Decoding Coca-Cola's Options Activity: What's the Big Picture?

Decoding Coca-Cola's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on $Coca-Cola (KO.US)$.

有大量資金可以花的投資者採取了看跌的立場 $可口可樂 (KO.US)$。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

今天,當我們在本辛加追蹤的公開期權歷史記錄中出現頭寸時,我們注意到了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with KO, it often means somebody knows something is about to happen.

無論這些是機構還是僅僅是富人,我們都不知道。但是,當 KO 發生這麼大的事情時,通常意味着有人知道某件事即將發生。

Today, Benzinga's options scanner spotted 8 options trades for Coca-Cola.

今天,Benzinga的期權掃描儀發現了可口可樂的8筆期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 25% bullish and 75%, bearish.

這些大手交易者的整體情緒分爲25%看漲和75%(看跌)。

Out of all of the options we uncovered, there was 1 put, for a total amount of $26,208, and 7, calls, for a total amount of $397,944.

在我們發現的所有期權中,有1個看跌期權,總額爲26,208美元,還有7個看漲期權,總額爲397,944美元。

What's The Price Target?

目標價格是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $57.0 to $61.0 for Coca-Cola over the recent three months.

根據交易活動,近三個月來,主要投資者的目標似乎是將可口可樂的價格範圍從57.0美元擴大到61.0美元。

Volume & Open Interest Development

交易量和未平倉合約的發展

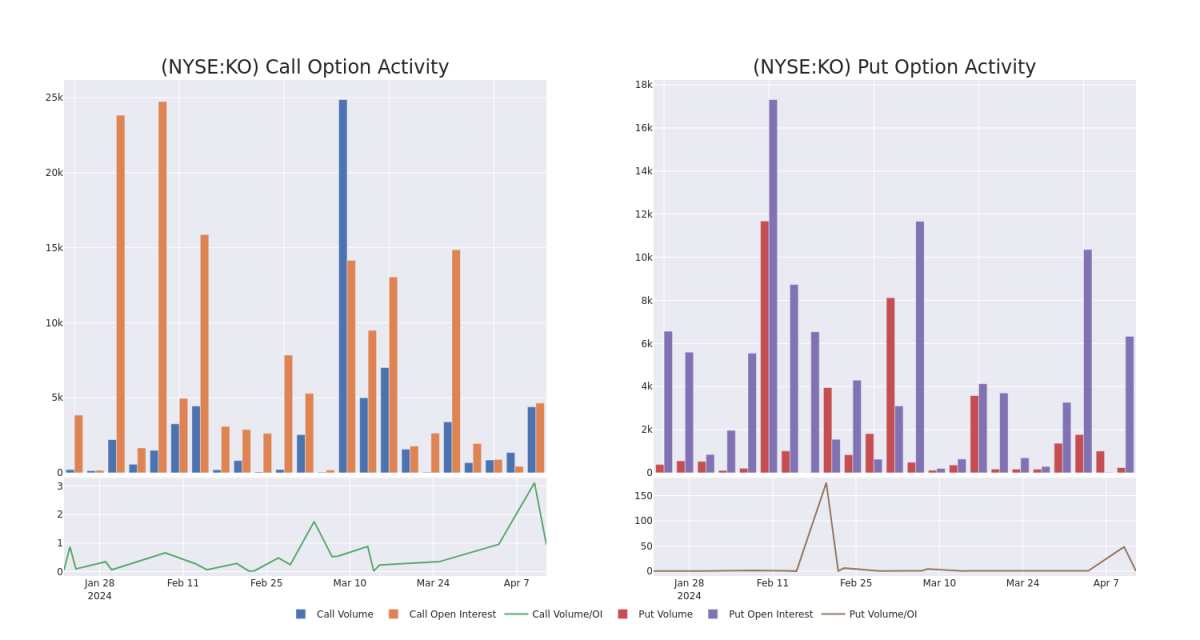

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平倉合約是一種對股票進行盡職調查的有見地的方法。

This data can help you track the liquidity and interest for Coca-Cola's options for a given strike price.

這些數據可以幫助您跟蹤給定行使價下可口可樂期權的流動性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Coca-Cola's whale activity within a strike price range from $57.0 to $61.0 in the last 30 days.

下面,我們可以分別觀察過去30天中可口可樂所有鯨魚活動的看漲和看跌期權交易量和未平倉合約的變化,其行使價在57.0美元至61.0美元之間。

Coca-Cola Call and Put Volume: 30-Day Overview

可口可樂看漲期權和看跌期權交易量:30 天概述

Biggest Options Spotted:

發現的最大選擇:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

KO |

CALL |

SWEEP |

BEARISH |

04/19/24 |

$1.57 |

$1.52 |

$1.52 |

$57.00 |

$152.0K |

10 |

60 |

KO |

CALL |

SWEEP |

BEARISH |

05/10/24 |

$0.31 |

$0.29 |

$0.29 |

$61.00 |

$78.3K |

995 |

2.7K |

KO |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$1.94 |

$1.91 |

$1.94 |

$57.50 |

$38.8K |

2.7K |

214 |

KO |

CALL |

TRADE |

BEARISH |

09/20/24 |

$2.0 |

$1.98 |

$1.98 |

$60.00 |

$35.6K |

384 |

41 |

KO |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$1.93 |

$1.92 |

$1.92 |

$57.50 |

$33.6K |

2.7K |

281 |

符號 |

看跌/看漲 |

交易類型 |

情緒 |

Exp。日期 |

問 |

出價 |

價格 |

行使價 |

總交易價格 |

未平倉合約 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

KO |

打電話 |

掃 |

粗魯的 |

04/19/24 |

1.57 |

1.52 美元 |

1.52 美元 |

57.00 美元 |

152.0 萬美元 |

10 |

60 |

KO |

打電話 |

掃 |

粗魯的 |

05/10/24 |

0.31 美元 |

0.29 美元 |

0.29 美元 |

61.00 美元 |

78.3 萬美元 |

995 |

2.7K |

KO |

打電話 |

掃 |

看漲 |

05/17/24 |

1.94 美元 |

1.91 |

1.94 美元 |

57.50 美元 |

38.8 萬美元 |

2.7K |

214 |

KO |

打電話 |

貿易 |

粗魯的 |

09/20/24 |

2.0 美元 |

1.98 美元 |

1.98 美元 |

60.00 美元 |

35.6 萬美元 |

384 |

41 |

KO |

打電話 |

掃 |

粗魯的 |

05/17/24 |

1.93 美元 |

1.92 美元 |

1.92 美元 |

57.50 美元 |

33.6K |

2.7K |

281 |

About Coca-Cola

關於可口可樂

Founded in 1886, Atlanta-headquartered Coca-Cola is the world's largest nonalcoholic beverage company, with a strong portfolio of 200 brands covering key categories including carbonated soft drinks, water, sports, energy, juice, and coffee. Together with bottlers and distribution partners, the company sells finished beverage products bearing Coca-Cola and licensed brands through retailers and food-service locations in more than 200 countries and regions globally. Coca-Cola generates around two thirds of its total revenues overseas, with a significant portion from emerging economies in Latin America and Asia-Pacific.

總部位於亞特蘭大的可口可樂成立於1886年,是全球最大的無酒精飲料公司,擁有由200個品牌組成的強大產品組合,涵蓋碳痠軟飲料、水、運動、能量、果汁和咖啡等關鍵類別。該公司與裝瓶商和分銷合作伙伴一起,通過全球200多個國家和地區的零售商和餐飲服務網點銷售含有可口可樂和特許品牌的成品飲料產品。可口可樂總收入的三分之二左右來自海外,其中很大一部分來自拉丁美洲和亞太地區的新興經濟體。

Present Market Standing of Coca-Cola

可口可樂目前的市場地位

Currently trading with a volume of 6,617,132, the KO's price is down by -1.34%, now at $58.26.

RSI readings suggest the stock is currently may be approaching oversold.

Anticipated earnings release is in 18 days.

KO目前的交易量爲6,617,132美元,價格下跌了-1.34%,目前爲58.26美元。

RSI讀數表明,該股目前可能已接近超賣。

預計收益將在18天后發佈。

What The Experts Say On Coca-Cola

專家對可口可樂的看法

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $68.0.

在過去的30天中,共有1位專業分析師對該股發表了看法,將平均目標股價定爲68.0美元。

An analyst from Barclays persists with their Overweight rating on Coca-Cola, maintaining a target price of $68.

巴克萊銀行的一位分析師堅持對可口可樂的增持評級,維持68美元的目標價。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Coca-Cola with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解可口可樂的最新期權交易,以獲取實時警報。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with KO, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with KO, it often means somebody knows something is about to happen.