Improved Revenues Required Before Future Bright Holdings Limited (HKG:703) Stock's 35% Jump Looks Justified

Improved Revenues Required Before Future Bright Holdings Limited (HKG:703) Stock's 35% Jump Looks Justified

Future Bright Holdings Limited (HKG:703) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 29%.

富昌控股有限公司(HKG: 703)股東會很高興看到股價表現良好,上漲了35%,並從先前的疲軟中恢復過來。過去30天使年增長率達到29%。

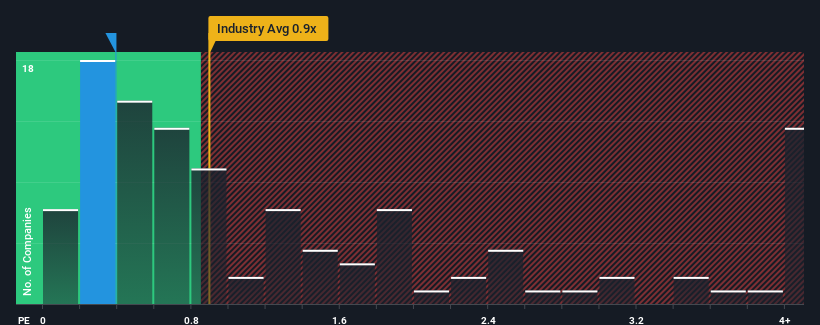

Even after such a large jump in price, Future Bright Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Hospitality industry in Hong Kong have P/S ratios greater than 0.9x and even P/S higher than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

即使在價格大幅上漲之後,富昌控股目前可能仍在發出看漲信號,其市銷率(或 “市盈率”)爲0.4倍,因爲香港酒店業幾乎有一半公司的市盈率大於0.9倍,甚至市盈率高於3倍的情況並不少見。但是,我們需要更深入地挖掘以確定降低市銷率是否有合理的依據。

SEHK:703 Price to Sales Ratio vs Industry March 14th 2024

SEHK: 703 2024 年 3 月 14 日與行業的股價銷售比率

How Has Future Bright Holdings Performed Recently?

未來光明控股最近表現如何?

We'd have to say that with no tangible growth over the last year, Future Bright Holdings' revenue has been unimpressive. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

我們不得不說,由於去年沒有切實的增長,Future Bright Holdings的收入並不令人印象深刻。一種可能性是市銷率很低,因爲投資者認爲這種良性的收入增長率在不久的將來可能會低於整個行業。如果你喜歡這家公司,你希望情況並非如此,這樣你就有可能在它失寵的時候買入一些股票。

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Future Bright Holdings' earnings, revenue and cash flow.

我們沒有分析師的預測,但您可以查看我們關於Future Bright Holdings收益、收入和現金流的免費報告,了解最近的趨勢如何爲公司未來做好準備。

Is There Any Revenue Growth Forecasted For Future Bright Holdings?

未來光明控股預計收入增長嗎?

The only time you'd be truly comfortable seeing a P/S as low as Future Bright Holdings' is when the company's growth is on track to lag the industry.

只有當公司的增長有望落後於該行業時,你才能真正放心地看到市盈率低至Future Bright Holdings的水平。

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 51% decline in revenue over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

如果我們回顧一下去年的收入,該公司公佈的業績與去年同期幾乎沒有任何偏差。這不是股東想要的,因爲這意味着在過去三年中,他們的總收入下降了51%。因此,股東會對中期收入增長率感到悲觀。

In contrast to the company, the rest of the industry is expected to grow by 24% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

與該公司形成鮮明對比的是,該行業的其他部門預計將在明年增長24%,這確實可以看出該公司最近的中期收入下降。

In light of this, it's understandable that Future Bright Holdings' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

有鑑於此,前程光明控股的市銷率將低於其他多數公司是可以理解的。但是,尚不能保證市銷率已達到最低水平,收入反向增長。如果公司不改善營收增長,市銷率有可能降至更低的水平。

What We Can Learn From Future Bright Holdings' P/S?

我們可以從未來光明控股的市銷率中學到什麼?

The latest share price surge wasn't enough to lift Future Bright Holdings' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

最近的股價上漲不足以使富途光明控股的市銷率接近行業中位數。儘管市銷率不應該成爲決定你是否買入股票的決定性因素,但它是衡量收入預期的有力晴雨表。

It's no surprise that Future Bright Holdings maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

在中期收入下滑的背景下,富昌控股維持低市銷率也就不足爲奇了。目前,股東們正在接受低市銷率,因爲他們承認未來的收入可能也不會帶來任何驚喜。除非最近的中期狀況有所改善,否則它們將繼續構成股價在這些水平附近的障礙。

We don't want to rain on the parade too much, but we did also find 3 warning signs for Future Bright Holdings (1 can't be ignored!) that you need to be mindful of.

我們不想在遊行隊伍中下太多雨,但我們也確實爲富昌控股找到了3個警告標誌(其中一個不容忽視!)你需要注意的。

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是要確保你尋找一家優秀的公司,而不僅僅是你遇到的第一個想法。因此,如果盈利能力的增長與你對一家優秀公司的想法一致,那就來看看這份免費名單吧,列出了最近收益增長強勁(市盈率低)的有趣公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接聯繫我們。或者,也可以發送電子郵件至編輯團隊 (at) simplywallst.com。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

We'd have to say that with no tangible growth over the last year, Future Bright Holdings' revenue has been unimpressive. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We'd have to say that with no tangible growth over the last year, Future Bright Holdings' revenue has been unimpressive. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.