中等”。儘管如此,在沒有解釋的情況下簡單地忽視本益比S是不明智的,因為投資者可能會忽視一個獨特的機會或代價高昂的錯誤。

View our latest analysis for Apex Ace Holding

查看我們對Apex Ace Holding的最新分析

What Does Apex Ace Holding's Recent Performance Look Like?

Apex Ace Holding最近的表現如何?

For example, consider that Apex Ace Holding's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

例如,考慮到Apex Ace Holding最近的財務表現一直很差,因為它的收入一直在下降。許多人可能預計,該公司在未來一段時間內將把令人失望的營收表現拋在腦後,這讓本益比/S指數沒有下跌。如果你喜歡這家公司,你至少會希望情況是這樣的,這樣你就可以在它不太受歡迎的時候買入一些股票。

What Are Revenue Growth Metrics Telling Us About The P/S?

收入增長指標告訴我們有關本益比的哪些資訊?

In order to justify its P/S ratio, Apex Ace Holding would need to produce growth that's similar to the industry.

為了證明其本益比與S的比率是合理的,Apex Ace Holding需要實現與該行業類似的增長。

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. Regardless, revenue has managed to lift by a handy 6.0% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

回顧過去一年的財務狀況,我們沮喪地看到該公司的收入下降了30%。無論如何,得益於早期的增長,收入與三年前相比總共增長了6.0%。因此,儘管股東們更願意繼續運營,但他們對中期營收增長率大致滿意。

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially higher than the company's recent medium-term annualised growth rates.

這與其他行業形成鮮明對比,預計明年該行業將增長14%,大大高於該公司最近的中期年化增長率。

In light of this, it's curious that Apex Ace Holding's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

有鑒於此,令人好奇的是,Apex Ace Holding的P/S與大多數其他公司的情況一致。顯然,該公司的許多投資者並不像最近的情況所顯示的那樣悲觀,他們現在不願拋售自己的股票。如果本益比/S指數跌至與近期增速更接近的水準,他們可能會在未來感到失望。

What Does Apex Ace Holding's P/S Mean For Investors?

Apex Ace Holding的P/S對投資者意味著什麼?

Apex Ace Holding's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Apex Ace Holding的股票最近勢頭強勁,使其本益比/S與行業其他股票持平。雖然市銷率不應該成為你是否買入一隻股票的決定性因素,但它是一個很好的收入預期晴雨錶。

We've established that Apex Ace Holding's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

我們已經確定,Apex Ace Holding的平均本益比S有點令人驚訝,因為該公司最近三年的增長低於更廣泛的行業預測。當我們看到營收疲軟且增長慢於行業增長時,我們懷疑該公司股價有下跌的風險,使本益比/S重新符合預期。除非近期的中期狀況有所改善,否則很難接受當前股價為公允價值。

And what about other risks? Every company has them, and we've spotted 3 warning signs for Apex Ace Holding (of which 2 are concerning!) you should know about.

還有其他風險呢?每家公司都有它們,我們已經發現Apex Ace持有的3個警告標誌(其中兩個是有關的!)你應該知道。

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果過去收益增長穩健的公司符合你的胃口,你可能想看看這個免費其他盈利增長強勁、本益比較低的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

For example, consider that Apex Ace Holding's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

For example, consider that Apex Ace Holding's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.