Financial giants have made a conspicuous bearish move on Riot Platforms. Our analysis of options history for Riot Platforms (NASDAQ:RIOT) revealed 11 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $53,887, and 9 were calls, valued at $461,623.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $2.0 and $35.0 for Riot Platforms, spanning the last three months.

Volume & Open Interest Development

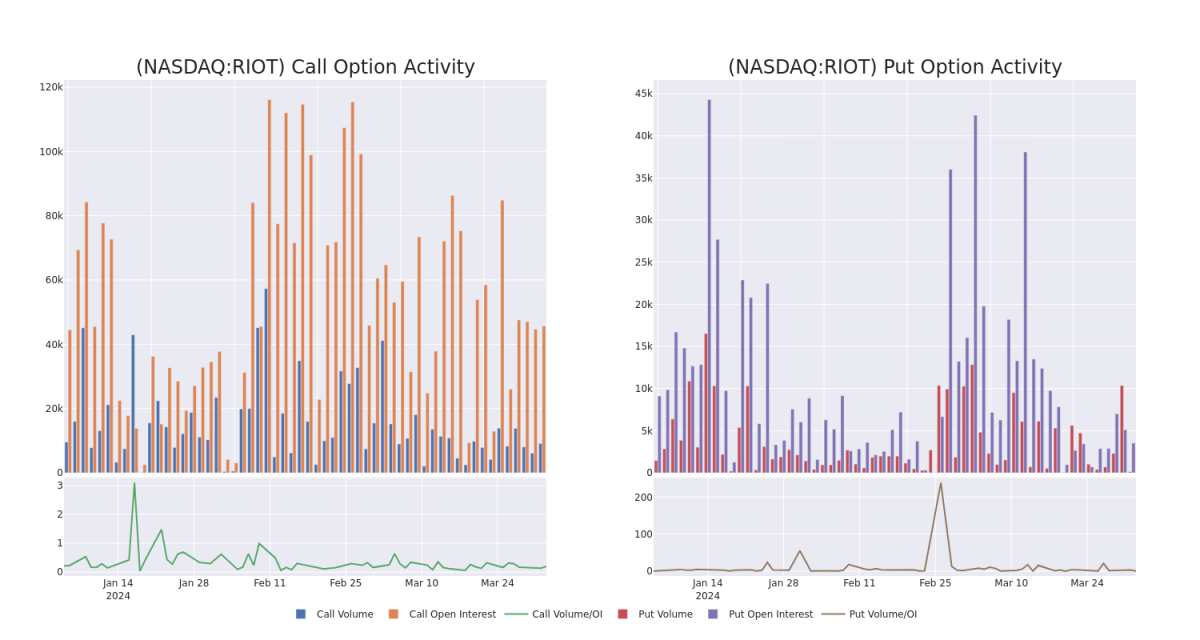

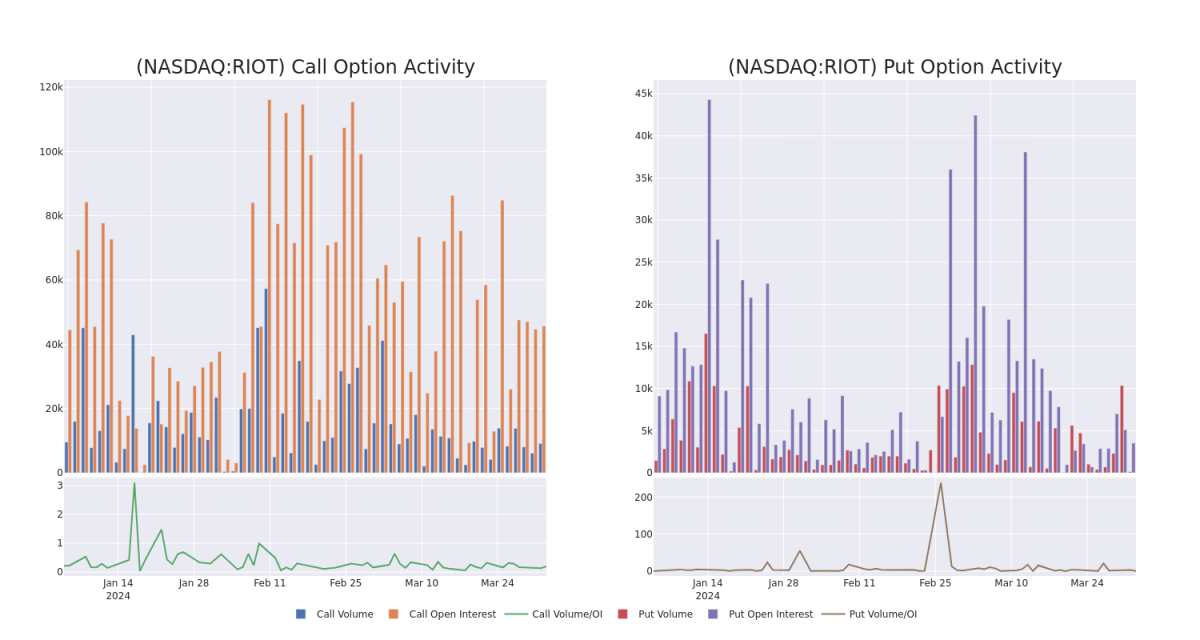

In today's trading context, the average open interest for options of Riot Platforms stands at 4923.3, with a total volume reaching 9,263.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Riot Platforms, situated within the strike price corridor from $2.0 to $35.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Riot Platforms stands at 4923.3, with a total volume reaching 9,263.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Riot Platforms, situated within the strike price corridor from $2.0 to $35.0, throughout the last 30 days.

Riot Platforms 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| RIOT | CALL | TRADE | BEARISH | 01/16/26 | $5.7 | $5.6 | $5.61 | $12.00 | $109.3K | 1.9K | 198 |

| RIOT | CALL | SWEEP | BULLISH | 06/21/24 | $0.75 | $0.71 | $0.75 | $20.00 | $90.0K | 10.0K | 1.3K |

| RIOT | CALL | SWEEP | BULLISH | 01/16/26 | $3.15 | $3.0 | $3.14 | $35.00 | $56.3K | 5.8K | 10 |

| RIOT | CALL | SWEEP | BEARISH | 04/12/24 | $0.44 | $0.42 | $0.42 | $11.50 | $42.0K | 371 | 4.0K |

| RIOT | CALL | TRADE | BEARISH | 04/12/24 | $0.46 | $0.42 | $0.42 | $11.50 | $42.0K | 371 | 3.0K |

About Riot Platforms

Riot Platforms Inc is a vertically integrated Bitcoin mining company focused on building, supporting, and operating blockchain technologies. The company's segments include Bitcoin Mining; Data Center Hosting and Engineering. It generates maximum revenue from the Bitcoin Mining segment which generates revenue from the Bitcoin the company earns through its mining activities.

In light of the recent options history for Riot Platforms, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Riot Platforms's Current Market Status

- With a volume of 13,937,426, the price of RIOT is down -5.41% at $10.85.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 36 days.

Expert Opinions on Riot Platforms

In the last month, 5 experts released ratings on this stock with an average target price of $18.6.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $20.

- An analyst from Needham downgraded its action to Buy with a price target of $18.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $20.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $20.

- In a positive move, an analyst from JP Morgan has upgraded their rating to Overweight and adjusted the price target to $15.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

金融巨頭在Riot Platforms上採取了明顯的看跌舉動。我們對Riot Platforms(NASDAQ:RIOT) 期權歷史的分析顯示了11筆不尋常的交易。

深入研究細節,我們發現45%的交易者看漲,而54%的交易者表現出看跌趨勢。在我們發現的所有交易中,有2筆是看跌期權,價值爲53,887美元,9筆是看漲期權,價值461,623美元。

目標價格是多少?

在評估了交易量和未平倉合約之後,很明顯,主要市場推動者將注意力集中在Riot Platforms在過去三個月的2.0美元至35.0美元之間的價格區間上。

交易量和未平倉合約的發展

在當今的交易背景下,Riot Platforms期權的平均未平倉合約爲4923.3,總交易量達到9,263.00。隨附的圖表描繪了過去30天Riot Platforms中看漲期權和看跌期權交易量以及未平倉合約的變化,這些交易位於行使價走勢從2.0美元到35.0美元之間。

在當今的交易背景下,Riot Platforms期權的平均未平倉合約爲4923.3,總交易量達到9,263.00。隨附的圖表描繪了過去30天Riot Platforms中看漲期權和看跌期權交易量以及未平倉合約的變化,這些交易位於行使價走勢從2.0美元到35.0美元之間。

Riot Platforms30天期權交易量和利息快照

觀察到的最大期權交易:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

RIOT | CALL | TRADE | BEARISH | 01/16/26 | $5.7 | $5.6 | $5.61 | $12.00 | $109.3K | 1.9K | 198 |

RIOT | CALL | SWEEP | BULLISH | 06/21/24 | $0.75 | $0.71 | $0.75 | $20.00 | $90.0K | 10.0K | 1.3K |

RIOT | CALL | SWEEP | BULLISH | 01/16/26 | $3.15 | $3.0 | $3.14 | $35.00 | $56.3K | 5.8K | 10 |

RIOT | CALL | SWEEP | BEARISH | 04/12/24 | $0.44 | $0.42 | $0.42 | $11.50 | $42.0K | 371 | 4.0K |

RIOT | CALL | TRADE | BEARISH | 04/12/24 | $0.46 | $0.42 | $0.42 | $11.50 | $42.0K | 371 | 3.0K |

關於Riot Platforms

Riot Platforms是一家垂直整合的比特幣礦業公司,專注於構建、支持和運營區塊鏈技術。該公司的業務領域包括比特幣挖礦;數據中心託管和工程。它從比特幣採礦領域產生最大收入,該領域從該公司通過採礦活動獲得的比特幣中獲得的收入中獲得。

鑑於Riot Platforms最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Riot Platforms的當前市場狀況

關於Riot Platforms的專家意見

上個月,5位專家發佈了該股的評級,平均目標價爲18.6美元。

坎託·菲茨傑拉德的一位分析師將其評級下調至增持,新的目標股價爲20美元,這反映了人們的擔憂。

Needham的一位分析師將其股票評級下調至買入,目標股價爲18美元。

坎託·菲茨傑拉德的一位分析師已將其評級下調至增持,將目標股價調整爲20美元。

坎託·菲茨傑拉德的一位分析師已將其評級下調至增持,將目標股價調整爲20美元。

摩根大通的一位分析師將其評級上調至增持,並將目標股價調整至15美元,這是一個積極的舉動。

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

在當今的交易背景下,Riot Platforms期權的平均未平倉合約爲4923.3,總交易量達到9,263.00。隨附的圖表描繪了過去30天Riot Platforms中看漲期權和看跌期權交易量以及未平倉合約的變化,這些交易位於行使價走勢從2.0美元到35.0美元之間。

在當今的交易背景下,Riot Platforms期權的平均未平倉合約爲4923.3,總交易量達到9,263.00。隨附的圖表描繪了過去30天Riot Platforms中看漲期權和看跌期權交易量以及未平倉合約的變化,這些交易位於行使價走勢從2.0美元到35.0美元之間。

In today's trading context, the average open interest for options of Riot Platforms stands at 4923.3, with a total volume reaching 9,263.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Riot Platforms, situated within the strike price corridor from $2.0 to $35.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Riot Platforms stands at 4923.3, with a total volume reaching 9,263.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Riot Platforms, situated within the strike price corridor from $2.0 to $35.0, throughout the last 30 days.