Investors Give Sphere 3D Corp. (NASDAQ:ANY) Shares A 27% Hiding

Investors Give Sphere 3D Corp. (NASDAQ:ANY) Shares A 27% Hiding

Unfortunately for some shareholders, the Sphere 3D Corp. (NASDAQ:ANY) share price has dived 27% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

對於一些股東來說,不幸的是,Sphere 3D Corp.(納斯達克股票代碼:ANY)的股價在過去三十天中下跌了27%,延續了最近的痛苦。在過去十二個月中已經持股的股東沒有獲得回報,反而坐視股價下跌了48%。

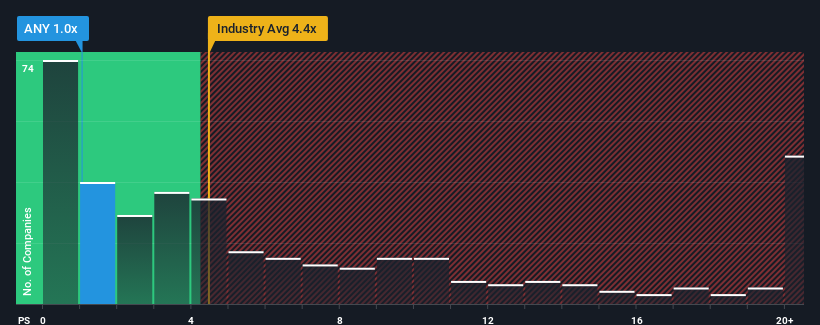

Following the heavy fall in price, Sphere 3D may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.4x and even P/S higher than 11x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

在價格大幅下跌之後,Sphere 3D目前看上去是一個強勁的買入機會,其市銷率(或 “市盈率”)爲1倍,因爲美國軟件行業幾乎有一半公司的市銷率大於4.4倍,即使市盈率高於11倍也並非不尋常。但是,市銷率可能很低是有原因的,需要進一步調查以確定其是否合理。

NasdaqCM:ANY Price to Sales Ratio vs Industry April 6th 2024

納斯達克公司:2024年4月6日與行業對比的任何股價與銷售比率

How Sphere 3D Has Been Performing

Sphere 3D 的表現如何

With revenue growth that's superior to most other companies of late, Sphere 3D has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Sphere 3D 的收入增長近來優於大多數其他公司,因此表現相對較好。許多人可能預計,強勁的收入表現將大幅下降,這抑制了股價,從而抑制了市銷率。如果你喜歡這家公司,你希望情況並非如此,這樣你就有可能在它失寵的時候買入一些股票。

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sphere 3D.

如果你想了解分析師對未來的預測,你應該查看我們關於Sphere 3D的免費報告。

Do Revenue Forecasts Match The Low P/S Ratio?

收入預測與低市銷率相匹配嗎?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Sphere 3D's to be considered reasonable.

人們固有的假設是,如果像Sphere 3D這樣的市銷率被認爲是合理的,公司的表現應該遠遠低於該行業。

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

首先回顧一下,我們發現該公司的收入在過去12個月中經歷了一些猛烈的增長。引人注目的是,由於過去12個月的驚人增長,三年的收入增長也點燃了世界。因此,我們可以首先確認該公司在這段時間內在增加收入方面做得非常出色。

Looking ahead now, revenue is anticipated to climb by 18% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

根據關注該公司的唯一分析師的說法,展望未來,預計來年收入將增長18%。由於預計該行業的收入僅爲15%,該公司有望實現更強勁的收入業績。

With this information, we find it odd that Sphere 3D is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

有了這些信息,我們覺得奇怪的是,Sphere 3D的市銷率低於該行業。看來大多數投資者根本不相信公司能夠實現未來的增長預期。

What We Can Learn From Sphere 3D's P/S?

我們可以從 Sphere 3D 的市銷率中學到什麼?

Sphere 3D's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Sphere 3D的市銷率最近看起來與其股價一樣疲軟。有人認爲,在某些行業中,市銷率是衡量價值的較差指標,但它可以是一個有力的商業信心指標。

To us, it seems Sphere 3D currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

在我們看來,鑑於Sphere 3D的預測收入增長高於其行業其他部門,目前的市銷率似乎明顯低迷。可能有一些主要的風險因素給市銷率帶來下行壓力。看來市場可能會預期收入不穩定,因爲這些條件通常會提振股價。

Before you settle on your opinion, we've discovered 5 warning signs for Sphere 3D (4 make us uncomfortable!) that you should be aware of.

在你確定自己的觀點之前,我們已經發現了 Sphere 3D 的 5 個警告標誌(4 個讓我們感到不舒服!)你應該注意的。

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是要確保你尋找一家優秀的公司,而不僅僅是你遇到的第一個想法。因此,如果盈利能力的增長與你對一家優秀公司的想法一致,那就來看看這份免費名單吧,列出了最近收益增長強勁(市盈率低)的有趣公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接聯繫我們。或者,也可以發送電子郵件至編輯團隊 (at) simplywallst.com。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

With revenue growth that's superior to most other companies of late, Sphere 3D has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

With revenue growth that's superior to most other companies of late, Sphere 3D has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.