Market Whales and Their Recent Bets on HUM Options

Market Whales and Their Recent Bets on HUM Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Humana.

有很多錢可以花的鯨魚對Humana採取了明顯的看跌立場。

Looking at options history for Humana (NYSE:HUM) we detected 12 trades.

查看Humana(紐約證券交易所代碼:HUM)的期權歷史記錄,我們發現了12筆交易。

If we consider the specifics of each trade, it is accurate to state that 16% of the investors opened trades with bullish expectations and 83% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,有16%的投資者以看漲的預期開盤,83%的投資者持看跌預期。

From the overall spotted trades, 8 are puts, for a total amount of $366,849 and 4, calls, for a total amount of $263,700.

在已發現的全部交易中,有8筆是看跌期權,總額爲366,849美元,4筆看漲期權,總額爲263,700美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $320.0 and $470.0 for Humana, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要的市場走勢者將注意力集中在Humana在過去三個月的320.0美元至470.0美元之間的價格區間上。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

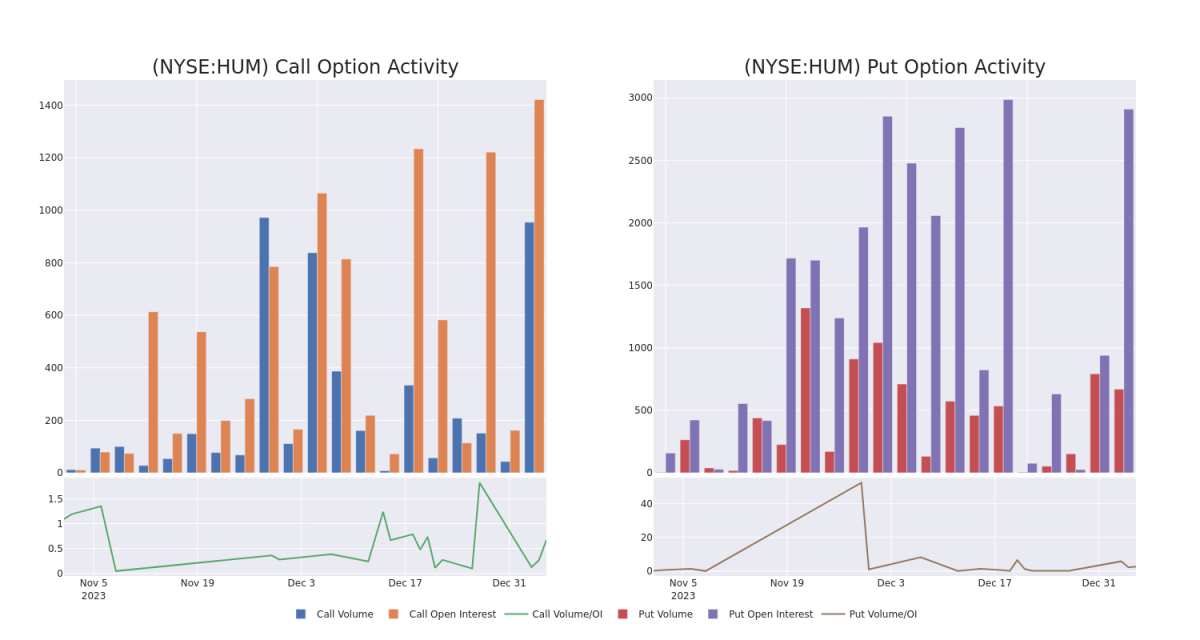

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平倉合約是對股票進行盡職調查的一種有見地的方式。

This data can help you track the liquidity and interest for Humana's options for a given strike price.

這些數據可以幫助您跟蹤給定行使價下Humana期權的流動性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Humana's whale activity within a strike price range from $320.0 to $470.0 in the last 30 days.

下面,我們可以觀察到過去30天內Humana所有鯨魚活動的看漲和看跌期權交易量和未平倉合約的變化,其行使價在320.0美元至470.0美元之間。

Humana Option Volume And Open Interest Over Last 30 Days

過去 30 天的 Humana 期權交易量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| HUM | CALL | SWEEP | BEARISH | 01/17/25 | $450.00 | $162.0K | 153 | 27 |

| HUM | PUT | TRADE | BEARISH | 01/26/24 | $440.00 | $96.2K | 1.0K | 1 |

| HUM | PUT | TRADE | BEARISH | 01/17/25 | $350.00 | $48.0K | 246 | 100 |

| HUM | PUT | TRADE | BULLISH | 05/17/24 | $470.00 | $46.0K | 25 | 22 |

| HUM | PUT | SWEEP | BEARISH | 05/17/24 | $470.00 | $41.0K | 25 | 38 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|

| 嗡嗡聲 | 打電話 | 掃 | 粗魯的 | 01/17/25 | 450.00 美元 | 162.0 萬美元 | 153 | 27 |

| 嗡嗡聲 | 放 | 貿易 | 粗魯的 | 01/26/24 | 440.00 美元 | 96.2 萬美元 | 1.0K | 1 |

| 嗡嗡聲 | 放 | 貿易 | 粗魯的 | 01/17/25 | 350.00 美元 | 48.0 萬美元 | 246 | 100 |

| 嗡嗡聲 | 放 | 貿易 | 看漲 | 05/17/24 | 470.00 美元 | 46.0 萬美元 | 25 | 22 |

| 嗡嗡聲 | 放 | 掃 | 粗魯的 | 05/17/24 | 470.00 美元 | 41.0 萬美元 | 25 | 38 |

About Humana

關於 Humana

Humana is one of the largest private health insurers in the U.S. with a focus on administering Medicare Advantage plans. The firm has built a niche specializing in government-sponsored programs, with nearly all its medical membership stemming from individual and group Medicare Advantage, Medicaid, and the military's Tricare program. The firm is also a leader in stand-alone prescription drug plans for seniors enrolled in traditional fee-for-service Medicare. Beyond medical insurance, the company provides other healthcare services, including primary-care services, at-home services, and pharmacy benefit management.

Humana是美國最大的私人健康保險公司之一,專注於管理Medicare Advantage計劃。該公司已經建立了一個專門從事政府贊助計劃的利基市場,其幾乎所有的醫療成員都來自個人和團體的Medicare Advantage、Medicaid和軍方的Tricare計劃。該公司還在爲參加傳統收費醫療保險的老年人提供獨立處方藥計劃方面處於領先地位。除醫療保險外,該公司還提供其他醫療保健服務,包括初級保健服務、居家服務和藥房福利管理。

Following our analysis of the options activities associated with Humana, we pivot to a closer look at the company's own performance.

在分析了與Humana相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

Current Position of Humana

Humana 的現狀

- Currently trading with a volume of 507,508, the HUM's price is down by -0.22%, now at $457.28.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 28 days.

- HUM目前的交易量爲507,508美元,價格下跌了-0.22%,目前爲457.28美元。

- RSI讀數表明,該股目前可能已接近超賣。

- 預計收益將在28天后發佈。

Expert Opinions on Humana

關於 Humana 的專家觀點

1 market experts have recently issued ratings for this stock, with a consensus target price of $550.0.

1位市場專家最近發佈了該股的評級,共識目標價爲550.0美元。

- Showing optimism, an analyst from Argus Research upgrades its rating to Buy with a revised price target of $550.

- 阿格斯研究的一位分析師表現出樂觀的態度,將其評級上調至買入,目標股價爲550美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Humana with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro獲取實時提醒,了解Humana的最新期權交易。