Is Bright Real Estate GroupLimited (SHSE:600708) A Risky Investment?

Is Bright Real Estate GroupLimited (SHSE:600708) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Bright Real Estate Group Co.,Limited (SHSE:600708) makes use of debt. But is this debt a concern to shareholders?

由伯克希爾·哈撒韋公司的查理·芒格支持的外部基金經理李露對此毫不掩飾,他說:“最大的投資風險不是價格的波動,而是你是否會遭受永久的資本損失。”當我們思考一家公司的風險有多大時,我們總是喜歡考慮其債務的用途,因爲債務過載可能導致破產。與許多其他公司一樣,光明房地產集團有限公司,Limited(上海證券交易所代碼:600708)使用債務。但是這筆債務是股東關心的問題嗎?

Why Does Debt Bring Risk?

爲什麼債務會帶來風險?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

當企業無法通過自由現金流或以誘人的價格籌集資金來輕鬆履行這些義務時,債務和其他負債就會成爲風險。資本主義的組成部分是 “創造性破壞” 過程,在這種過程中,倒閉的企業被銀行家無情地清算。但是,更常見(但仍然令人痛苦)的情況是,它必須以低廉的價格籌集新的股本,從而永久稀釋股東。當然,債務的好處在於它通常代表廉價資本,尤其是當它以高回報率進行再投資的能力取代公司的稀釋時。當我們考慮公司使用債務時,我們首先將現金和債務放在一起考慮。

What Is Bright Real Estate GroupLimited's Debt?

光明房地產集團有限公司的債務是多少?

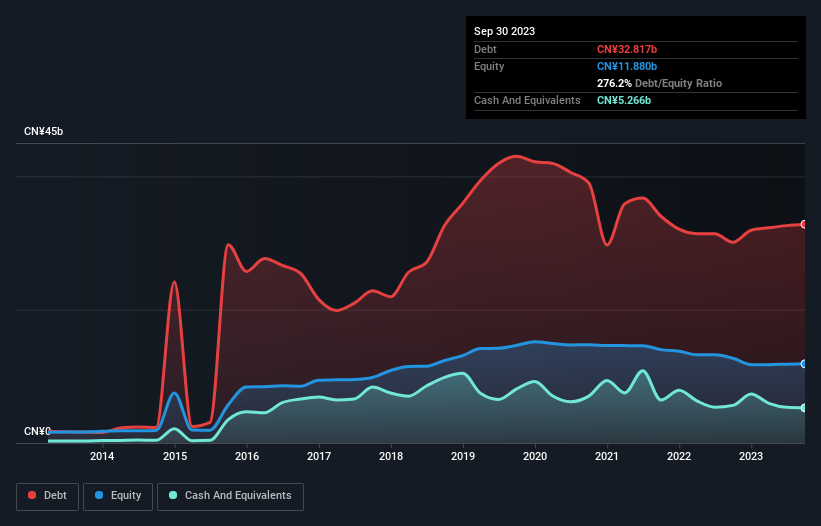

The image below, which you can click on for greater detail, shows that at September 2023 Bright Real Estate GroupLimited had debt of CN¥32.8b, up from CN¥30.1b in one year. However, it does have CN¥5.27b in cash offsetting this, leading to net debt of about CN¥27.6b.

您可以點擊下圖查看更多詳情,該圖片顯示,截至2023年9月,光明房地產集團有限公司的債務爲328億元人民幣,高於一年內的301億元人民幣。但是,它確實有527億元的現金抵消了這一點,淨負債約爲276億加元。

How Healthy Is Bright Real Estate GroupLimited's Balance Sheet?

光明房地產集團有限公司的資產負債表有多健康?

Zooming in on the latest balance sheet data, we can see that Bright Real Estate GroupLimited had liabilities of CN¥21.7b due within 12 months and liabilities of CN¥30.6b due beyond that. Offsetting these obligations, it had cash of CN¥5.27b as well as receivables valued at CN¥9.50b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥37.5b.

放大最新的資產負債表數據,我們可以看到,光明房地產集團有限公司的負債爲217億元人民幣,12個月內到期,負債爲306億元人民幣。除這些債務外,它有527億元人民幣的現金以及價值950億元人民幣的應收賬款將在12個月內到期。因此,其負債超過其現金和(短期)應收賬款總額375億元人民幣。

This deficit casts a shadow over the CN¥4.57b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Bright Real Estate GroupLimited would likely require a major re-capitalisation if it had to pay its creditors today.

這一赤字給這家457億元人民幣的公司蒙上了陰影,就像一個聳立在凡人之上的巨人。因此,我們絕對認爲股東需要密切關注這個問題。畢竟,如果光明房地產集團有限公司今天必須向債權人付款,則可能需要進行大規模的資本重組。

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

我們使用兩個主要比率來告知我們相對於收益的債務水平。第一個是淨負債除以利息、稅項、折舊和攤銷前的收益(EBITDA),第二個是其利息和稅前收益(EBIT)覆蓋其利息支出(或簡稱利息保障)的多少倍。因此,我們將債務與收益的關係考慮在內,包括和不包括折舊和攤銷費用。

Bright Real Estate GroupLimited has a rather high debt to EBITDA ratio of 37.8 which suggests a meaningful debt load. However, its interest coverage of 3.1 is reasonably strong, which is a good sign. Even worse, Bright Real Estate GroupLimited saw its EBIT tank 61% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Bright Real Estate GroupLimited will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

光明房地產集團有限公司的債務與息稅折舊攤銷前利潤的比率相當高,爲37.8,這表明債務負擔相當可觀。但是,其3.1的利息覆蓋率相當強,這是一個好兆頭。更糟糕的是,光明房地產集團有限公司的息稅前利潤在過去12個月中下降了61%。如果收益繼續保持這一軌跡,那麼償還債務負擔將比說服我們在雨中跑一場馬拉松更難。毫無疑問,我們從資產負債表中學到的關於債務的知識最多。但是你不能完全孤立地看待債務;因爲光明房地產集團有限公司需要收益來償還債務。因此,在考慮債務時,絕對值得一看收益趨勢。單擊此處查看交互式快照。

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Bright Real Estate GroupLimited actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

最後,公司只能用冷硬現金償還債務,不能用會計利潤償還債務。因此,我們總是檢查息稅前利潤中有多少轉化爲自由現金流。在過去的三年中,光明房地產集團有限公司產生的自由現金流實際上超過了息稅前利潤。當Daft Punk音樂會的節拍下降時,這種強勁的現金轉換讓我們和觀衆一樣興奮。

Our View

我們的觀點

On the face of it, Bright Real Estate GroupLimited's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. We're quite clear that we consider Bright Real Estate GroupLimited to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Bright Real Estate GroupLimited that you should be aware of.

從表面上看,Bright Real Estate GroupLimited的息稅前利潤增長率使我們對該股持初步看法,其總負債水平並不比一年中最繁忙夜晚那家空蕩蕩的餐廳更具吸引力。但至少在將息稅前利潤轉換爲自由現金流方面相當不錯;這令人鼓舞。我們很清楚,由於其資產負債表狀況良好,我們認爲光明房地產集團有限公司的風險確實相當大。出於這個原因,我們對該股非常謹慎,我們認爲股東應密切關注其流動性。資產負債表顯然是分析債務時需要關注的領域。但歸根結底,每家公司都可以控制資產負債表之外存在的風險。例如,我們已經確定了Bright Real Estate GroupLimited的兩個警告信號,你應該注意這些信號。

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

當一切都說完之後,有時更容易將注意力集中在甚至不需要債務的公司上。讀者現在可以100%免費訪問淨負債爲零的成長型股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。