Options Corner: What Big Money Thinks of Occidental Petroleum

Options Corner: What Big Money Thinks of Occidental Petroleum

High-rolling investors have positioned themselves bearish on $Occidental Petroleum (OXY.US)$, and it's important for retail traders to take note. This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in OXY often signals that someone has privileged information.

高額投資者已將自己定位爲看跌 $西方石油 (OXY.US)$,對於零售交易者來說,注意這一點很重要。今天,通過Benzinga對公開期權數據的跟蹤,這項活動引起了我們的注意。這些投資者的身份尚不確定,但是OXY的如此重大變動通常表明有人擁有特權信息。

Today, Benzinga's options scanner spotted 9 options trades for Occidental Petroleum. This is not a typical pattern.

今天,本辛加的期權掃描儀發現了西方石油的9筆期權交易。這不是典型的模式。

The sentiment among these major traders is split, with 22% bullish and 77% bearish. Among all the options we identified, there was one put, amounting to $30,600, and 8 calls, totaling $647,222.

這些主要交易者的情緒分歧,22%看漲,77%看跌。在我們確定的所有期權中,有一個看跌期權,金額爲30,600美元,還有8個看漲期權,總額爲647,222美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $52.5 and $62.5 for Occidental Petroleum, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者將注意力集中在西方石油公司過去三個月的52.5美元至62.5美元之間的價格區間上。

Volume & Open Interest Development

交易量和未平倉合約的發展

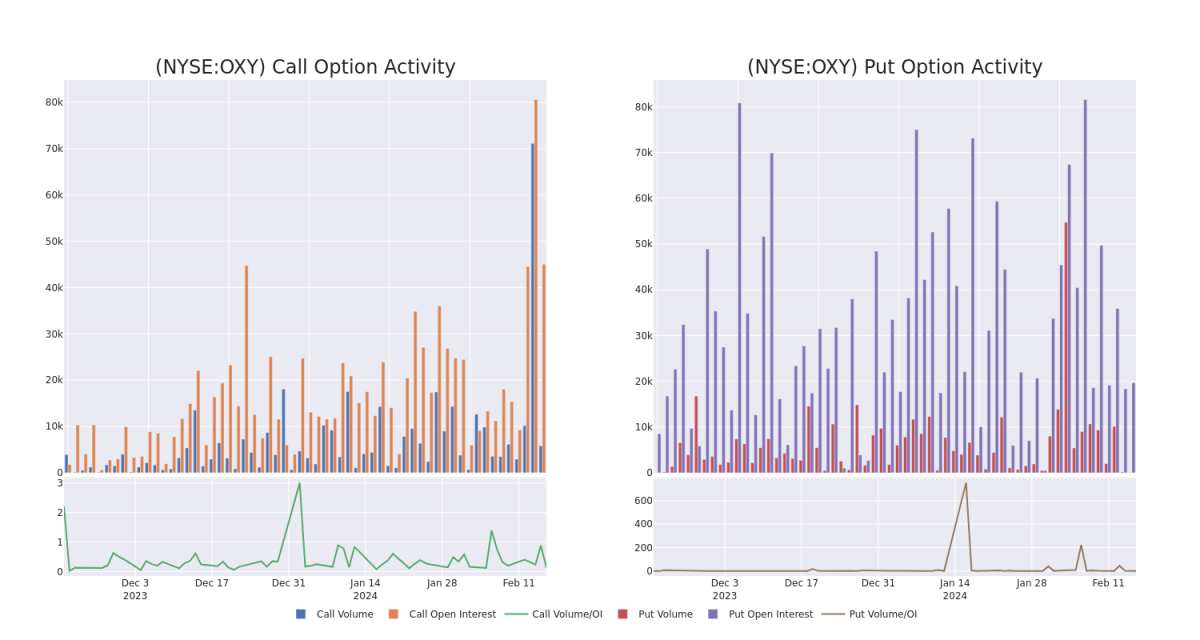

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Occidental Petroleum's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Occidental Petroleum's significant trades, within a strike price range of $52.5 to $62.5, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量西方石油公司在特定行使價下期權的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月西方石油公司重要交易的看漲期權和未平倉合約的趨勢,行使價區間爲52.5美元至62.5美元。

Occidental Petroleum 30-Day Option Volume & Interest Snapshot

西方石油公司30天期權交易量和利息快照

Largest Options Trades Observed:

觀察到的最大期權交易:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|

OXY |

CALL |

SWEEP |

BEARISH |

04/19/24 |

$57.50 |

$261.8K |

2.6K |

624 |

OXY |

CALL |

SWEEP |

BULLISH |

06/21/24 |

$60.00 |

$121.1K |

4.5K |

14 |

OXY |

CALL |

SWEEP |

BEARISH |

04/19/24 |

$62.50 |

$77.0K |

8.7K |

4.0K |

OXY |

CALL |

TRADE |

BEARISH |

01/17/25 |

$62.50 |

$58.5K |

7.0K |

0 |

OXY |

CALL |

SWEEP |

BEARISH |

03/15/24 |

$57.50 |

$38.8K |

9.1K |

254 |

符號 |

看跌/看漲 |

交易類型 |

情緒 |

Exp。日期 |

行使價 |

總交易價格 |

未平倉合約 |

音量 |

|---|---|---|---|---|---|---|---|---|

OXY |

打電話 |

掃 |

粗魯的 |

04/19/24 |

57.50 美元 |

261.8 萬美元 |

2.6K |

624 |

OXY |

打電話 |

掃 |

看漲 |

06/21/24 |

60.00 美元 |

121.1 萬美元 |

4.5K |

14 |

OXY |

打電話 |

掃 |

粗魯的 |

04/19/24 |

62.50 美元 |

77.0 萬美元 |

8.7K |

4.0K |

OXY |

打電話 |

貿易 |

粗魯的 |

01/17/25 |

62.50 美元 |

58.5 萬美元 |

7.0K |

0 |

OXY |

打電話 |

掃 |

粗魯的 |

03/15/24 |

57.50 美元 |

38.8 萬美元 |

9.1K |

254 |

About Occidental Petroleum

關於西方石油公司

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2022, the company reported net proved reserves of 3.8 billion barrels of oil equivalent. Net production averaged 1,159 thousand barrels of oil equivalent per day in 2022 at a ratio of 75% oil and natural gas liquids and 25% natural gas.

西方石油公司是一家獨立的勘探和生產公司,業務遍及美國、拉丁美洲和中東。截至2022年底,該公司報告的淨探明儲量爲38億桶石油當量。2022年,淨產量平均爲每天11.59萬桶石油當量,比率爲75%的液化石油和天然氣以及25%的天然氣。

Having examined the options trading patterns of Occidental Petroleum, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了西方石油公司的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Where Is Occidental Petroleum Standing Right Now?

西方石油現在在哪裏?

Currently trading with a volume of 3,309,902, the OXY's price is up by 0.45%, now at $60.38.

RSI readings suggest the stock is currently neutral between overbought and oversold.

Anticipated earnings release is in 81 days.

OXY目前的交易量爲3,309,902美元,價格上漲了0.45%,目前爲60.38美元。

RSI讀數表明,該股目前在超買和超賣之間處於中性。

預計業績將在81天后發佈。

Professional Analyst Ratings for Occidental Petroleum

西方石油專業分析師評級

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $73.0.

在過去的30天中,共有3位專業分析師對該股發表了看法,將平均目標股價設定爲73.0美元。

An analyst from Raymond James has decided to maintain their Strong Buy rating on Occidental Petroleum, which currently sits at a price target of $68.

Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Occidental Petroleum with a target price of $77.

Reflecting concerns, an analyst from Stephens & Co. lowers its rating to Overweight with a new price target of $74.

雷蒙德·詹姆斯的一位分析師決定維持對西方石油的強勁買入評級,目前的目標股價爲68美元。

Truist Securities的一位分析師在評估中保持了對西方石油的買入評級,目標價爲77美元。

斯蒂芬斯公司的一位分析師將其評級下調至增持,新的目標股價爲74美元,這反映了人們的擔憂。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Occidental Petroleum options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時警報,隨時了解最新的西方石油期權交易。