We Think Shareholders Are Less Likely To Approve A Pay Rise For Ri Ying Holdings Limited's (HKG:1741) CEO For Now

We Think Shareholders Are Less Likely To Approve A Pay Rise For Ri Ying Holdings Limited's (HKG:1741) CEO For Now

Key Insights

關鍵見解

- Ri Ying Holdings' Annual General Meeting to take place on 13th of March

- Salary of HK$1.80m is part of CEO Chi Keung Lau's total remuneration

- Total compensation is similar to the industry average

- Ri Ying Holdings' three-year loss to shareholders was 61% while its EPS was down 39% over the past three years

- 日英控股的年度股東大會將於3月13日舉行

- 180萬港元的薪水是首席執行官劉志強總薪酬的一部分

- 總薪酬與行業平均水平相似

- 日盈控股三年股東虧損爲61%,而其每股收益在過去三年中下降了39%

Shareholders of Ri Ying Holdings Limited (HKG:1741) will have been dismayed by the negative share price return over the last three years. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. Shareholders will have a chance to take their concerns to the board at the next AGM on 13th of March and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

日盈控股有限公司(HKG: 1741)的股東將對過去三年的負股價回報率感到沮喪。此外,儘管收入增長,但該公司的每股收益增長並不樂觀。股東們將有機會在3月13日的下一次股東周年大會上向董事會提出他們的擔憂,並對包括高管薪酬在內的決議進行投票,研究表明這可能會對公司業績產生影響。這就是爲什麼我們認爲股東目前應該推遲對首席執行官的加薪。

How Does Total Compensation For Chi Keung Lau Compare With Other Companies In The Industry?

劉智強的總薪酬與業內其他公司相比如何?

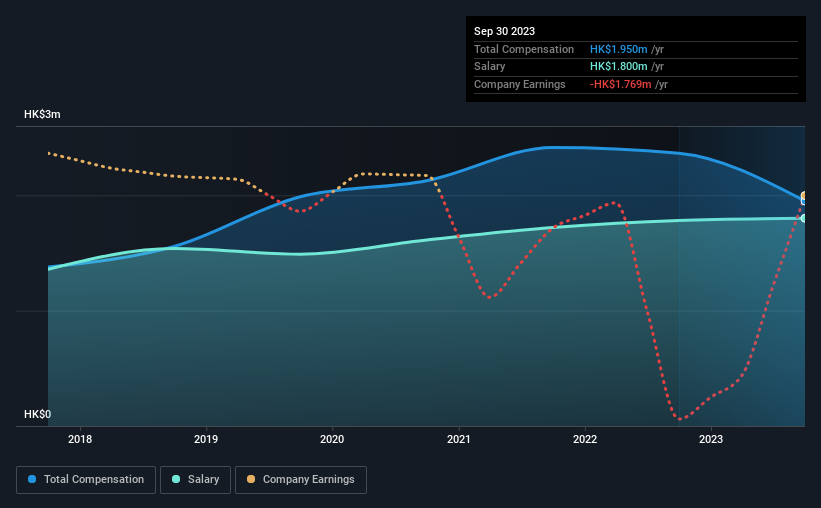

Our data indicates that Ri Ying Holdings Limited has a market capitalization of HK$496m, and total annual CEO compensation was reported as HK$2.0m for the year to September 2023. We note that's a decrease of 18% compared to last year. In particular, the salary of HK$1.80m, makes up a huge portion of the total compensation being paid to the CEO.

我們的數據顯示,日盈控股有限公司的市值爲4.96億港元,截至2023年9月的一年中,首席執行官的年薪酬總額爲200萬港元。我們注意到,與去年相比下降了18%。特別是,180萬港元的薪水佔支付給首席執行官的總薪酬的很大一部分。

On comparing similar-sized companies in the Hong Kong Construction industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$2.2m. This suggests that Ri Ying Holdings remunerates its CEO largely in line with the industry average.

在比較香港建築業中市值低於16億港元的類似規模的公司時,我們發現首席執行官的總薪酬中位數爲220萬港元。這表明日英控股首席執行官的薪酬基本與行業平均水平一致。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$1.8m | HK$1.8m | 92% |

| Other | HK$150k | HK$582k | 8% |

| Total Compensation | HK$2.0m | HK$2.4m | 100% |

| 組件 | 2023 | 2022 | 比例 (2023) |

| 工資 | 180 萬港元 | 180 萬港元 | 92% |

| 其他 | 港幣 150 萬元 | 582k 港元 | 8% |

| 總薪酬 | 200 萬港元 | 240 萬港元 | 100% |

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. Our data reveals that Ri Ying Holdings allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

就行業而言,在我們分析的所有公司中,工資約佔總薪酬的85%,而其他薪酬佔總薪酬的15%。我們的數據顯示,日英控股的薪水分配或多或少與整個市場一致。如果工資在總薪酬中占主導地位,則表明首席執行官的薪酬不太傾向於可變部分,而可變部分通常與績效有關。

A Look at Ri Ying Holdings Limited's Growth Numbers

看看日盈控股有限公司的增長數字

Over the last three years, Ri Ying Holdings Limited has shrunk its earnings per share by 39% per year. Its revenue is up 105% over the last year.

在過去三年中,日盈控股有限公司的每股收益每年縮水39%。其收入比去年增長了105%。

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

三年內每股收益的下降可以說是令人擔憂的。但相比之下,收入增長強勁,這表明未來每股收益的增長潛力。這兩個指標正朝着不同的方向發展,因此,儘管很難自信地判斷表現,但我們認爲該股值得關注。儘管我們沒有分析師的預測,但您可能需要評估這種數據豐富的收益、收入和現金流可視化。

Has Ri Ying Holdings Limited Been A Good Investment?

日盈控股有限公司是一項不錯的投資嗎?

The return of -61% over three years would not have pleased Ri Ying Holdings Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

三年內-61%的回報率不會讓日盈控股有限公司的股東感到高興。因此,股東們可能希望公司在首席執行官薪酬方面不那麼慷慨。

In Summary...

總而言之...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. The upcoming AGM will provide shareholders the opportunity to revisit the company's remuneration policies and evaluate if the board's judgement and decision-making is aligned with that of the company's shareholders.

股東的回報令人失望,而且收益增長乏力,這在某種程度上解釋了回報不佳的原因。即將舉行的股東周年大會將使股東有機會重新審視公司的薪酬政策,並評估董事會的判斷和決策是否與公司股東的判斷和決策一致。

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 4 warning signs for Ri Ying Holdings (of which 2 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

通過研究一家公司的首席執行官薪酬趨勢,以及研究業務的其他方面,我們可以學到很多關於公司的信息。這就是我們進行研究的原因,爲日盈控股確定了4個警告信號(其中2個不容忽視!)爲了對股票有一個全面的了解,你應該知道這一點。

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

可以說,業務質量比首席執行官的薪酬水平重要得多。因此,請查看這份免費清單,列出了股本回報率高、負債率低的有趣公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. Our data reveals that Ri Ying Holdings allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. Our data reveals that Ri Ying Holdings allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.