Sunsea AIoT Technology (SZSE:002313) Shareholders Are up 15% This Past Week, but Still in the Red Over the Last Five Years

Sunsea AIoT Technology (SZSE:002313) Shareholders Are up 15% This Past Week, but Still in the Red Over the Last Five Years

This month, we saw the Sunsea AIoT Technology Co., Ltd. (SZSE:002313) up an impressive 87%. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 63% in that time. So we're hesitant to put much weight behind the short term increase. But it could be that the fall was overdone.

本月,我們看到日海智能物聯技術有限公司(深圳證券交易所:002313)上漲了87%,令人印象深刻。但是,對於那些在過去五年中承受巨額虧損的人來說,這並不令人安慰。實際上,股價已經下跌得相當嚴重,當時下跌了約63%。因此,我們對短期增長給予高度重視猶豫不決。但這可能是秋天已經過頭了。

While the last five years has been tough for Sunsea AIoT Technology shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

儘管過去五年對Sunsea AIoT Technology的股東來說是艱難的,但過去一週顯示出希望的跡象。因此,讓我們來看看長期基本面,看看它們是否是負回報的驅動力。

Sunsea AIoT Technology wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Sunsea AIoT Technology在過去十二個月中沒有盈利,我們不太可能看到其股價與每股收益(EPS)之間存在很強的相關性。可以說,收入是我們的下一個最佳選擇。當一家公司沒有盈利時,我們通常預計收入會有良好的增長。可以想象,收入的快速增長如果持續下去,通常會帶來利潤的快速增長。

In the last five years Sunsea AIoT Technology saw its revenue shrink by 6.7% per year. While far from catastrophic that is not good. The share price decline of 10% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

在過去的五年中,日海AIoT科技的收入每年下降6.7%。雖然這遠非災難性,但這並不好。鑑於該公司正在虧損,收入正朝着錯誤的方向發展,股價在五年內複合下跌10%是可以理解的。投資者對這隻股票產生迫在眉睫的熱情的可能性似乎比路易絲·布魯克斯要小。歸根結底,這可能值得關注——如果收入回升,股價可能會隨之上漲。

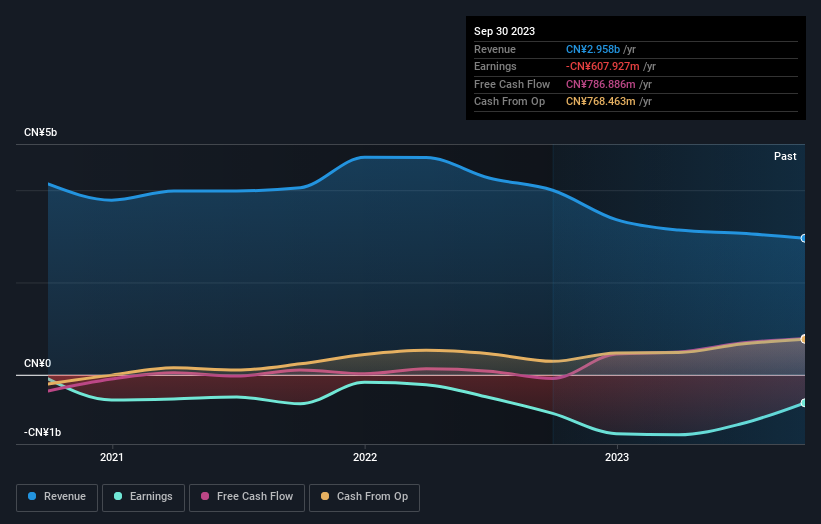

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

下圖顯示了收入和收入隨時間推移的跟蹤情況(如果您點擊圖片,可以看到更多細節)。

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

資產負債表的強度至關重要。可能值得一看我們關於其財務狀況如何隨着時間的推移而變化的免費報告。

A Different Perspective

不同的視角

It's good to see that Sunsea AIoT Technology has rewarded shareholders with a total shareholder return of 54% in the last twelve months. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Sunsea AIoT Technology that you should be aware of before investing here.

很高興看到日海AIoT Technology在過去十二個月中向股東提供了54%的總股東回報率。值得注意的是,與最近的股價表現相比,五年期年化股東總回報率每年虧損10%,這非常不利。長期虧損使我們保持謹慎,但短期股東總回報率的增長無疑暗示着更光明的未來。我發現將長期股價視爲業務績效的代表非常有趣。但是,要真正獲得見解,我們還需要考慮其他信息。例如,我們發現了Sunsea AIoT Technology的兩個警告信號,在這裏投資之前,您應該注意這些信號。

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

如果你像我一樣,那麼你不會想錯過這份業內人士正在收購的成長型公司的免費名單。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所交易的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。