Anhui Conch Cement Company Limited's (HKG:914) Earnings Are Not Doing Enough For Some Investors

Anhui Conch Cement Company Limited's (HKG:914) Earnings Are Not Doing Enough For Some Investors

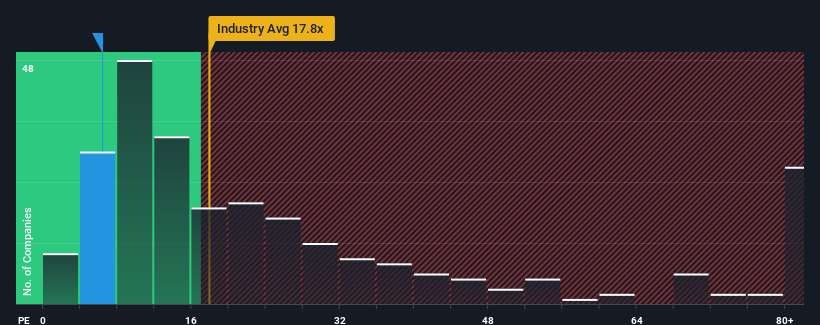

With a price-to-earnings (or "P/E") ratio of 6.4x Anhui Conch Cement Company Limited (HKG:914) may be sending bullish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios greater than 9x and even P/E's higher than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

安徽海螺水泥股份有限公司(HKG: 914)的市盈率(或 “市盈率”)爲6.4倍,目前可能會發出看漲信號,因爲香港幾乎有一半公司的市盈率大於9倍,甚至市盈率高於18倍也並不罕見。儘管如此,我們需要更深入地挖掘以確定降低市盈率是否有合理的基礎。

With earnings that are retreating more than the market's of late, Anhui Conch Cement has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

安徽海螺水泥的收益回落幅度超過了近期的市場,因此一直非常低迷。市盈率可能很低,因爲投資者認爲這種糟糕的收益表現根本不會改善。如果你仍然喜歡這家公司,那麼在做出任何決定之前,你會希望其盈利軌跡得到扭轉。如果不是,那麼現有股東可能很難對股價的未來走向感到興奮。

Check out our latest analysis for Anhui Conch Cement

查看我們對安徽海螺水泥的最新分析

SEHK:914 Price to Earnings Ratio vs Industry January 24th 2024

SEHK: 914 2024 年 1 月 24 日對比行業的市盈率

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Anhui Conch Cement.

如果你想了解分析師對未來的預測,你應該查看我們關於安徽海螺水泥的免費報告。

Is There Any Growth For Anhui Conch Cement?

安徽海螺水泥有增長嗎?

Anhui Conch Cement's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

安徽海螺水泥的市盈率對於一家預計增長有限,而且重要的是表現不如市場表現的公司來說是典型的。

Retrospectively, the last year delivered a frustrating 49% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 65% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

回顧過去,去年的公司利潤下降了49%,令人沮喪。過去三年看起來也不太好,因爲該公司的每股收益總共縮水了65%。因此,股東會對中期收益增長率感到悲觀。

Looking ahead now, EPS is anticipated to climb by 7.2% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 15% each year, which is noticeably more attractive.

根據關注該公司的分析師的說法,展望未來,預計未來三年每股收益將每年增長7.2%。同時,預計其餘市場每年將增長15%,這明顯更具吸引力。

With this information, we can see why Anhui Conch Cement is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

有了這些信息,我們可以明白爲什麼安徽海螺水泥的市盈率低於市場。看來大多數投資者預計未來增長有限,只願意爲股票支付較少的金額。

The Final Word

最後一句話

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

有人認爲,市盈率在某些行業中是衡量價值的次要指標,但它可能是一個有力的商業信心指標。

As we suspected, our examination of Anhui Conch Cement's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

正如我們所懷疑的那樣,我們對安徽海螺水泥分析師預測的審查顯示,其盈利前景不佳是其低市盈率的原因。在現階段,投資者認爲,收益改善的可能性不足以證明更高的市盈率是合理的。除非這些條件有所改善,否則它們將繼續構成股價在這些水平附近的障礙。

We don't want to rain on the parade too much, but we did also find 2 warning signs for Anhui Conch Cement that you need to be mindful of.

我們不想在遊行隊伍中下太多雨,但我們還發現了安徽海螺水泥的兩個警示標誌,你需要注意。

You might be able to find a better investment than Anhui Conch Cement. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

你也許能找到比安徽海螺水泥更好的投資。如果你想選擇可能的候選人,可以免費查看這份有趣的公司名單,這些公司的市盈率很低(但已經證明可以增加收益)。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接聯繫我們。或者,也可以發送電子郵件至編輯團隊 (at) simplywallst.com。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

SEHK:914 Price to Earnings Ratio vs Industry January 24th 2024

SEHK:914 Price to Earnings Ratio vs Industry January 24th 2024