The Three-year Earnings Decline Has Likely Contributed ToShenyang Chemical Industry's (SZSE:000698) Shareholders Losses of 52% Over That Period

The Three-year Earnings Decline Has Likely Contributed ToShenyang Chemical Industry's (SZSE:000698) Shareholders Losses of 52% Over That Period

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the last three years have been particularly tough on longer term Shenyang Chemical Industry Co., Ltd. (SZSE:000698) shareholders. Unfortunately, they have held through a 52% decline in the share price in that time. And over the last year the share price fell 23%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 18% in the last three months.

事實是,如果你投資足夠長的時間,你最終會有一些虧損的股票。但是,對於瀋陽化工股份有限公司(SZSE: 000698)的長期股東來說,過去三年尤其艱難。不幸的是,在那段時間內,他們的股價一直下跌了52%。在過去的一年中,股價下跌了23%,因此我們懷疑許多股東是否感到高興。最近跌勢加速,股價在過去三個月中下跌了18%。

If the past week is anything to go by, investor sentiment for Shenyang Chemical Industry isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

如果說過去一週有意義的話,投資者對瀋陽化工的情緒並不樂觀,所以讓我們看看基本面和股價之間是否存在不匹配的情況。

Shenyang Chemical Industry wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

瀋陽化工在過去十二個月中沒有盈利,我們不太可能看到其股價與每股收益(EPS)之間存在很強的相關性。可以說,收入是我們的下一個最佳選擇。無利可圖的公司的股東通常希望強勁的收入增長。那是因爲如果收入增長可以忽略不計,而且從來沒有盈利,就很難確信一家公司能否實現可持續發展。

Over the last three years, Shenyang Chemical Industry's revenue dropped 26% per year. That means its revenue trend is very weak compared to other loss making companies. Arguably, the market has responded appropriately to this business performance by sending the share price down 15% (annualized) in the same time period. When revenue is dropping, and losses are still costing, and the share price sinking fast, it's fair to ask if something is remiss. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

在過去三年中,瀋陽化工的收入每年下降26%。這意味着與其他虧損公司相比,其收入趨勢非常疲軟。可以說,市場對這一業務表現做出了適當的反應,使股價在同一時期下跌了15%(按年計算)。當收入下降,虧損仍在付出代價,股價快速下跌時,可以公平地問一下是否存在疏忽之處。在因股價下跌的業務而蒙受損失之後,我們一直在考慮急切的持倉者是否仍在向我們提供合理的退出價格。

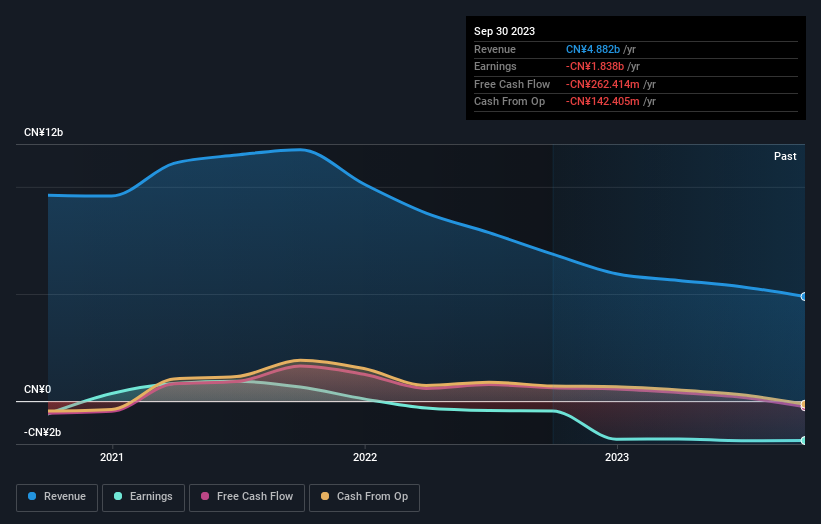

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

下圖顯示了收入和收入隨時間推移的跟蹤情況(如果您點擊圖片,可以看到更多細節)。

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

您可以在這張免費的交互式圖片中看到其資產負債表如何隨着時間的推移而增強(或減弱)。

A Different Perspective

不同的視角

We regret to report that Shenyang Chemical Industry shareholders are down 23% for the year. Unfortunately, that's worse than the broader market decline of 16%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Shenyang Chemical Industry , and understanding them should be part of your investment process.

我們遺憾地報告,瀋陽化工的股東今年下跌了23%。不幸的是,這比整個市場16%的跌幅還要嚴重。話雖如此,在下跌的市場中,一些股票不可避免地會被超賣。關鍵是要密切關注基本發展。不幸的是,去年的表現可能預示着尚未解決的挑戰,因爲它比過去五年中6%的年化虧損還要糟糕。我們意識到羅斯柴爾德男爵曾說過,投資者應該 “在街頭流血時買入”,但我們警告說,投資者應首先確保他們購買的是高質量的企業。儘管市場狀況可能對股價產生的不同影響值得考慮,但還有其他因素更爲重要。例如,投資風險的幽靈無處不在。我們已經向瀋陽化工確定了一個警告信號,了解它們應該是您投資過程的一部分。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

如果你想看看另一家公司——一家財務狀況可能優異的公司——那麼千萬不要錯過這份已經證明自己可以增加收益的公司的免費名單。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所交易的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。