MeiHua Holdings Group Co.,Ltd Just Missed EPS By 5.9%: Here's What Analysts Think Will Happen Next

MeiHua Holdings Group Co.,Ltd Just Missed EPS By 5.9%: Here's What Analysts Think Will Happen Next

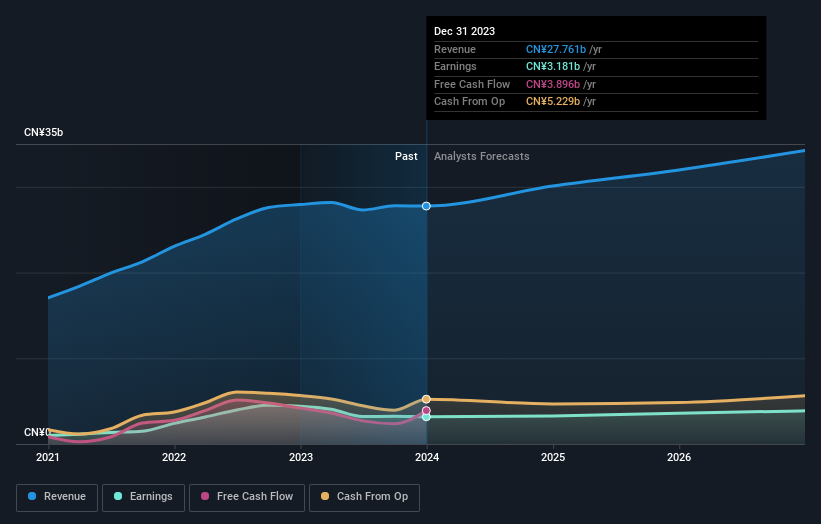

MeiHua Holdings Group Co.,Ltd (SHSE:600873) just released its latest full-year report and things are not looking great. MeiHua Holdings GroupLtd missed analyst forecasts, with revenues of CN¥28b and statutory earnings per share (EPS) of CN¥1.06, falling short by 2.8% and 5.9% respectively. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on MeiHua Holdings GroupLtd after the latest results.

梅花控股集團有限公司, Ltd(上海證券交易所代碼:600873)剛剛發佈了最新的全年報告,但情況看起來並不樂觀。梅花控股集團有限公司未達到分析師的預期,收入爲280億元人民幣,法定每股收益(EPS)爲1.06元人民幣,分別下降2.8%和5.9%。分析師通常會在每份收益報告中更新他們的預測,我們可以從他們的估計中判斷他們對公司的看法是否發生了變化,或者是否有任何新的問題需要注意。讀者會很高興得知我們已經彙總了最新的法定預測,以了解分析師在最新業績公佈後是否改變了對梅花控股集團有限公司的看法。

Taking into account the latest results, the current consensus from MeiHua Holdings GroupLtd's three analysts is for revenues of CN¥30.1b in 2024. This would reflect a decent 8.4% increase on its revenue over the past 12 months. Statutory per share are forecast to be CN¥1.11, approximately in line with the last 12 months. In the lead-up to this report, the analysts had been modelling revenues of CN¥31.4b and earnings per share (EPS) of CN¥1.28 in 2024. The analysts seem less optimistic after the recent results, reducing their revenue forecasts and making a real cut to earnings per share numbers.

考慮到最新業績,梅花控股集團的三位分析師目前的共識是,2024年的收入爲301億元人民幣。這將反映其在過去12個月中收入的8.4%可觀增長。預計法定每股收益爲1.11元人民幣,與過去12個月大致持平。在本報告發布之前,分析師一直在模擬2024年的收入爲314億元人民幣,每股收益(EPS)爲1.28元人民幣。在最近的業績公佈後,分析師似乎不那麼樂觀,他們下調了收入預期,並實際削減了每股收益數字。

Despite the cuts to forecast earnings, there was no real change to the CN¥13.78 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic MeiHua Holdings GroupLtd analyst has a price target of CN¥14.56 per share, while the most pessimistic values it at CN¥13.00. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

儘管下調了預期收益,但13.78元人民幣的目標股價沒有實際變化,這表明分析師認爲這些變化不會對其內在價值產生有意義的影響。但是,固定單一價格目標可能是不明智的,因爲共識目標實際上是分析師目標股價的平均值。因此,一些投資者喜歡查看估計範圍,看看對公司的估值是否有任何分歧。最樂觀的梅花控股集團有限公司分析師將目標股價定爲每股14.56元人民幣,而最悲觀的分析師則認爲目標股價爲13.00元人民幣。儘管如此,由於估計範圍如此之窄,這表明分析師對他們認爲該公司的價值有了很好的了解。

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that MeiHua Holdings GroupLtd's revenue growth is expected to slow, with the forecast 8.4% annualised growth rate until the end of 2024 being well below the historical 18% p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 13% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than MeiHua Holdings GroupLtd.

當然,看待這些預測的另一種方法是將它們與行業本身聯繫起來。我們要強調的是,梅花控股集團有限公司的收入增長預計將放緩,預計到2024年底的8.4%的年化增長率將遠低於過去五年18%的歷史年增長率。相比之下,該行業的其他公司(根據分析師的預測),後者的總體收入預計每年將增長13%。因此,很明顯,儘管收入增長預計將放緩,但整個行業的增長速度預計也將超過梅花控股集團有限公司。

The Bottom Line

底線

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for MeiHua Holdings GroupLtd. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

最大的擔憂是,分析師下調了每股收益預期,這表明梅花控股集團有限公司可能會面臨業務不利因素。不幸的是,他們還下調了收入預期,我們的數據顯示,與整個行業相比,表現不佳。即便如此,每股收益對業務的內在價值更爲重要。共識目標股價沒有實際變化,這表明該業務的內在價值與最新估計相比沒有發生任何重大變化。

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for MeiHua Holdings GroupLtd going out to 2026, and you can see them free on our platform here..

話雖如此,公司收益的長期軌跡比明年重要得多。在Simply Wall St,我們有分析師對梅花控股集團有限公司到2026年的全方位估計,你可以在我們的平台上免費看到這些估計。

Don't forget that there may still be risks. For instance, we've identified 1 warning sign for MeiHua Holdings GroupLtd that you should be aware of.

別忘了可能仍然存在風險。例如,我們已經確定了梅花控股集團有限公司的1個警告標誌,你應該注意這一點。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。