As Guangzhou Baiyunshan Pharmaceutical Holdings (HKG:874) Lifts 3.2% This Past Week, Investors May Now Be Noticing the Company's Five-year Earnings Growth

As Guangzhou Baiyunshan Pharmaceutical Holdings (HKG:874) Lifts 3.2% This Past Week, Investors May Now Be Noticing the Company's Five-year Earnings Growth

The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited (HKG:874) shareholders for doubting their decision to hold, with the stock down 32% over a half decade.

股票挑選的主要目標是尋找市場超越的股票。不過,遊戲的主旨是尋找足夠的贏家來抵消輸家,因此,在過去的五年中,擁有長揸白雲山股份有限公司(HKG:874)的股東們對於持有這隻股票感到懷疑也就不足爲奇了,因爲股票下跌了32%。

While the stock has risen 3.2% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

雖然該股票在過去一週內上漲了3.2%,但長揸股東仍處於虧損之中,讓我們看看基本面能告訴我們什麼。

See our latest analysis for Guangzhou Baiyunshan Pharmaceutical Holdings

查看我們最新的白雲山藥業控股分析報告

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

雖然一些人仍然在教授高效市場假說,但已經證明市場是過度反應的動態系統,投資者不總是理性的。一種有缺陷但合理的評估公司情緒變化的方法是比較每股收益 (EPS) 與股價。

While the share price declined over five years, Guangzhou Baiyunshan Pharmaceutical Holdings actually managed to increase EPS by an average of 1.3% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

儘管股價在五年內下跌,廣州白雲山藥業集團實際上還成功每年平均增長了0.8%的每股收益。鑑於股價的反應,人們可能懷疑每股收益不是業務表現在該期間的一個好指南(也許是由於一次性損失或收益),或者可能市場此前非常樂觀,因此股票雖有提高每股收益表現,卻仍讓人失望。增加每股收益平均每年增長1.3%。鑑於股價反應,可能會懷疑在此期間EPS並不是業務表現的好指引(也許是由於一次性的損失或收益)。或者,市場先前非常樂觀,所以儘管EPS有所改善,但該股票仍然表現不佳。

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, five years ago. Having said that, we might get a better idea of what's going on with the stock by looking at other metrics.

我們喜歡內部人員在過去的12個月中購買股票。 話雖如此,大多數人認爲,收益和收入增長趨勢是業務更有意義的指標。 如果您正在考慮購買或出售CVB金融股票,請查看此免費報告,其中顯示了分析師的利潤預測。

Revenue is actually up 8.4% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

該時間段內營業收入實際上增長了8.4%。因此,看起來需要更仔細地審視基本面,才能理解爲什麼股價低迷。畢竟,可能會有機會。

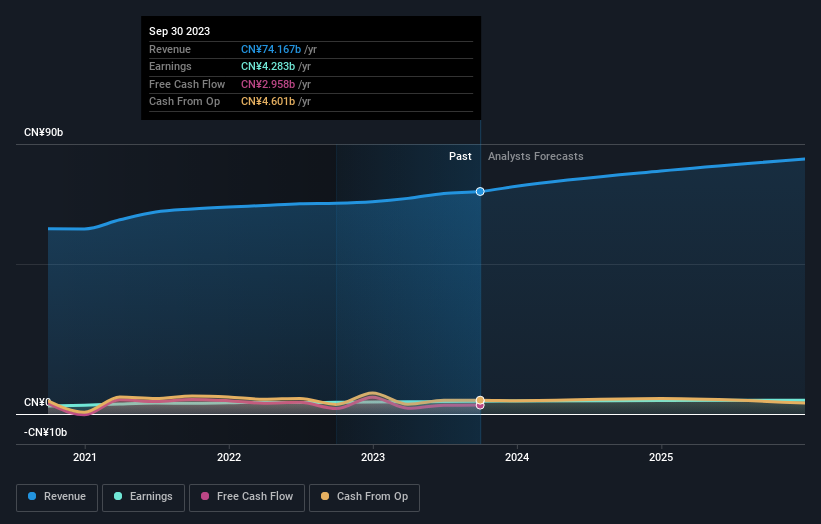

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

下面的圖表顯示了收益和營收隨時間的變化情況(通過單擊圖像揭示確切的值)。

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Guangzhou Baiyunshan Pharmaceutical Holdings stock, you should check out this free report showing analyst profit forecasts.

我們很高興地報告,該公司的CEO薪酬比同類公司的大多數CEO都要謙遜。監控CEO的薪酬是值得的,但更重要的問題是公司是否將通過年份實現盈利增長。如果您想購買或出售白雲山藥業控股的股票,您應該查閱這份顯示分析師利潤預測的免費報告。

What About Dividends?

那麼分紅怎麼樣呢?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Guangzhou Baiyunshan Pharmaceutical Holdings, it has a TSR of -22% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

在考慮投資回報時,重要的是考慮總股東回報(TSR)和股票回報之間的差異。 TSR包括任何剝離或折讓的資本籌集(基於股息被重新投資的假設),以及任何股息。因此,對於支付慷慨的股息公司而言,TSR通常比股票回報高得多。就中國神威藥業集團而言,其TSR在過去5年中達到了75%。這超過了我們之前提到的股票回報。該公司支付的股息已經提高了總股東回報。總股東回報和股票回報相對於股價回報而言,TSR包括股息的價值(假設它們已經再投資)以及任何折價融資或分拆的利益。因此,對於支付豐厚股息的公司而言,TSR通常比股價回報高得多。對於白雲山藥業控股而言,它在過去的5年中的TSR爲-22%。這超過了我們之前提到的股價回報。毫無疑問,股息支付基本上解釋了這種差距!

A Different Perspective

不同的觀點

Guangzhou Baiyunshan Pharmaceutical Holdings provided a TSR of 13% over the year (including dividends). That's fairly close to the broader market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 4% over the last five years. While 'turnarounds seldom turn' there are green shoots for Guangzhou Baiyunshan Pharmaceutical Holdings. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Guangzhou Baiyunshan Pharmaceutical Holdings is showing 1 warning sign in our investment analysis , you should know about...

白雲山藥業控股在上一年提供了13%的TSR(包括股息)。這相當接近更廣泛市場的回報。好消息是,股價在短期內上漲,這與過去5年的年化損失率4%相悖。雖然“縱然客市場難求”,但對於白雲山藥業控股來說,現在有一些跡象表明復甦有望。我發現長期股價作爲業務表現的代理很有趣。但是爲了真正獲得洞察力,我們需要考慮其他信息。即使如此,也要注意,在我們的投資分析中,白雲山藥業控股正在顯示1個警告標誌,您需要了解...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

如果您喜歡跟管理層一起購買股票,那麼您可能會喜歡這個免費的公司清單。(提示:內部人一直在購買它們)。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

請注意,本文引用的市場回報反映了當前在香港證券交易所交易的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或電郵 editorial-team (at) simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。