Here's Why Inly Media (SHSE:603598) Can Afford Some Debt

Here's Why Inly Media (SHSE:603598) Can Afford Some Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Inly Media Co., Ltd. (SHSE:603598) does carry debt. But the more important question is: how much risk is that debt creating?

禾倫·巴菲特曾說過一句名言:“波動性遠非風險的代名詞。”當你檢查公司的資產負債表的風險時,考慮它的資產負債表是很自然的,因爲企業倒閉時通常會涉及債務。重要的是,英利媒體有限公司(上海證券交易所股票代碼:603598)確實有債務。但更重要的問題是:這筆債務會帶來多大的風險?

When Is Debt Dangerous?

債務何時危險?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

債務可以幫助企業,直到企業難以償還債務,無論是新資本還是自由現金流。歸根結底,如果公司無法履行償還債務的法律義務,股東可能一無所有地離開。但是,更常見(但仍然代價高昂)的情況是,公司必須以低廉的價格發行股票,永久稀釋股東,以支撐其資產負債表。但是,通過取代稀釋,對於需要資本以高回報率投資增長的企業來說,債務可能是一個非常好的工具。在考慮企業使用多少債務時,要做的第一件事是將現金和債務放在一起看。

See our latest analysis for Inly Media

查看我們對Inly Media的最新分析

What Is Inly Media's Debt?

Inly Media 的債務是什麼?

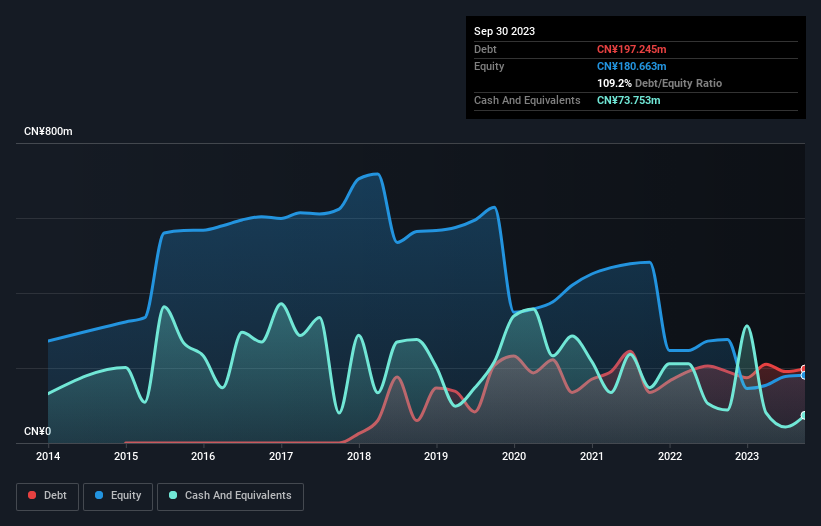

The chart below, which you can click on for greater detail, shows that Inly Media had CN¥197.2m in debt in September 2023; about the same as the year before. However, because it has a cash reserve of CN¥73.8m, its net debt is less, at about CN¥123.5m.

您可以點擊下圖查看更多詳情,該圖表顯示,2023年9月,Inly Media的債務爲1.972億元人民幣;與前一年大致相同。但是,由於其現金儲備爲7,380萬元人民幣,其淨負債較少,約爲1.235億加元。

How Healthy Is Inly Media's Balance Sheet?

Inly Media 的資產負債表有多健康?

According to the last reported balance sheet, Inly Media had liabilities of CN¥1.04b due within 12 months, and liabilities of CN¥43.4m due beyond 12 months. Offsetting these obligations, it had cash of CN¥73.8m as well as receivables valued at CN¥720.4m due within 12 months. So its liabilities total CN¥292.7m more than the combination of its cash and short-term receivables.

根據上次報告的資產負債表,Inly Media的負債爲10.4億元人民幣,12個月後到期的負債爲4,340萬元人民幣。除了這些債務外,它還有7,380萬元人民幣的現金以及價值7.204億元人民幣的應收賬款將在12個月內到期。因此,其負債總額比其現金和短期應收賬款的總額高出2.927億元人民幣。

Since publicly traded Inly Media shares are worth a total of CN¥4.11b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Inly Media will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

由於公開交易的Inly Media股票總價值爲41.1億元人民幣,因此這種負債水平似乎不太可能構成重大威脅。話雖如此,很明顯,我們應該繼續監控其資產負債表,以免情況惡化。毫無疑問,我們從資產負債表中學到的關於債務的知識最多。但是你不能完全孤立地看待債務;因爲Inly Media需要收益來償還債務。因此,在考慮債務時,絕對值得一看收益趨勢。單擊此處查看交互式快照。

Over 12 months, Inly Media saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

在過去的12個月中,Inly Media的收入保持相當穩定,並且沒有公佈利息和稅前盈利。雖然這還不錯,但我們希望看到增長。

Caveat Emptor

Caveat Emptor

Over the last twelve months Inly Media produced an earnings before interest and tax (EBIT) loss. Indeed, it lost CN¥49m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled CN¥6.2m in negative free cash flow over the last twelve months. So suffice it to say we do consider the stock to be risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for Inly Media that you should be aware of.

在過去的十二個月中,Inly Media出現了息稅前收益(EBIT)虧損。事實上,它在息稅前利潤水平上損失了4900萬元人民幣。當我們審視這一點並回顧其資產負債表上相對於現金的負債時,對我們來說,公司有任何債務似乎是不明智的。坦率地說,我們認爲資產負債表遠非匹配,儘管可以隨着時間的推移而改善。另一個需要謹慎的原因是,在過去的十二個月中,自由現金流爲負620萬元人民幣。因此,只要說我們確實認爲這隻股票有風險就足夠了。毫無疑問,我們從資產負債表中學到的關於債務的知識最多。但是,並非所有的投資風險都存在於資產負債表中,遠非如此。例如,我們已經爲Inly Media確定了兩個你應該注意的警告信號。

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

當然,如果你是那種喜歡在沒有債務負擔的情況下購買股票的投資者,那麼請立即查看我們的獨家淨現金增長股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。