Do Guangdong Provincial Expressway Development's (SZSE:000429) Earnings Warrant Your Attention?

Do Guangdong Provincial Expressway Development's (SZSE:000429) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

投資者通常以發現 “下一件大事” 的想法爲指導,即使這意味着在沒有任何收入的情況下購買 “故事股票”,更不用說獲利了。不幸的是,這些高風險投資通常幾乎不可能獲得回報,許多投資者爲吸取教訓付出了代價。虧損的公司總是與時間賽跑以實現財務可持續性,因此這些公司的投資者承擔的風險可能超出了應有的範圍。

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Guangdong Provincial Expressway Development (SZSE:000429). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Guangdong Provincial Expressway Development with the means to add long-term value to shareholders.

儘管處於科技股藍天投資時代,但許多投資者仍然採取更傳統的策略:購買廣東省高速公路開發公司(SZSE: 000429)等盈利公司的股票。即使這家公司受到市場的公平估值,投資者也會同意,創造持續的利潤將繼續爲廣東省高速公路開發公司提供爲股東增加長期價值的手段。

How Fast Is Guangdong Provincial Expressway Development Growing?

廣東省高速公路的發展速度有多快?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Guangdong Provincial Expressway Development has managed to grow EPS by 23% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

市場在短期內是投票機,但從長遠來看是一臺權衡器,因此您預計股價最終將跟隨每股收益(EPS)的結果。因此,經驗豐富的投資者在進行投資研究時密切關注公司的每股收益是有道理的。很高興看到廣東省高速公路發展公司在三年內設法將每股收益增長23%。一般來說,如果一家公司能跟上步伐,我們會這麼說 那個 有點像增長,股東們會喜氣洋洋。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Guangdong Provincial Expressway Development shareholders can take confidence from the fact that EBIT margins are up from 56% to 61%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

查看利息和稅前收益(EBIT)利潤率以及收入增長通常會很有幫助,這樣可以重新了解公司的增長質量。廣東省高速公路發展公司的股東可以從息稅前利潤率從56%上升到61%,收入也在增長這一事實中獲得信心。在我們的書中,勾選這兩個方框是增長的好兆頭。

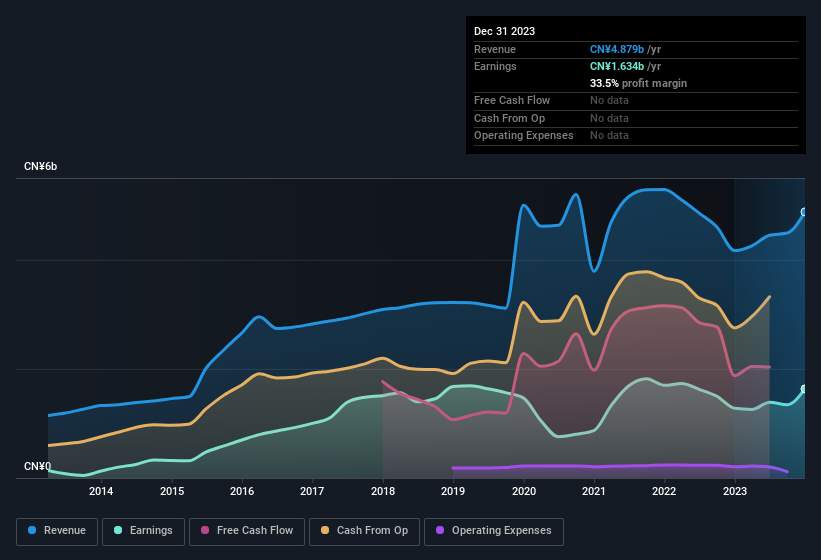

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

下圖顯示了該公司的收入和收入隨着時間的推移是如何發展的。要了解更多細節,請點擊圖片。

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Guangdong Provincial Expressway Development.

當然,訣竅是找到未來表現最好的股票,而不是過去的股票。當然,你可以根據過去的表現來看待你的看法,但你可能還需要查看這張專業分析師對廣東省高速公路發展每股收益預測的互動圖表。

Are Guangdong Provincial Expressway Development Insiders Aligned With All Shareholders?

廣東省高速公路發展內部人士是否與所有股東保持一致?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Guangdong Provincial Expressway Development shares worth a considerable sum. To be specific, they have CN¥192m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 1.0%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

可以說,看到公司領導者將資金投入到危險之中真是令人高興,因爲這提高了企業經營者與其真正所有者之間激勵措施的一致性。股東們會對內部人士擁有價值可觀的廣東省高速公路發展股份感到高興。具體而言,他們擁有價值1.92億元人民幣的股票。這表明了大量的支持,也可能表明對業務戰略的信念。儘管他們的所有權僅佔1.0%,但要鼓勵企業維持爲股東創造價值的戰略,這仍然是一個相當大的風險。

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Guangdong Provincial Expressway Development with market caps between CN¥14b and CN¥46b is about CN¥1.5m.

儘管通過大量投資看到內部人士對公司抱有堅定的信心總是件好事,但股東詢問管理層薪酬政策是否合理也很重要。對首席執行官薪酬的簡要分析表明確實如此。我們的分析發現,市值在140億元人民幣至460億元人民幣之間的廣東省高速公路開發公司首席執行官的總薪酬中位數約爲150萬元人民幣。

The Guangdong Provincial Expressway Development CEO received CN¥828k in compensation for the year ending December 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

截至2022年12月的財年,廣東省高速公路發展首席執行官獲得了82.8萬元人民幣的薪酬。這實際上低於類似規模公司首席執行官的中位數。首席執行官薪酬並不是公司最需要考慮的方面,但如果合理,這可以增強領導層關注股東利益的信心。更籠統地說,它也可以是善治的標誌。

Should You Add Guangdong Provincial Expressway Development To Your Watchlist?

您是否應該將廣東省高速公路開發添加到您的關注清單中?

If you believe that share price follows earnings per share you should definitely be delving further into Guangdong Provincial Expressway Development's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. The overarching message here is that Guangdong Provincial Expressway Development has underlying strengths that make it worth a look at. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Guangdong Provincial Expressway Development that you should be aware of.

如果你認爲股價緊隨每股收益,那麼你肯定應該進一步研究廣東省高速公路發展公司的強勁每股收益增長。如果這還不夠,還要考慮首席執行官的薪酬相當合理,內部人士與其他股東一起投資良好。這裏的首要信息是,廣東省高速公路發展具有潛在的優勢,值得一看。別忘了可能仍然存在風險。例如,我們已經確定了廣東省高速公路發展的一個警告標誌,你應該注意這個標誌。

Although Guangdong Provincial Expressway Development certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have also seen recent insider buying..

儘管廣東省高速公路發展確實看起來不錯,但如果內部人士買入股票,它可能會吸引更多的投資者。如果你想看看有內幕買入的公司,那就看看這些精心挑選的中國公司,這些公司不僅擁有強勁的增長,而且最近也出現了內幕買盤。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文中討論的內幕交易是指相關司法管轄區內應報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Guangdong Provincial Expressway Development shareholders can take confidence from the fact that EBIT margins are up from 56% to 61%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Guangdong Provincial Expressway Development shareholders can take confidence from the fact that EBIT margins are up from 56% to 61%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.