Cathay Pacific Airways Limited (HKG:293) Doing What It Can To Lift Shares

Cathay Pacific Airways Limited (HKG:293) Doing What It Can To Lift Shares

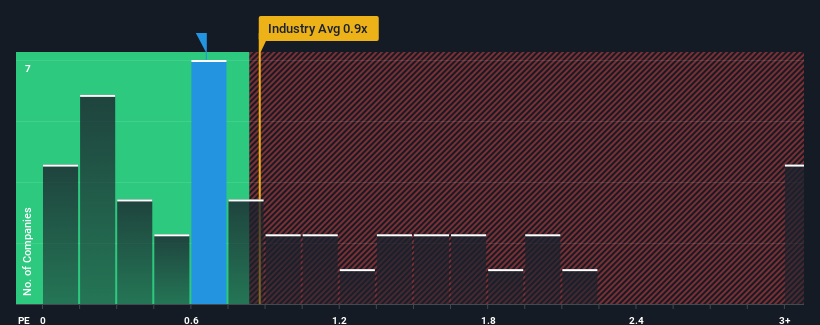

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Airlines industry in Hong Kong, you could be forgiven for feeling indifferent about Cathay Pacific Airways Limited's (HKG:293) P/S ratio of 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

香港航空業的平均市售率(或 “市盈率”)接近0.9倍,你對此漠不關心是可以原諒的 國泰航空有限公司的 (HKG: 293) 市盈率爲0.7倍。儘管這可能不會引起任何關注,但如果市盈率不合理,投資者可能會錯過潛在的機會或忽視迫在眉睫的失望。

View our latest analysis for Cathay Pacific Airways

查看我們對國泰航空的最新分析

How Has Cathay Pacific Airways Performed Recently?

國泰航空最近的表現如何?

Recent times haven't been great for Cathay Pacific Airways as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

最近國泰航空的收入增長速度低於大多數其他公司,因此國泰航空的收入增長速度並不理想。一種可能性是市盈率適中,因爲投資者認爲這種乏善可陳的收入表現將得到扭轉。如果不是,那麼現有股東可能會對股價的可行性感到有些緊張。

Is There Some Revenue Growth Forecasted For Cathay Pacific Airways?

預計國泰航空的收入會有所增長嗎?

In order to justify its P/S ratio, Cathay Pacific Airways would need to produce growth that's similar to the industry.

爲了證明其市盈率是合理的,國泰航空需要實現與行業相似的增長。

Retrospectively, the last year delivered an exceptional 58% gain to the company's top line. Still, revenue has fallen 6.2% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

回顧過去,去年該公司的收入實現了驚人的58%的增長。儘管如此,總收入仍比三年前下降了6.2%,這令人失望。因此,不幸的是,我們必須承認,在此期間,該公司在增加收入方面做得並不出色。

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 17% per annum over the next three years. That's shaping up to be materially higher than the 11% per year growth forecast for the broader industry.

展望未來,報道該公司的十二位分析師的估計表明,未來三年收入將每年增長17%。這將大大高於整個行業每年11%的增長預期。

In light of this, it's curious that Cathay Pacific Airways' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

有鑑於此,奇怪的是,國泰航空的市盈率與大多數其他公司的市盈率持平。可能是大多數投資者不相信該公司能夠實現未來的增長預期。

The Key Takeaway

關鍵要點

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

通常,在做出投資決策時,我們會謹慎行事,不要過多地閱讀市售比率,儘管這可以充分揭示其他市場參與者對公司的看法。

We've established that Cathay Pacific Airways currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

我們已經確定,國泰航空目前的市盈率低於預期,因爲其預測的收入增長高於整個行業。市場定價可能存在一些風險,這使市盈率無法與樂觀的前景相提並論。看來有些人確實在預測收入不穩定,因爲這些條件通常應該會提振股價。

Having said that, be aware Cathay Pacific Airways is showing 1 warning sign in our investment analysis, you should know about.

話雖如此,請注意 國泰航空顯示了 1 個警告標誌 在我們的投資分析中,你應該知道。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果實力雄厚的公司讓你大開眼界,那麼你一定要看看這個 免費的 以低市盈率交易(但已證明可以增加收益)的有趣公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎? 取得聯繫 直接和我們在一起。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。 我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。簡而言之,華爾街在上述任何股票中都沒有頭寸。