We Ran A Stock Scan For Earnings Growth And Hangcha Group (SHSE:603298) Passed With Ease

We Ran A Stock Scan For Earnings Growth And Hangcha Group (SHSE:603298) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

投資者通常以發現 “下一件大事” 的想法爲指導,即使這意味着在沒有任何收入的情況下購買 “故事股”,更不用說獲利了。但是正如彼得·林奇所說 One Up On Wall 街,“遠射幾乎永遠不會得到回報。”虧損的公司可以像海綿一樣爭奪資本,因此投資者應謹慎行事,不要一筆又一筆地投入好錢。

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hangcha Group (SHSE:603298). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

如果這種公司不是你的風格,你喜歡能創造收入甚至盈利的公司,那麼你很可能會對Hangcha Group(SHSE: 603298)感興趣。儘管這並不一定說明其價值是否被低估,但該業務的盈利能力足以保證一定程度的升值,尤其是在其增長的情況下。

View our latest analysis for Hangcha Group

查看我們對Hangcha集團的最新分析

How Fast Is Hangcha Group Growing?

杭茶集團的增長速度有多快?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Hangcha Group's EPS has grown 22% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

如果你認爲市場的效率甚至含糊不清,那麼從長遠來看,你預計公司的股價將遵循其每股收益(EPS)的業績。因此,有經驗的投資者在進行投資研究時密切關注公司的每股收益是有道理的。股東們會很高興知道杭茶集團的每股收益在三年內每年複合增長22%。一般而言,如果一家公司能跟上步伐,我們會這樣說 那個 有點像增長,股東們會喜氣洋洋。

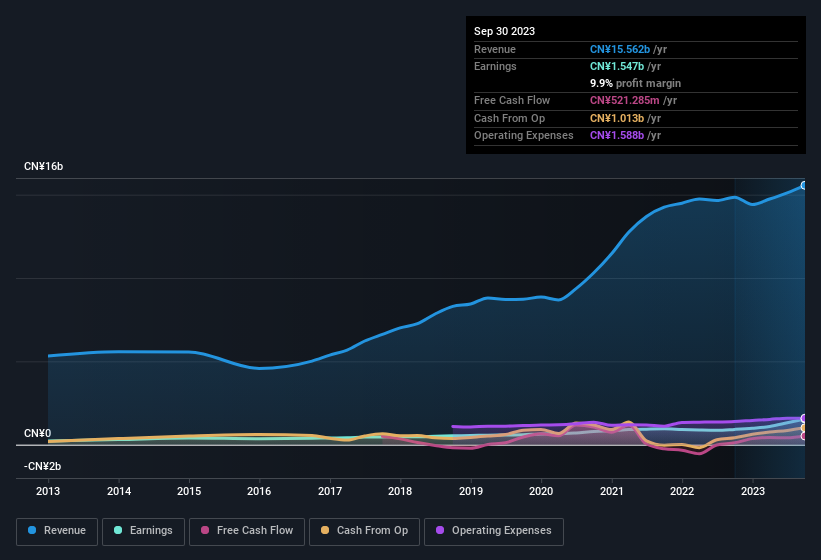

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Hangcha Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Hangcha Group shareholders can take confidence from the fact that EBIT margins are up from 6.4% to 9.9%, and revenue is growing. Both of which are great metrics to check off for potential growth.

查看息稅前收益(EBIT)利潤率以及收入增長通常會很有幫助,這樣可以重新了解公司的增長質量。值得注意的是,杭茶集團的收入 來自運營 低於其過去十二個月的收入,因此這可能會扭曲我們對其利潤率的分析。息稅前利潤率從6.4%上升到9.9%,收入也在增長,杭茶集團的股東可以從這一事實中獲得信心。這兩個都是衡量潛在增長的好指標。

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

在下圖中,您可以看到隨着時間的推移,公司的收益和收入是如何增長的。點擊圖表查看確切數字。

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Hangcha Group's future profits.

你不是用眼睛看着後視鏡開車,所以你可能會對這份顯示分析師對Hangcha Group未來利潤預測的免費報告更感興趣。

Are Hangcha Group Insiders Aligned With All Shareholders?

Hangcha Group 內部人士是否與所有股東保持一致?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Hangcha Group insiders have a significant amount of capital invested in the stock. We note that their impressive stake in the company is worth CN¥1.2b. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

公司領導人的行爲必須符合股東的最大利益,因此內幕投資始終是市場的保證。因此,很高興看到Hangcha Group內部人士將大量資本投資於該股。我們注意到,他們在該公司的可觀股份價值12億元人民幣。持有人應該會發現這種程度的內幕承諾非常令人鼓舞,因爲這將確保公司的領導者也能在股票上經歷成功或失敗。

Is Hangcha Group Worth Keeping An Eye On?

Hangcha Group 值得關注嗎?

If you believe that share price follows earnings per share you should definitely be delving further into Hangcha Group's strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Hangcha Group , and understanding these should be part of your investment process.

如果你認爲股價跟隨每股收益,那麼你肯定應該進一步研究Hangcha Group強勁的每股收益增長。在這樣的每股收益增長率下,看到公司高層通過繼續持有大量投資對公司充滿信心也就不足爲奇了。快速增長和自信的內部人士應該足以值得進一步研究,因此看來這是一隻值得關注的好股票。仍然有必要考慮永遠存在的投資風險幽靈。我們已經向Hangcha Group發現了兩個警告信號,了解這些信號應該成爲您投資過程的一部分。

Although Hangcha Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

儘管Hangcha Group看起來確實不錯,但如果內部人士購買股票,它可能會吸引更多的投資者。如果你想看到內幕買入,那麼這份由內部人士收購的成長型公司的免費名單可能正是你想要的。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文中討論的內幕交易是指相關司法管轄區內應報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。