- 要聞

- 市場對拉爾夫·勞倫公司(紐約證券交易所代碼:RL)仍然缺乏信心

Market Still Lacking Some Conviction On Ralph Lauren Corporation (NYSE:RL)

Market Still Lacking Some Conviction On Ralph Lauren Corporation (NYSE:RL)

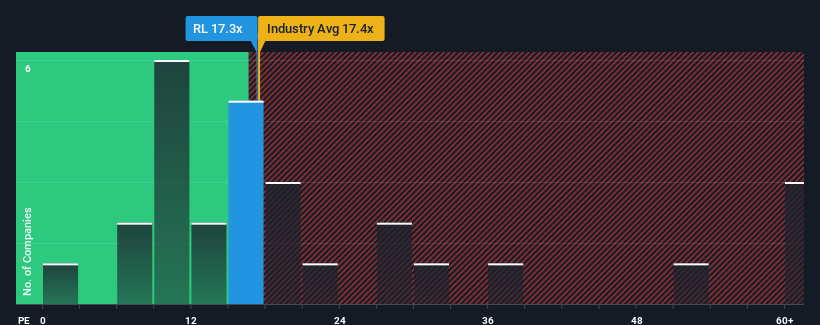

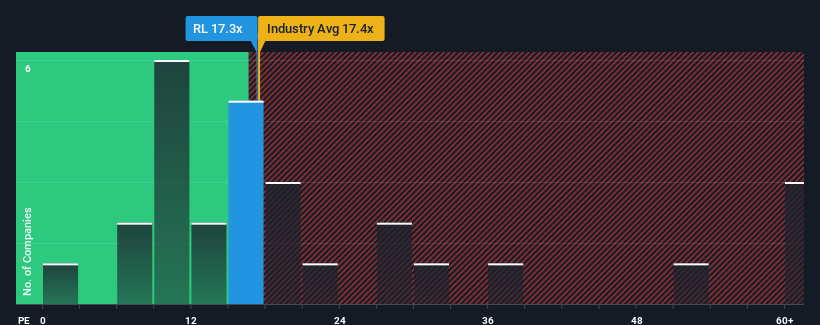

With a median price-to-earnings (or "P/E") ratio of close to 17x in the United States, you could be forgiven for feeling indifferent about Ralph Lauren Corporation's (NYSE:RL) P/E ratio of 17.3x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Ralph Lauren certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Ralph Lauren

How Is Ralph Lauren's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Ralph Lauren's to be considered reasonable.

There's an inherent assumption that a company should be matching the market for P/E ratios like Ralph Lauren's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 9.2% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 15% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 12% each year growth forecast for the broader market.

In light of this, it's curious that Ralph Lauren's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Ralph Lauren's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Ralph Lauren currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Ralph Lauren that we have uncovered.

If you're unsure about the strength of Ralph Lauren's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

由於美國的市盈率(或 “市盈率”)中位數接近17倍,你對拉爾夫·勞倫公司(紐約證券交易所代碼:RL)17.3倍的市盈率漠不關心是可以原諒的。但是,在沒有解釋的情況下乾脆忽略市盈率是不明智的,因爲投資者可能忽視了獨特的機會或代價高昂的錯誤。

拉爾夫·勞倫(Ralph Lauren)最近無疑做得很好,因爲其收益增長爲正數,而大多數其他公司的收益卻出現倒退。許多人可能預計強勁的收益表現會像其他表現一樣惡化,這使市盈率無法上升。如果你喜歡這家公司,你會希望情況並非如此,這樣你就有可能在它不太有利的情況下買入一些股票。

看看我們對拉爾夫·勞倫的最新分析

拉爾夫·勞倫的增長趨勢如何?

人們固有的假設是,像拉爾夫·勞倫這樣的市盈率應該與市場相匹配,這樣才能被視爲合理。

人們固有的假設是,像拉爾夫·勞倫這樣的市盈率應該與市場相匹配,這樣才能被視爲合理。

首先回顧一下,我們發現該公司去年成功地將每股收益增長了9.2%。但是,最近三年的總體表現不如根本沒有帶來任何增長。因此,股東可能不會對不穩定的中期增長率過於滿意。

展望未來,關注該公司的分析師表示,預計未來三年每股收益每年將增長15%。這將大大高於整個市場每年12%的增長預期。

有鑑於此,奇怪的是,拉爾夫·勞倫的市盈率與大多數其他公司持平。顯然,一些股東對預測持懷疑態度,並一直在接受較低的銷售價格。

拉爾夫·勞倫市盈率的底線

雖然市盈率不應該是決定你是否買入股票的決定性因素,但它是衡量收益預期的有力晴雨表。

我們已經確定,拉爾夫·勞倫目前的市盈率低於預期,因爲其預測增長高於整個市場。當我們看到強勁的收益前景和快於市場的增長時,我們假設潛在風險可能會給市盈率帶來壓力。至少價格下跌的風險似乎得到了抑制,但投資者似乎認爲未來的收益可能會出現一些波動。

在你採取下一步行動之前,你應該了解我們爲Ralph Lauren發現的兩個警告信號。

如果你不確定拉爾夫·勞倫的業務實力,爲什麼不瀏覽我們爲你可能錯過的其他公司提供的具有堅實業務基礎的股票互動清單。

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧