EXCLUSIVE: Magnificent 7 Takes Center Stage In Roundhill's Expanded ETF Lineup With Inverse And Leveraged Options

EXCLUSIVE: Magnificent 7 Takes Center Stage In Roundhill's Expanded ETF Lineup With Inverse And Leveraged Options

Roundhill Investments has just introduced two new exchange-traded funds (ETFs) to its lineup, providing investors with innovative avenues for inverse and leveraged exposure to the renowned Magnificent Seven stocks.

Roundhill Investments剛剛在其產品陣容中推出了兩隻新的交易所交易基金(ETF),爲投資者提供了反向和槓桿投資著名的科技七巨頭股票的創新途徑。

Recognized as the pioneer ETF issuer in this space, Roundhill Investments launched the Roundhill Magnificent Seven ETF (NYSE:MAGS) last year, featuring an equally weighted exposure to Microsoft Corp. (NYSE:MSFT), Apple Inc. (NASDAQ:AAPL), Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon Inc. (NASDAQ:AMZN), Meta Platforms Inc. (NASDAQ:META), NVIDIA Corp. (NASDAQ:NVDA), and Tesla, Inc. (NASDAQ:TSLA), with quarterly rebalancing.

Roundhill Investments被公認爲該領域的先驅ETF發行人,去年推出了Roundhill Magnificent Seven ETF(紐約證券交易所代碼:MAGS)、蘋果公司(納斯達克股票代碼:AAPL)、Alphabet Inc.(納斯達克股票代碼:GOOG)、亞馬遜公司(納斯達克股票代碼:AMZN)、Meta Platforms 等加權敞口 Meta Platforms Inc.(納斯達克股票代碼:META)、英偉達公司(納斯達克股票代碼:NVDA)和特斯拉公司(納斯達克股票代碼:TSLA),進行了季度再平衡。

Expanding the investment horizon within this select group of stocks, Roundhill has now unveiled the Roundhill Daily Inverse Magnificent Seven ETF (NYSE:MAGQ) and the Roundhill Daily 2X Long Magnificent Seven ETF (NYSE:MAGX). Both began trading on Thursday.

隆德希爾擴大了這組精選股票的投資範圍,現已推出朗德希爾每日反向壯麗七人ETF(紐約證券交易所代碼:MAGQ)和朗德希爾每日2X多頭宏偉七人ETF(紐約證券交易所代碼:MAGX)。兩者均於週四開始交易。

A Complete Toolkit For Traders To Express Views On Magnificent 7

交易者表達對 Magnificent 7 觀點的完整工具包

"We wanted to offer a complete toolkit for investors and traders to express views on Magnificent Seven," Dave Mazza, chief officer strategist at Roundhill Investment, said Thursday in an exclusive interview with Benzinga.

朗德希爾投資首席策略師戴夫·馬紮週四在接受本辛加獨家採訪時表示:“我們希望爲投資者和交易者提供一個完整的工具包,讓他們表達對科技七巨頭的看法。”

According to the market expert, Magnificent Seven have been in the 'driver's seat' thus far, but he highlighted an increasing interest among traders in taking contrarian positions due to the significant market concentration, anticipating potential market shifts.

根據市場專家的說法,到目前爲止,科技七巨頭一直處於 “主導地位”,但他強調,由於市場高度集中,交易者對採取逆勢頭寸的興趣與日俱增,預計市場可能發生變化。

Both ETFs are structured around daily total return swaps.

兩隻ETF都圍繞每日總回報互換來構建。

The Roundhill Daily Inverse Magnificent Seven ETF aims to deliver the inverse daily return of the Magnificent Seven basket. For instance, a 2% decline in the underlying stocks would be translated into a 2% increase in MAGQ ETF value, and vice versa.

Roundhill Daily Inverse Magnificent Seven ETF旨在提供壯麗七人組籃子的反向每日回報。例如,標的股票下跌2%將轉化爲MAGQ ETF價值增長2%,反之亦然。

Conversely, the Roundhill Daily 2X Long Magnificent Seven ETF seeks to provide twice the daily total return of the group, amplifying gains or losses accordingly. For example, a 2% rise in the Magnificent Seven stocks would result in a 4% increase in MAGX ETF value, but likewise, negative performance would be magnified.

相反,Roundhill Daily 2X Long Magnificent Seven ETF旨在提供該集團每日總回報率的兩倍,從而相應地擴大收益或虧損。例如,科技七巨頭股上漲2%將導致MAGX ETF價值增長4%,但同樣,負面表現也會被放大。

Mazza expressed confidence in attracting new inflows into these newly launched funds and reiterated Roundhill's commitment in the offering of innovative ETFs.

Mazza表示有信心吸引新的資金流入這些新推出的基金,並重申了朗德希爾對發行創新ETF的承諾。

Over the past two months alone, the 'plain-vanilla' Roundhill Magnificent Seven ETF has garnered over $100 million if inflows, pushing its total assets under management to $152 million.

僅在過去兩個月中,“普通的” 朗德希爾科技七巨頭ETF就獲得了超過1億美元的資金流入,使其管理的總資產達到1.52億美元。

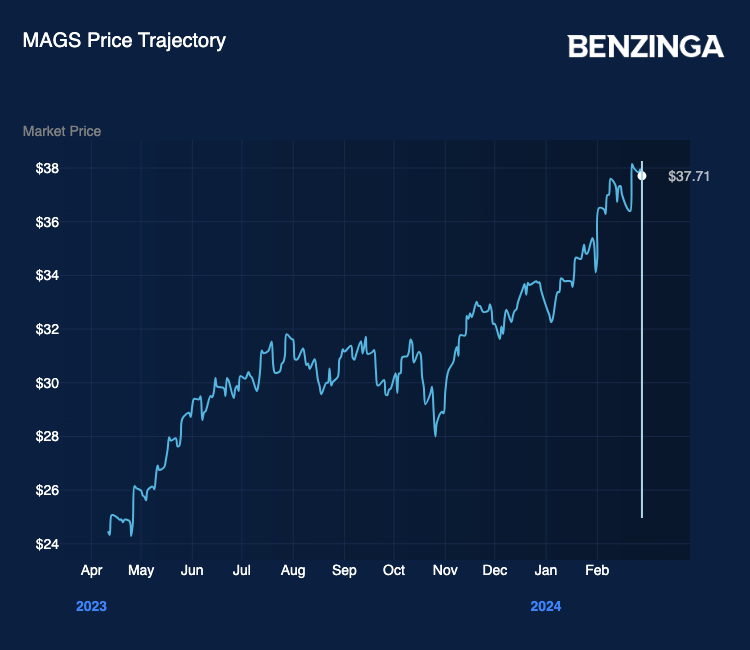

The fund has seen nearly a 14% increase year-to-date and more than a 50% surge since its inception in April 2023.

該基金今年迄今已增長近14%,自2023年4月成立以來增長了50%以上。

Read now: Beyond Tech And AI: Why The Sector Hedge Funds Prefer Is Not The One You'd Expect

立即閱讀: 超越科技和人工智能:爲什麼對沖基金偏愛的行業不是你所期望的

Photo: Shutterstock

照片:Shutterstock

"We wanted to offer a complete toolkit for investors and traders to express views on Magnificent Seven," Dave Mazza, chief officer strategist at Roundhill Investment, said Thursday in an exclusive interview with Benzinga.

"We wanted to offer a complete toolkit for investors and traders to express views on Magnificent Seven," Dave Mazza, chief officer strategist at Roundhill Investment, said Thursday in an exclusive interview with Benzinga.