Sapiens International (NASDAQ:SPNS) Ticks All The Boxes When It Comes To Earnings Growth

Sapiens International (NASDAQ:SPNS) Ticks All The Boxes When It Comes To Earnings Growth

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

對於初學者來說,收購一家向投資者講述好故事的公司似乎是個好主意(也是一個令人興奮的前景),即使該公司目前缺乏收入和利潤記錄。有時,這些故事會使投資者的思想蒙上陰影,導致他們用自己的情感進行投資,而不是根據良好的公司基本面進行投資。虧損的公司一直在爭分奪秒地實現財務可持續性,因此這些公司的投資者承擔的風險可能超出了應有的水平。

In contrast to all that, many investors prefer to focus on companies like Sapiens International (NASDAQ:SPNS), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

與此形成鮮明對比的是,許多投資者更願意關注像Sapiens International(納斯達克股票代碼:SPNS)這樣的公司,該公司不僅有收入,還有利潤。儘管這並不一定說明其估值是否被低估,但該業務的盈利能力足以保證一定的升值——尤其是在其增長的情況下。

View our latest analysis for Sapiens International

查看我們對 Sapiens International 的最新分析

How Fast Is Sapiens International Growing?

Sapiens International 的增長速度有多快?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Sapiens International has grown EPS by 18% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

如果你認爲市場的效率甚至含糊不清,那麼從長遠來看,你預計公司的股價將遵循其每股收益(EPS)的結果。因此,有很多投資者喜歡購買每股收益不斷增長的公司的股票。令人印象深刻的是,在過去三年中,Sapiens International的每股收益複合增長了18%。一般來說,如果一家公司能跟上步伐,我們會這麼說 那個 有點像增長,股東們會喜氣洋洋。

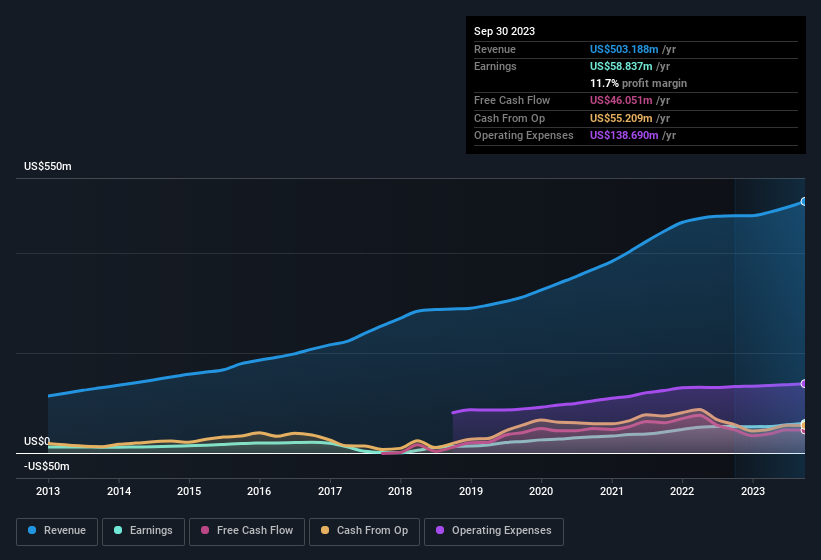

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Sapiens International achieved similar EBIT margins to last year, revenue grew by a solid 6.0% to US$503m. That's a real positive.

收入增長是可持續增長的重要指標,再加上較高的息稅前收益(EBIT)利潤率,這是公司保持市場競爭優勢的好方法。儘管我們注意到Sapiens International的息稅前利潤率與去年相似,但收入穩步增長了6.0%,達到5.03億美元。這確實是一個積極的方面。

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

您可以在下圖中查看該公司的收入和收益增長趨勢。要獲得更詳細的細節,請點擊圖片。

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Sapiens International's future profits.

你開車時不要注視後視鏡,因此你可能會對這份免費報告更感興趣,該報告顯示了分析師對Sapiens International未來利潤的預測。

Are Sapiens International Insiders Aligned With All Shareholders?

Sapiens International Insiders 是否與所有股東一致?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Sapiens International shares worth a considerable sum. As a matter of fact, their holding is valued at US$12m. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

可以說,看到公司領導者將資金投入到危險之中真是令人高興,因爲這提高了企業經營者與其真正所有者之間激勵措施的一致性。股東們會對內部人士擁有價值可觀的Sapiens International股票感到高興。事實上,他們的持股價值1200萬美元。這是一大筆錢,也不是努力工作的小動力。儘管這僅佔公司的0.7%左右,但這筆錢足以表明企業領導者和普通股東之間的一致性。

Is Sapiens International Worth Keeping An Eye On?

智人國際值得關注嗎?

For growth investors, Sapiens International's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Sapiens International's continuing strength. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Still, you should learn about the 1 warning sign we've spotted with Sapiens International.

對於成長型投資者來說,Sapiens International的原始收益增長率是夜間的燈塔。此外,高水平的內部所有權令人印象深刻,這表明管理層對每股收益的增長表示讚賞,並對Sapiens International的持續實力充滿信心。快速增長和自信的內部人士應該足以值得進一步研究,因此看來這是一隻值得關注的好股票。不過,你應該了解一下我們在Sapiens International上發現的1個警告標誌。

Although Sapiens International certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of companies that not only boast of strong growth but have also seen recent insider buying..

儘管Sapiens International看起來確實不錯,但如果內部人士買入股票,它可能會吸引更多的投資者。如果你想看看有內幕買入的公司,那就看看這些精心挑選的公司,這些公司不僅增長強勁,而且最近也出現了內幕買盤。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文中討論的內幕交易是指相關司法管轄區內應報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Sapiens International has grown EPS by 18% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Sapiens International has grown EPS by 18% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.