We're Interested To See How Soleno Therapeutics (NASDAQ:SLNO) Uses Its Cash Hoard To Grow

We're Interested To See How Soleno Therapeutics (NASDAQ:SLNO) Uses Its Cash Hoard To Grow

There's no doubt that money can be made by owning shares of unprofitable businesses. By way of example, Soleno Therapeutics (NASDAQ:SLNO) has seen its share price rise 2,010% over the last year, delighting many shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

毫無疑問,擁有無利可圖的企業的股份可以賺錢。舉個例子,索理諾療法(納斯達克股票代碼:SLNO)的股價比去年上漲了2,010%,這讓許多股東感到高興。但是,儘管成功是衆所周知的,但投資者不應忽視許多無利可圖的公司,這些公司只會耗盡所有現金然後倒閉。

In light of its strong share price run, we think now is a good time to investigate how risky Soleno Therapeutics' cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

鑑於其強勁的股價走勢,我們認爲現在是調查Soleno Therapeutics現金消耗風險的好時機。在本報告中,我們將考慮公司的年度負自由現金流,此後將其稱爲 “現金消耗”。首先,我們將通過將其現金消耗與現金儲備進行比較來確定其現金流道。

Does Soleno Therapeutics Have A Long Cash Runway?

Soleno Therapeutics 的現金流是否很長?

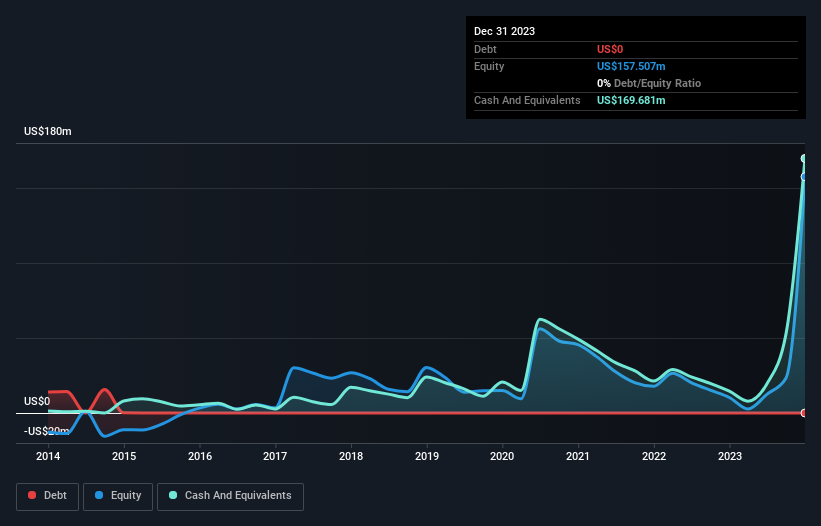

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In December 2023, Soleno Therapeutics had US$170m in cash, and was debt-free. In the last year, its cash burn was US$24m. So it had a cash runway of about 7.1 years from December 2023. Notably, however, analysts think that Soleno Therapeutics will break even (at a free cash flow level) before then. If that happens, then the length of its cash runway, today, would become a moot point. You can see how its cash balance has changed over time in the image below.

你可以通過將公司的現金金額除以現金的支出率來計算公司的現金流量。2023年12月,Soleno Therapeutics擁有1.7億美元的現金,並且沒有債務。去年,其現金消耗爲2400萬美元。因此,從2023年12月起,它的現金流約爲7.1年。但是,值得注意的是,分析師認爲,在此之前,Soleno Therapeutics將實現收支平衡(在自由現金流水平上)。如果發生這種情況,那麼今天其現金跑道的長度將成爲一個有爭議的問題。您可以在下圖中看到其現金餘額如何隨着時間的推移而變化。

How Is Soleno Therapeutics' Cash Burn Changing Over Time?

隨着時間的推移,索理諾療法的現金消耗量將如何變化?

Because Soleno Therapeutics isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Over the last year its cash burn actually increased by 14%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

由於Soleno Therapeutics目前沒有創造收入,因此我們認爲這是一項處於早期階段的業務。儘管如此,作爲評估其現金消耗情況的一部分,我們仍然可以研究其現金消耗軌跡。在過去的一年中,其現金消耗實際上增加了14%,這表明管理層正在增加對未來增長的投資,但速度不會太快。這不一定是一件壞事,但投資者應注意這樣一個事實,這將縮短現金流道。雖然過去總是值得研究的,但最重要的是未來。出於這個原因,看看我們的分析師對公司的預測很有意義。

Can Soleno Therapeutics Raise More Cash Easily?

Soleno Therapeutics 能否輕鬆籌集更多現金?

While Soleno Therapeutics does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

儘管Soleno Therapeutics確實有穩健的現金流,但其現金消耗軌跡可能會讓一些股東考慮公司何時可能需要籌集更多資金。一般而言,上市企業可以通過發行股票或承擔債務來籌集新現金。許多公司最終發行新股以資助未來的增長。通過觀察公司相對於其市值的現金消耗,我們可以深入了解如果公司需要籌集足夠的現金來彌補下一年的現金消耗,股東會被稀釋多少。

Since it has a market capitalisation of US$1.4b, Soleno Therapeutics' US$24m in cash burn equates to about 1.7% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

由於其市值爲14億美元,Soleno Therapeutics的2400萬美元現金消耗相當於其市值的1.7%左右。這意味着它可以輕鬆發行幾股股票來爲更多的增長提供資金,並且很可能有能力廉價地借款。

So, Should We Worry About Soleno Therapeutics' Cash Burn?

那麼,我們是否應該擔心Soleno Therapeutics的現金消耗?

As you can probably tell by now, we're not too worried about Soleno Therapeutics' cash burn. For example, we think its cash runway suggests that the company is on a good path. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. On another note, Soleno Therapeutics has 3 warning signs (and 2 which are concerning) we think you should know about.

正如你現在可能知道的那樣,我們對索理諾療法的現金消耗並不太擔心。例如,我們認爲其現金流表明該公司走上了一條不錯的道路。儘管其現金消耗的增加並不理想,但本文中提到的其他因素足以彌補該指標的弱點。分析師預測它將達到盈虧平衡,這讓股東們感到鼓舞。在考慮了本文中的一系列因素之後,我們對其現金消耗感到非常放鬆,因爲該公司似乎處於繼續爲其增長提供資金的有利地位。另一方面,Soleno Therapeutics有3個警告信號(其中2個令人擔憂),我們認爲你應該知道。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

當然,通過尋找其他地方,你可能會找到一筆不錯的投資。因此,來看看這份免費的有趣公司名單以及這份成長型股票清單(根據分析師的預測)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

Because Soleno Therapeutics isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Over the last year its cash burn actually increased by 14%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Because Soleno Therapeutics isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Over the last year its cash burn actually increased by 14%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.