Gansu Golden Solar (SZSE:300093) Shareholder Returns Have Been Impressive, Earning 160% in 5 Years

Gansu Golden Solar (SZSE:300093) Shareholder Returns Have Been Impressive, Earning 160% in 5 Years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. One great example is Gansu Golden Solar Co., Ltd (SZSE:300093) which saw its share price drive 160% higher over five years. It's even up 13% in the last week.

在購買公司股票(假設沒有槓桿作用)之後,最糟糕的結果是你損失了所有投入的資金。但是,當你選擇一家真正蓬勃發展的公司時,你可以 使 超過 100%。一個很好的例子是甘肅金光能股份有限公司(深圳證券交易所代碼:300093),其股價在五年內上漲了160%。上週它甚至上漲了13%。

Since the stock has added CN¥438m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

由於該股僅在過去一週的市值就增加了4.38億元人民幣,因此讓我們看看基礎表現是否推動了長期回報。

View our latest analysis for Gansu Golden Solar

查看我們對甘肅金太陽的最新分析

Gansu Golden Solar wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

甘肅金光能在過去十二個月中沒有盈利,我們不太可能看到其股價與每股收益(EPS)之間存在很強的相關性。可以說,收入是我們的下一個最佳選擇。一般而言,沒有利潤的公司預計每年收入將增長,而且速度很快。這是因爲快速的收入增長可以很容易地推斷出來預測利潤,通常規模相當大。

Over the last half decade Gansu Golden Solar's revenue has actually been trending down at about 8.4% per year. Given that scenario, we wouldn't have expected the share price to rise 21% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, we are a bit cautious in this kind of situation.

在過去的五年中,甘肅金光能的收入實際上一直呈下降趨勢,每年約8.4%。在這種情況下,我們本來不希望股價每年上漲21%,但它就是這樣做的。這很好地提醒人們,對未來的預期,而不是過去的歷史,總是會影響股價。儘管如此,在這種情況下我們還是有點謹慎的。

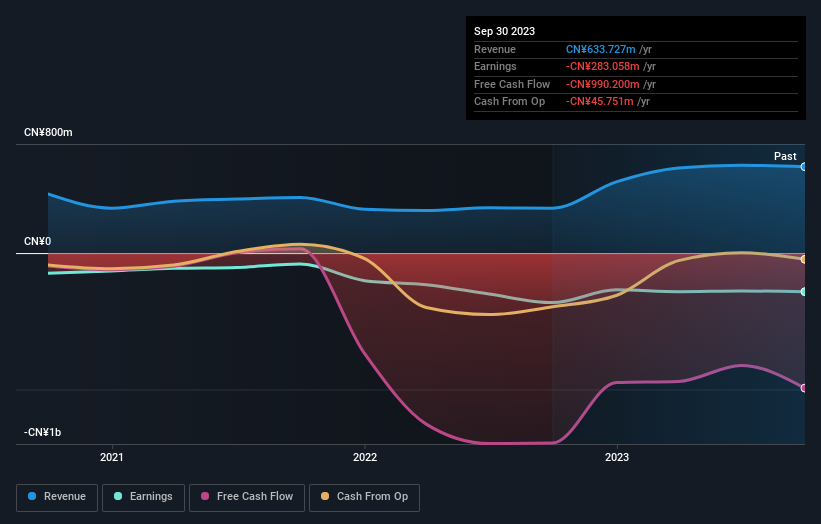

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

你可以在下面看到收入和收入如何隨着時間的推移而變化(點擊圖片發現確切的數值)。

Take a more thorough look at Gansu Golden Solar's financial health with this free report on its balance sheet.

通過這份免費的資產負債表報告,更全面地了解甘肅金光能的財務狀況。

A Different Perspective

不同的視角

While the broader market lost about 4.2% in the twelve months, Gansu Golden Solar shareholders did even worse, losing 59%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 21% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Gansu Golden Solar , and understanding them should be part of your investment process.

儘管整個市場在十二個月中下跌了約4.2%,但甘肅金光能股東的表現甚至更糟,跌幅爲59%。話雖如此,在下跌的市場中,一些股票不可避免地會被超賣。關鍵是要密切關注基本發展。好的一面是,長期股東賺了錢,在過去的五年中,每年增長21%。最近的拋售可能是一個機會,因此可能值得查看基本面數據以尋找長期增長趨勢的跡象。儘管市場狀況可能對股價產生的不同影響值得考慮,但還有其他因素更爲重要。例如,投資風險的幽靈無處不在。我們已經確定了甘肅金光能的三個警告信號,了解它們應該是您投資過程的一部分。

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

對於那些喜歡尋找中獎投資的人來說,這份最近有內幕收購的成長型公司的免費名單可能只是門票。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所交易的股票的市場加權平均回報率。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

Gansu Golden Solar wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Gansu Golden Solar wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.