Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. For example, the Royal Caribbean Cruises Ltd. (NYSE:RCL) share price is up 80% in the last 1 year, clearly besting the market return of around 14% (not including dividends). So that should have shareholders smiling. It is also impressive that the stock is up 33% over three years, adding to the sense that it is a real winner.

So let's assess the underlying fundamentals over the last 1 year and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Royal Caribbean Cruises

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

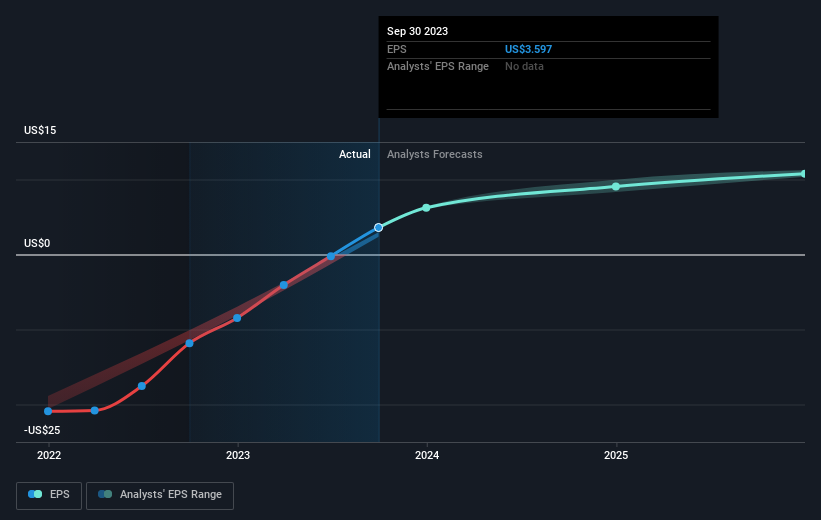

During the last year Royal Caribbean Cruises grew its earnings per share, moving from a loss to a profit.

We think the growth looks very prospective, so we're not surprised the market liked it too. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

NYSE:RCL Earnings Per Share Growth November 27th 2023

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Royal Caribbean Cruises has rewarded shareholders with a total shareholder return of 80% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 0.9% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Royal Caribbean Cruises (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

被動投資指數基金可以產生與整個市場大致相匹配的回報。但是,如果你選擇了正確的個股,你的收益可能不止於此。例如,皇家加勒比郵輪有限公司(紐約證券交易所代碼:RCL)的股價在過去1年中上漲了80%,顯然超過了約14%的市場回報率(不包括股息)。因此,這應該讓股東們微笑。同樣令人印象深刻的是,該股在三年內上漲了33%,這更加讓人感覺自己是真正的贏家。

因此,讓我們評估過去一年的基本面,看看它們是否與股東回報步調一致。

查看我們對皇家加勒比郵輪的最新分析

儘管一些人繼續教導高效市場假說,但事實證明,市場是反應過度的動態系統,投資者並不總是理性的。研究市場情緒如何隨着時間的推移而變化的一種方法是研究公司股價與其每股收益(EPS)之間的相互作用。

儘管一些人繼續教導高效市場假說,但事實證明,市場是反應過度的動態系統,投資者並不總是理性的。研究市場情緒如何隨着時間的推移而變化的一種方法是研究公司股價與其每股收益(EPS)之間的相互作用。

去年,皇家加勒比郵輪公司的每股收益從虧損轉爲盈利。

我們認爲增長看起來很有前景,因此市場也喜歡增長並不奇怪。一般來說,盈利能力的轉折點是仔細研究公司的好時機,以免錯過獲利的機會。

下圖描述了 EPS 隨着時間的推移是如何變化的(點擊圖片可以看到確切的值)。

紐約證券交易所:RCL 每股收益增長 2023 年 11 月 27 日

我們喜歡內部人士在過去十二個月中一直在購買股票。即便如此,未來的收益對於當前股東能否賺錢要重要得多。在買入或賣出股票之前,我們始終建議仔細研究歷史增長趨勢,可在此處查閱。

不同的視角

很高興看到皇家加勒比郵輪在過去十二個月中向股東提供了80%的股東總回報率。毫無疑問,最近的回報比五年內每年0.9%的股東總回報率損失要好得多。我們通常更看重短期內的長期業績,但最近的改善可能暗示業務將出現(積極的)轉折點。我發現從長遠來看,將股價視爲業務表現的代表非常有趣。但是,要真正獲得見解,我們還需要考慮其他信息。例如,以永遠存在的投資風險幽靈爲例。我們已經在皇家加勒比郵輪公司發現了兩個警告信號(至少有一個有點不愉快),了解它們應該是您投資過程的一部分。

還有很多其他公司有內部人士購買股票。你可能不想錯過這份業內人士正在收購的成長型公司的免費名單。

請注意,本文引用的市場回報反映了目前在美國交易所交易的股票的市場加權平均回報。

儘管一些人繼續教導高效市場假說,但事實證明,市場是反應過度的動態系統,投資者並不總是理性的。研究市場情緒如何隨着時間的推移而變化的一種方法是研究公司股價與其每股收益(EPS)之間的相互作用。

儘管一些人繼續教導高效市場假說,但事實證明,市場是反應過度的動態系統,投資者並不總是理性的。研究市場情緒如何隨着時間的推移而變化的一種方法是研究公司股價與其每股收益(EPS)之間的相互作用。

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).