Check Out What Whales Are Doing With PATH

Check Out What Whales Are Doing With PATH

Financial giants have made a conspicuous bearish move on UiPath. Our analysis of options history for UiPath (NYSE:PATH) revealed 13 unusual trades.

金融巨頭對UiPath採取了明顯的看跌舉動。我們對UiPath(紐約證券交易所代碼:PATH)期權歷史的分析顯示了13筆不尋常的交易。

Delving into the details, we found 23% of traders were bullish, while 76% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $81,370, and 11 were calls, valued at $594,235.

深入研究細節,我們發現23%的交易者看漲,而76%的交易者表現出看跌傾向。在我們發現的所有交易中,有2筆是看跌期權,價值81,370美元,11筆是看漲期權,價值594,235美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $18.0 and $32.0 for UiPath, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場推動者將注意力集中在UiPath在過去三個月的18.0美元至32.0美元之間的價格區間上。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

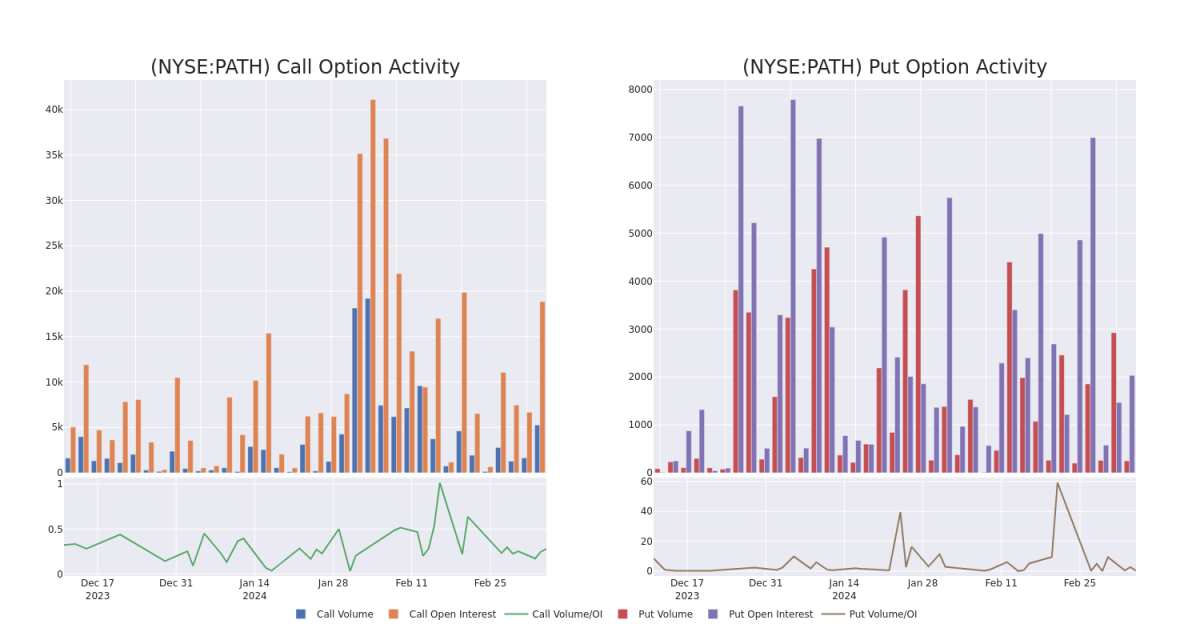

In terms of liquidity and interest, the mean open interest for UiPath options trades today is 2321.0 with a total volume of 5,515.00.

就流動性和利息而言,今天UiPath期權交易的平均未平倉合約爲2321.0,總交易量爲5,515.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for UiPath's big money trades within a strike price range of $18.0 to $32.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天UiPath在18.0美元至32.0美元行使價區間內的看漲期權和看跌期權交易的交易量和未平倉合約的變化。

UiPath Option Activity Analysis: Last 30 Days

UiPath 期權活動分析:過去 30 天

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| PATH | CALL | SWEEP | BEARISH | 04/19/24 | $27.00 | $119.0K | 358 | 2.1K |

| PATH | CALL | SWEEP | BEARISH | 08/16/24 | $18.00 | $87.7K | 656 | 132 |

| PATH | CALL | SWEEP | BEARISH | 08/16/24 | $18.00 | $72.3K | 656 | 240 |

| PATH | CALL | SWEEP | BULLISH | 05/17/24 | $30.00 | $66.2K | 10.5K | 748 |

| PATH | PUT | TRADE | BEARISH | 05/17/24 | $23.00 | $48.2K | 1.8K | 219 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|

| 路徑 | 打電話 | 掃 | 粗魯的 | 04/19/24 | 27.00 美元 | 119.0 萬美元 | 358 | 2.1K |

| 路徑 | 打電話 | 掃 | 粗魯的 | 08/16/24 | 18.00 美元 | 87.7 萬美元 | 656 | 132 |

| 路徑 | 打電話 | 掃 | 粗魯的 | 08/16/24 | 18.00 美元 | 72.3 萬美元 | 656 | 240 |

| 路徑 | 打電話 | 掃 | 看漲 | 05/17/24 | 30.00 美元 | 66.2 萬美元 | 10.5K | 748 |

| 路徑 | 放 | 貿易 | 粗魯的 | 05/17/24 | 23.00 美元 | 48.2 萬美元 | 1.8K | 219 |

About UiPath

關於 UiPath

UiPath Inc creates an end-to-end platform that provides automation with user emulation at its core. Its platform is built to be used by employees throughout a company and to address a wide variety of use cases, from simple tasks to long-running, complex business processes. It generates revenue from the sale of licenses for its proprietary software, maintenance and support, and professional services. It generates a majority of its revenues from the US, followed by Romania.

UiPath Inc 創建了一個端到端平台,該平台以用戶仿真爲核心提供自動化。其平台專爲整個公司的員工使用而構建,用於解決從簡單任務到長期運行的複雜業務流程等各種用例。它通過出售其專有軟件的許可證、維護和支持以及專業服務來創造收入。它的大部分收入來自美國,其次是羅馬尼亞。

In light of the recent options history for UiPath, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於UiPath最近的期權歷史記錄,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

UiPath's Current Market Status

UiPath 的當前市場狀況

- Currently trading with a volume of 3,889,586, the PATH's price is up by 2.77%, now at $23.04.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 7 days.

- PATH目前的交易量爲3,889,586美元,價格上漲了2.77%,目前爲23.04美元。

- RSI讀數表明,該股目前在超買和超賣之間處於中立狀態。

- 預計收益將在7天后發佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for UiPath with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用 Benzinga Pro 獲取實時提醒,隨時了解 UiPath 的最新期權交易。