Options Corner: Unpacking the Latest Options Trading Trends in ConocoPhillips

Options Corner: Unpacking the Latest Options Trading Trends in ConocoPhillips

Whales with a lot of money to spend have taken a noticeably bearish stance on $ConocoPhillips (COP.US)$.

有很多錢可以花的鯨魚已經採取了明顯的看跌立場 $康菲石油 (COP.US)$。

Looking at options history for ConocoPhillips, we detected 9 trades.

查看康菲石油公司的期權歷史記錄,我們發現了9筆交易。

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 66% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,33%的投資者以看漲的預期開倉,66%的投資者以看跌的預期開盤。

From the overall spotted trades, 2 are puts, for a total amount of $91,344 and 7, calls, for a total amount of $542,110.

在已發現的全部交易中,有2筆是看跌期權,總額爲91,344美元,7筆看漲期權,總額爲542,110美元。

Predicted Price Range

預測的價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $70.0 and $135.0 for ConocoPhillips, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者將注意力集中在康菲石油公司過去三個月的70.0美元至135.0美元之間的價格區間上。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

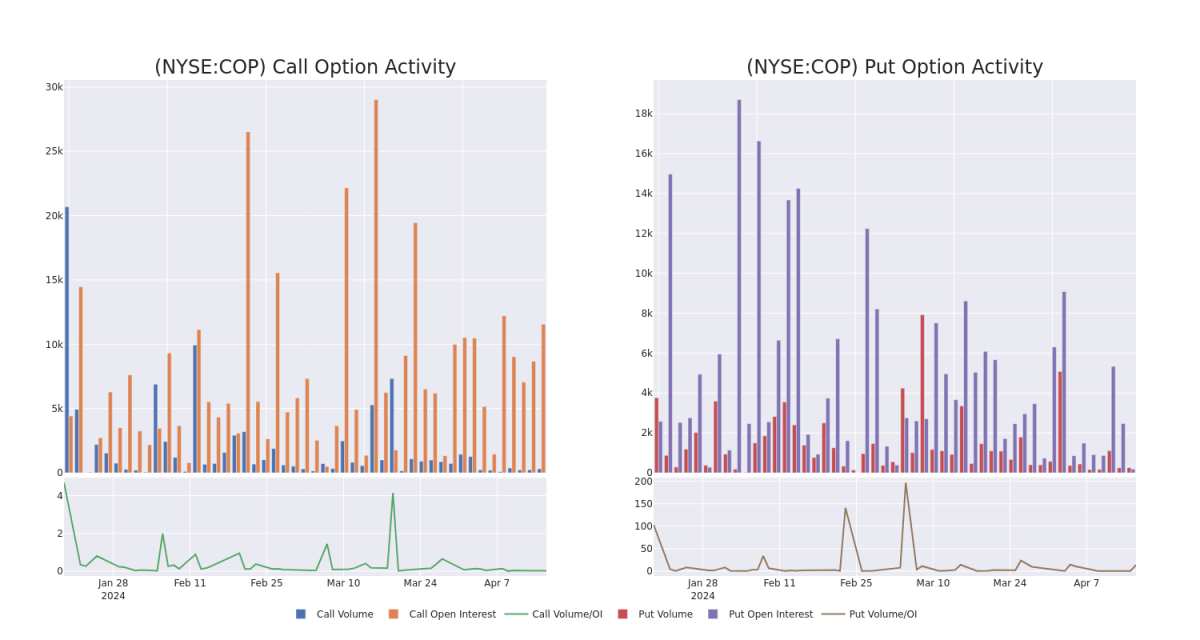

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in ConocoPhillips's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to ConocoPhillips's substantial trades, within a strike price spectrum from $70.0 to $135.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了康菲石油公司在指定行使價下期權的流動性和投資者對康菲石油公司的期權的興趣。即將發佈的數據顯示了與康菲石油公司的大量交易相關的看漲期權和看跌期權交易量和未平倉合約的波動,在過去30天內,行使價範圍從70.0美元到135.0美元不等。

ConocoPhillips Call and Put Volume: 30-Day Overview

康菲石油看漲和看跌交易量:30 天概述

Biggest Options Spotted:

發現的最大選擇:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

COP |

CALL |

SWEEP |

BULLISH |

09/20/24 |

$40.25 |

$38.2 |

$40.25 |

$90.00 |

$201.2K |

56 |

0 |

COP |

CALL |

SWEEP |

BEARISH |

08/16/24 |

$5.6 |

$5.55 |

$5.55 |

$135.00 |

$138.7K |

1.2K |

280 |

COP |

CALL |

SWEEP |

NEUTRAL |

05/17/24 |

$11.9 |

$11.0 |

$11.0 |

$120.00 |

$57.2K |

7.6K |

9 |

COP |

PUT |

SWEEP |

BULLISH |

11/15/24 |

$3.2 |

$3.1 |

$3.15 |

$110.00 |

$49.1K |

12 |

157 |

COP |

CALL |

TRADE |

BEARISH |

05/17/24 |

$20.0 |

$19.8 |

$19.8 |

$110.00 |

$43.5K |

1.0K |

22 |

符號 |

看跌/看漲 |

交易類型 |

情緒 |

Exp。日期 |

問 |

出價 |

價格 |

行使價 |

總交易價格 |

未平倉合約 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

COP |

打電話 |

掃 |

看漲 |

09/20/24 |

40.25 美元 |

38.2 美元 |

40.25 美元 |

90.00 美元 |

201.2K 美元 |

56 |

0 |

COP |

打電話 |

掃 |

粗魯的 |

08/16/24 |

5.6 美元 |

5.55 美元 |

5.55 美元 |

135.00 美元 |

138.7 萬美元 |

1.2K |

280 |

COP |

打電話 |

掃 |

中立 |

05/17/24 |

11.9 美元 |

11.0 美元 |

11.0 美元 |

120.00 美元 |

57.2 萬美元 |

7.6K |

9 |

COP |

放 |

掃 |

看漲 |

11/15/24 |

3.2 美元 |

3.1 美元 |

3.15 美元 |

110.00 美元 |

49.1 萬美元 |

12 |

157 |

COP |

打電話 |

貿易 |

粗魯的 |

05/17/24 |

20.0 美元 |

19.8 美元 |

19.8 美元 |

110.00 美元 |

43.5 萬美元 |

1.0K |

22 |

About ConocoPhillips

關於康菲石油公司

ConocoPhillips is a U.S.-based independent exploration and production firm. In 2022, it produced 1.2 million barrels per day of oil and natural gas liquids and 3.1 billion cubic feet per day of natural gas, primarily from Alaska and the Lower 48 in the United States and Norway in Europe and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2022 were 6.6 billion barrels of oil equivalent.

康菲石油公司是一家總部位於美國的獨立勘探和生產公司。2022年,它每天生產120萬桶石油和液化天然氣,每天生產31億立方英尺的天然氣,主要來自美國的阿拉斯加和下48個國家、歐洲的挪威以及亞太和中東的幾個國家。截至2022年底,探明儲量爲66億桶石油當量。

Current Position of ConocoPhillips

康菲石油公司目前的位置

With a trading volume of 2,229,464, the price of COP is down by -0.46%, reaching $129.65.

Current RSI values indicate that the stock is may be approaching overbought.

Next earnings report is scheduled for 16 days from now.

COP的交易量爲2,229,464美元,下跌了-0.46%,至129.65美元。

當前的RSI值表明該股可能已接近超買。

下一份收益報告定於16天后發佈。

What The Experts Say On ConocoPhillips

專家對康菲石油公司的看法

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $150.2.

在過去的一個月中,5位行業分析師分享了他們對該股的見解,提出平均目標價爲150.2美元。

An analyst from Truist Securities has decided to maintain their Buy rating on ConocoPhillips, which currently sits at a price target of $170.

An analyst from Wells Fargo has decided to maintain their Overweight rating on ConocoPhillips, which currently sits at a price target of $149.

Consistent in their evaluation, an analyst from Scotiabank keeps a Sector Perform rating on ConocoPhillips with a target price of $135.

An analyst from Barclays has revised its rating downward to Overweight, adjusting the price target to $158.

An analyst from Mizuho downgraded its action to Neutral with a price target of $139.

Truist Securities的一位分析師已決定維持對康菲石油公司的買入評級,目前的目標股價爲170美元。

富國銀行的一位分析師已決定維持對康菲石油公司的增持評級,目前的目標股價爲149美元。

豐業銀行的一位分析師在評估中保持了康菲石油的行業表現評級,目標價爲135美元。

巴克萊銀行的一位分析師已將其評級下調至增持,將目標股價調整爲158美元。

瑞穗的一位分析師將其評級下調至中性,目標股價爲139美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ConocoPhillips options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時提醒,隨時了解康菲石油公司的最新期權交易。

From the overall spotted trades, 2 are puts, for a total amount of $91,344 and 7, calls, for a total amount of $542,110.

From the overall spotted trades, 2 are puts, for a total amount of $91,344 and 7, calls, for a total amount of $542,110.