AvidXchange Holdings, Inc. (NASDAQ:AVDX): When Will It Breakeven?

AvidXchange Holdings, Inc. (NASDAQ:AVDX): When Will It Breakeven?

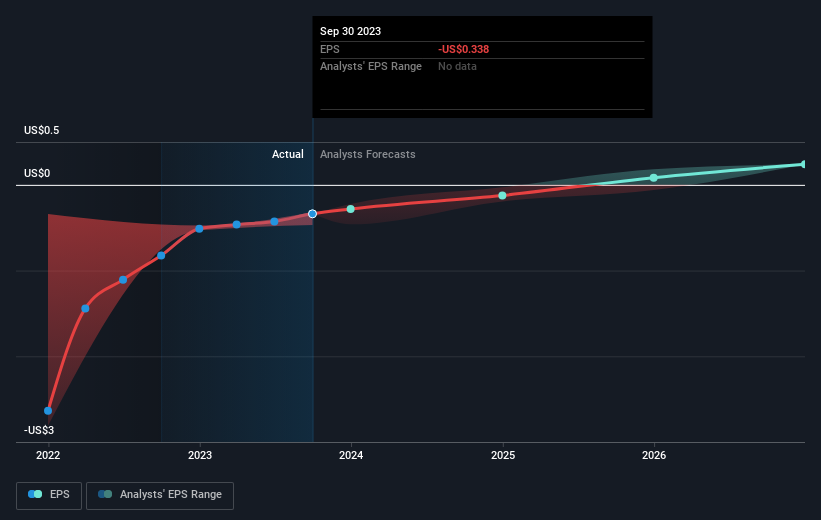

We feel now is a pretty good time to analyse AvidXchange Holdings, Inc.'s (NASDAQ:AVDX) business as it appears the company may be on the cusp of a considerable accomplishment. AvidXchange Holdings, Inc. provides accounts payable (AP) automation software and payment solutions for middle market businesses and their suppliers in North America. With the latest financial year loss of US$101m and a trailing-twelve-month loss of US$68m, the US$2.2b market-cap company alleviated its loss by moving closer towards its target of breakeven. The most pressing concern for investors is AvidXchange Holdings' path to profitability – when will it breakeven? We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

我們認爲現在是分析AvidXChange Holdings, Inc.的好時機。”s(納斯達克股票代碼:AVDX)的業務看來該公司可能正處於取得重大成就的風口浪尖。AvidXChange Holdings, Inc. 爲北美的中間市場企業及其供應商提供應付賬款(AP)自動化軟件和支付解決方案。這家市值爲22億美元的公司最近一個財年的虧損爲1.01億美元,過去十二個月的虧損爲6800萬美元,通過接近盈虧平衡的目標來緩解虧損。投資者最緊迫的擔憂是AvidXChange Holdings的盈利之路——它何時會實現盈虧平衡?我們簡要概述了行業分析師對該公司、盈虧平衡年份和隱含增長率的預期。

Check out our latest analysis for AvidXchange Holdings

查看我們對 AvidXChange Holdings 的最新分析

AvidXchange Holdings is bordering on breakeven, according to the 13 American Diversified Financial analysts. They expect the company to post a final loss in 2024, before turning a profit of US$17m in 2025. So, the company is predicted to breakeven just over a year from now. What rate will the company have to grow year-on-year in order to breakeven on this date? Using a line of best fit, we calculated an average annual growth rate of 70%, which is rather optimistic! Should the business grow at a slower rate, it will become profitable at a later date than expected.

根據13位美國多元化金融分析師的說法,AvidXChange Holdings接近盈虧平衡。他們預計,該公司將在2024年公佈最終虧損,然後在2025年實現1700萬美元的盈利。因此,預計該公司將在一年多後實現盈虧平衡。爲了在這一天實現盈虧平衡,公司必須同比增長多少?使用最適合的線,我們計算出平均年增長率爲70%,這相當樂觀!如果業務增長速度放緩,則盈利的時間將比預期的晚。

Underlying developments driving AvidXchange Holdings' growth isn't the focus of this broad overview, however, take into account that generally a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

推動AvidXChange Holdings增長的潛在發展並不是本次廣泛概述的重點,但是,請考慮到高增長率通常並非不尋常,尤其是在公司處於投資期時。

One thing we'd like to point out is that The company has managed its capital judiciously, with debt making up 13% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

我們想指出的一件事是,該公司謹慎地管理了資本,債務佔股權的13%。這意味着其運營資金主要來自股權資本,其低債務債務降低了投資這家虧損公司的風險。

Next Steps:

後續步驟:

There are key fundamentals of AvidXchange Holdings which are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at AvidXchange Holdings, take a look at AvidXchange Holdings' company page on Simply Wall St. We've also compiled a list of essential aspects you should further examine:

本文未涵蓋AvidXChange Holdings的關鍵基礎知識,但我們必須再次強調,這只是一個基本的概述。要更全面地了解AvidXChange Holdings,請查看 AvidXChange Holdings 在 Simply Wall St 上的公司頁面。我們還整理了一份你應該進一步研究的重要方面清單:

- Historical Track Record: What has AvidXchange Holdings' performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on AvidXchange Holdings' board and the CEO's background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

- 歷史記錄:AvidXChange Holdings過去的表現如何?詳細了解過去的往績分析,並查看我們分析的免費可視化表示,以提高清晰度。

- 管理團隊:由經驗豐富的管理團隊掌舵增強了我們對業務的信心——看看誰是AvidXChange Holdings董事會成員以及首席執行官的背景。

- 其他表現優異的股票:還有其他股票可以提供更好的前景並有良好的往績記錄嗎?在這裏瀏覽我們免費列出的這些優質股票。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

Underlying developments driving AvidXchange Holdings' growth isn't the focus of this broad overview, however, take into account that generally a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

Underlying developments driving AvidXchange Holdings' growth isn't the focus of this broad overview, however, take into account that generally a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.