Health Check: How Prudently Does Ribbon Communications (NASDAQ:RBBN) Use Debt?

Health Check: How Prudently Does Ribbon Communications (NASDAQ:RBBN) Use Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Ribbon Communications Inc. (NASDAQ:RBBN) makes use of debt. But the more important question is: how much risk is that debt creating?

傳奇基金經理李露(由查理·芒格支持)曾經說過:“最大的投資風險不是價格的波動,而是你是否會遭受永久的資本損失。”當我們考慮一家公司的風險時,我們總是喜歡看它對債務的使用,因爲債務超負荷可能導致破產。與許多其他公司一樣,Ribbon Communications Inc.(納斯達克股票代碼:RBBN)也使用債務。但更重要的問題是:這筆債務造成了多少風險?

When Is Debt Dangerous?

債務何時危險?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

當企業無法通過自由現金流或以有吸引力的價格籌集資金來輕鬆履行債務和其他負債時,債務和其他負債就會面臨風險。資本主義的重要組成部分是 “創造性破壞” 的過程,在這個過程中,倒閉的企業將被銀行家無情地清算。儘管這種情況並不常見,但我們經常會看到負債公司永久稀釋股東,因爲貸款人強迫他們以不利的價格籌集資金。當然,債務的好處在於它通常代表廉價資本,尤其是當它取代了對一家能夠以高回報率進行再投資的公司的攤薄時。當我們考慮公司使用債務時,我們首先要同時考慮現金和債務。

Check out our latest analysis for Ribbon Communications

查看我們對絲帶通訊的最新分析

How Much Debt Does Ribbon Communications Carry?

Ribbon Communications 揹負多少

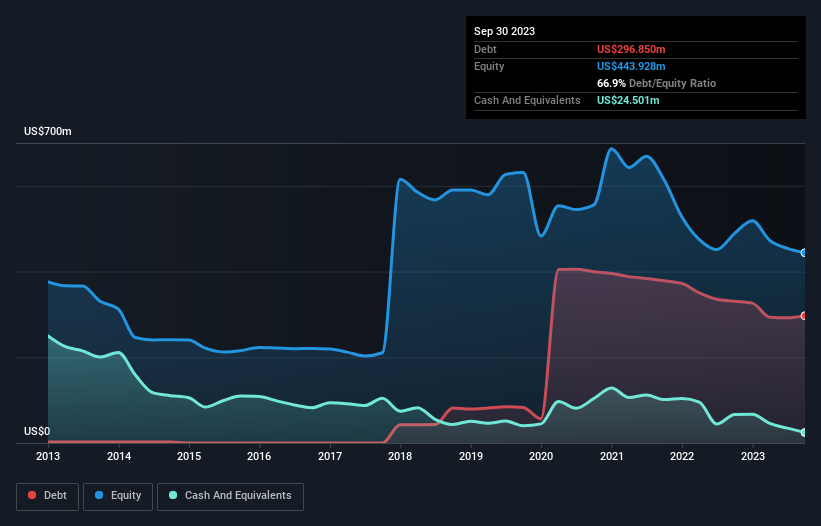

As you can see below, Ribbon Communications had US$296.9m of debt at September 2023, down from US$330.8m a year prior. However, it does have US$24.5m in cash offsetting this, leading to net debt of about US$272.3m.

如下所示,截至2023年9月,Ribbon Communications的債務爲2.969億美元,低於去年同期的3.308億美元。但是,它確實有2450萬美元的現金抵消了這一點,導致淨負債約爲2.723億美元。

How Healthy Is Ribbon Communications' Balance Sheet?

Ribon Communications 的資產負債表有多健康?

The latest balance sheet data shows that Ribbon Communications had liabilities of US$325.5m due within a year, and liabilities of US$352.2m falling due after that. Offsetting these obligations, it had cash of US$24.5m as well as receivables valued at US$242.2m due within 12 months. So it has liabilities totalling US$411.0m more than its cash and near-term receivables, combined.

最新的資產負債表數據顯示,Ribbon Communications在一年內到期的負債爲3.255億美元,此後到期的負債爲3.522億美元。爲了抵消這些債務,它有2450萬美元的現金以及價值2.422億美元的應收賬款,將在12個月內到期。因此,它的負債總額比其現金和短期應收賬款的總和高出4.11億美元。

When you consider that this deficiency exceeds the company's US$388.1m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Ribbon Communications can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

當你考慮到這種缺陷超過了公司3.881億美元的市值時,你很可能會傾向於仔細審查資產負債表。在公司不得不迅速清理資產負債表的情況下,股東似乎很可能會遭受大規模稀釋。毫無疑問,我們從資產負債表中學到的關於債務的知識最多。但最終,該業務的未來盈利能力將決定Ribbon Communications能否隨着時間的推移加強其資產負債表。因此,如果你想看看專業人士的想法,你可能會發現這份關於分析師利潤預測的免費報告很有趣。

Over 12 months, Ribbon Communications reported revenue of US$834m, which is a gain of 2.1%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

在過去的12個月中,Ribbon Communications公佈的收入爲8.34億美元,增長2.1%,儘管該公司沒有報告任何利息和稅前收益。就我們的口味而言,這種增長速度有點慢,但是創造一個世界需要所有類型。

Caveat Emptor

Caveat Emptor

Importantly, Ribbon Communications had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at US$19m. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. For example, we would not want to see a repeat of last year's loss of US$53m. In the meantime, we consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Ribbon Communications is showing 2 warning signs in our investment analysis , you should know about...

重要的是,Ribbon Communications去年出現了利息稅前收益(EBIT)虧損。具體而言,息稅前利潤虧損爲1900萬美元。考慮到除了上述負債外,我們還對公司感到緊張。它需要迅速改善其運營,我們才會對此感興趣。例如,我們不希望看到去年5300萬美元的虧損重演。同時,我們認爲該股存在風險。資產負債表顯然是分析債務時需要關注的領域。但歸根結底,每家公司都可以控制資產負債表之外的風險。請注意,Ribbon Communications在我們的投資分析中顯示了兩個警告信號,您應該知道...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

當一切都說完之後,有時更容易將注意力集中在甚至不需要債務的公司上。讀者現在可以100%免費訪問淨負債爲零的成長型股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

As you can see below, Ribbon Communications had US$296.9m of debt at September 2023, down from US$330.8m a year prior. However, it does have US$24.5m in cash offsetting this, leading to net debt of about US$272.3m.

As you can see below, Ribbon Communications had US$296.9m of debt at September 2023, down from US$330.8m a year prior. However, it does have US$24.5m in cash offsetting this, leading to net debt of about US$272.3m.