Phillips 66 Options Trading: A Deep Dive Into Market Sentiment

Phillips 66 Options Trading: A Deep Dive Into Market Sentiment

Investors with a lot of money to spend have taken a bearish stance on Phillips 66 (NYSE:PSX).

有很多錢可以花的投資者對菲利普斯66(紐約證券交易所代碼:PSX)採取了看跌立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

今天,當我們在本辛加追蹤的公開期權歷史記錄中出現頭寸時,我們注意到了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PSX, it often means somebody knows something is about to happen.

這些是機構還是僅僅是富人,我們都不知道。但是,當PSX發生這麼大的事情時,這通常意味着有人知道某件事即將發生。

Today, Benzinga's options scanner spotted 11 options trades for Phillips 66.

今天,本辛加的期權掃描儀發現了菲利普斯66的11筆期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 45% bullish and 54%, bearish.

這些大手交易者的整體情緒分爲45%看漲和54%(看跌)。

Out of all of the options we uncovered, there was 1 put, for a total amount of $78,853, and 10, calls, for a total amount of $718,550.

在我們發現的所有期權中,有1個看跌期權,總金額爲78,853美元,還有10個看漲期權,總金額爲718,550美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $72.5 and $140.0 for Phillips 66, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,在過去三個月中,主要的市場推動者將注意力集中在72.5美元至140.0美元之間的價格區間上。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

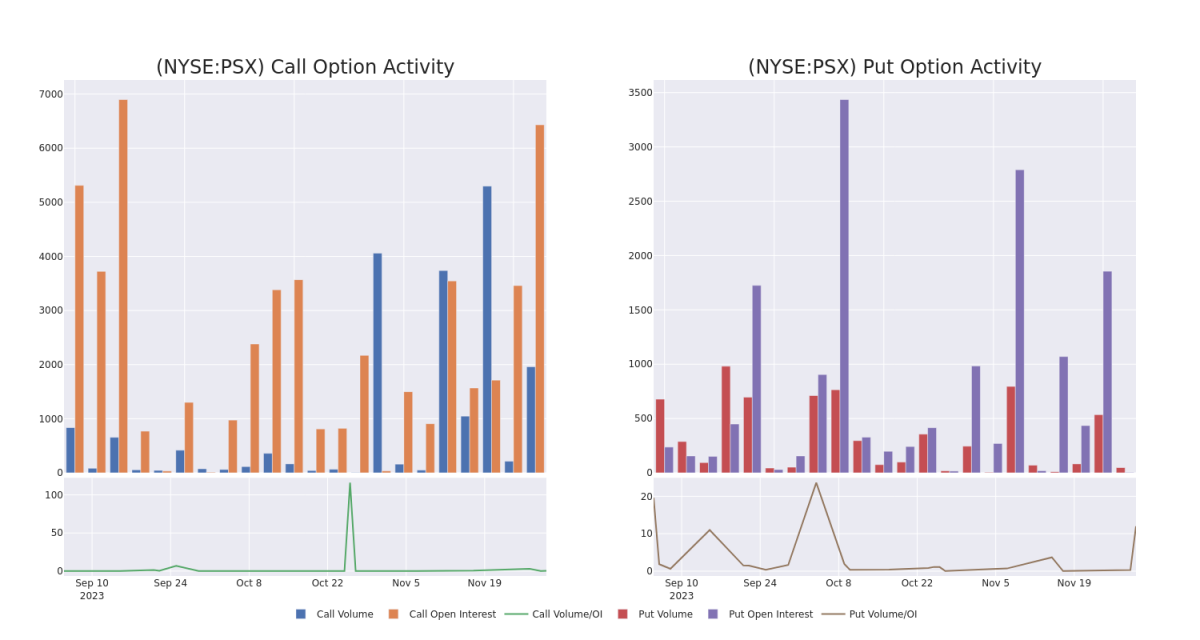

In today's trading context, the average open interest for options of Phillips 66 stands at 715.0, with a total volume reaching 2,009.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Phillips 66, situated within the strike price corridor from $72.5 to $140.0, throughout the last 30 days.

在當今的交易背景下,飛利浦66期權的平均未平倉合約爲715.0,總成交量達到2,009.00。隨附的圖表描繪了在過去30天中,位於行使價走廊內的菲利普斯66高價值交易的看漲期權和看跌期權交易量以及未平倉合約的走勢,價格從72.5美元到140.0美元不等。

Phillips 66 Option Activity Analysis: Last 30 Days

菲利普斯 66 期權活動分析:過去 30 天

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| PSX | CALL | TRADE | BEARISH | 01/19/24 | $125.00 | $136.4K | 3.4K | 645 |

| PSX | CALL | TRADE | BULLISH | 05/17/24 | $115.00 | $116.5K | 333 | 0 |

| PSX | CALL | SWEEP | BULLISH | 01/16/26 | $140.00 | $95.4K | 7 | 66 |

| PSX | CALL | TRADE | NEUTRAL | 06/21/24 | $135.00 | $87.0K | 420 | 155 |

| PSX | PUT | SWEEP | BEARISH | 01/16/26 | $135.00 | $78.8K | 4 | 48 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|

| PSX | 打電話 | 貿易 | 粗魯的 | 01/19/24 | 125.00 美元 | 136.4 萬美元 | 3.4K | 645 |

| PSX | 打電話 | 貿易 | 看漲 | 05/17/24 | 115.00 美元 | 116.5 萬美元 | 333 | 0 |

| PSX | 打電話 | 掃 | 看漲 | 01/16/26 | 140.00 美元 | 95.4 萬美元 | 7 | 66 |

| PSX | 打電話 | 貿易 | 中立 | 06/21/24 | 135.00 美元 | 87.0 萬美元 | 420 | 155 |

| PSX | 放 | 掃 | 粗魯的 | 01/16/26 | 135.00 美元 | 78.8 萬美元 | 4 | 48 |

About Phillips 66

關於菲利普斯 66

Phillips 66 is an independent refiner with 12 refineries that have a total crude throughput capacity of 1.9 million barrels per day, or mmb/d. In 2023, the Rodeo, California, facility will cease operations and be converted to produce renewable diesel. The midstream segment comprises extensive transportation and NGL processing assets and includes DCP Midstream, which holds 600 mbd of NGL fractionation and 22,000 miles of pipeline. Its CPChem chemical joint venture operates facilities in the United States and the Middle East and primarily produces olefins and polyolefins.

菲利普斯66是一家獨立煉油廠,擁有12家煉油廠,其原油總吞吐量爲每天190萬桶,合mmb/d。2023年,位於加利福尼亞州羅迪奧的工廠將停止運營並轉爲生產可再生柴油。中游板塊包括大量的運輸和液化天然氣加工資產,包括DCP Midstream,該公司擁有600 mbd的液化天然氣分餾和22,000英里的管道。其CpChem化學合資企業在美國和中東設有工廠,主要生產烯烴和聚烯烴。

Present Market Standing of Phillips 66

菲利普斯66目前的市場地位

- Currently trading with a volume of 4,173,682, the PSX's price is up by 4.73%, now at $128.0.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 61 days.

- PSX目前的交易量爲4,173,682美元,其價格上漲了4.73%,目前爲128.0美元。

- RSI讀數表明,該股目前可能接近超買。

- 預計收益將在61天后發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

If you want to stay updated on the latest options trades for Phillips 66, Benzinga Pro gives you real-time options trades alerts.

如果您想隨時了解Phillips 66的最新期權交易,Benzinga Pro會爲您提供實時期權交易提醒。