Estimating The Intrinsic Value Of Shenzhen Worldunion Group Incorporated (SZSE:002285)

Estimating The Intrinsic Value Of Shenzhen Worldunion Group Incorporated (SZSE:002285)

Key Insights

關鍵見解

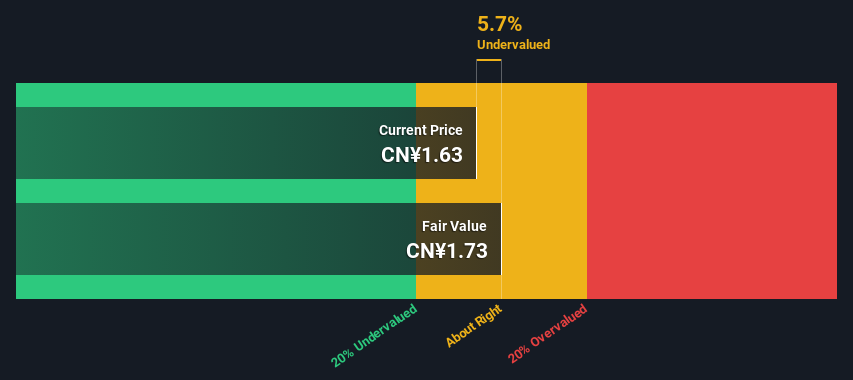

- The projected fair value for Shenzhen Worldunion Group is CN¥1.73 based on 2 Stage Free Cash Flow to Equity

- Shenzhen Worldunion Group's CN¥1.63 share price indicates it is trading at similar levels as its fair value estimate

- Peers of Shenzhen Worldunion Group are currently trading on average at a 1,460% premium

- 根據兩階段股權自由現金流,深圳世聯集團的預計公允價值爲1.73元人民幣

- 深圳世聯集團1.63元人民幣的股價表明其交易價格與其公允價值估計相似

- 深圳世聯集團的同行目前的平均交易溢價爲1,460%

In this article we are going to estimate the intrinsic value of Shenzhen Worldunion Group Incorporated (SZSE:002285) by projecting its future cash flows and then discounting them to today's value. This will be done using the Discounted Cash Flow (DCF) model. There's really not all that much to it, even though it might appear quite complex.

在本文中,我們將通過預測深圳世聯集團公司(SZSE:002285)未來的現金流,然後將其折現爲今天的價值,來估算其內在價值。這將使用折扣現金流 (DCF) 模型來完成。儘管它可能看起來很複雜,但實際上並沒有那麼多。

Remember though, that there are many ways to estimate a company's value, and a DCF is just one method. Anyone interested in learning a bit more about intrinsic value should have a read of the Simply Wall St analysis model.

但請記住,估算公司價值的方法有很多,而差價合約只是一種方法。任何有興趣進一步了解內在價值的人都應該讀一讀 Simply Wall St 分析模型。

The Method

該方法

We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company's cash flows. Generally the first stage is higher growth, and the second stage is a lower growth phase. In the first stage we need to estimate the cash flows to the business over the next ten years. Seeing as no analyst estimates of free cash flow are available to us, we have extrapolate the previous free cash flow (FCF) from the company's last reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

我們使用所謂的兩階段模型,這僅意味着公司的現金流有兩個不同的增長期。通常,第一階段是較高的增長階段,第二階段是較低的增長階段。在第一階段,我們需要估算未來十年的業務現金流。鑑於我們沒有分析師對自由現金流的估計,我們從公司上次公佈的價值中推斷了之前的自由現金流(FCF)。我們假設自由現金流萎縮的公司將減緩其萎縮速度,而自由現金流不斷增長的公司在此期間的增長率將放緩。我們這樣做是爲了反映早期增長的放緩幅度往往比後來的幾年更大。

Generally we assume that a dollar today is more valuable than a dollar in the future, so we need to discount the sum of these future cash flows to arrive at a present value estimate:

通常,我們假設今天的一美元比未來一美元更有價值,因此我們需要對這些未來現金流的總和進行折價才能得出現值估計:

10-year free cash flow (FCF) estimate

10 年自由現金流 (FCF) 估計

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | |

| Levered FCF (CN¥, Millions) | CN¥335.1m | CN¥287.6m | CN¥261.6m | CN¥247.3m | CN¥240.0m | CN¥237.2m | CN¥237.4m | CN¥239.6m | CN¥243.2m | CN¥248.0m |

| Growth Rate Estimate Source | Est @ -21.52% | Est @ -14.18% | Est @ -9.05% | Est @ -5.45% | Est @ -2.93% | Est @ -1.17% | Est @ 0.06% | Est @ 0.93% | Est @ 1.53% | Est @ 1.95% |

| Present Value (CN¥, Millions) Discounted @ 9.0% | CN¥307 | CN¥242 | CN¥202 | CN¥175 | CN¥156 | CN¥141 | CN¥129 | CN¥120 | CN¥112 | CN¥104 |

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | |

| 槓桿FCF(人民幣,百萬) | 3.351 億元人民幣 | 2876 萬元人民幣 | 2.616億元人民幣 | 2.473 億人民幣 | 人民幣 240.0 萬元 | 237.2 萬元人民幣 | 2.374 億元人民幣 | 239.6 億元人民幣 | 243.2 億人民幣 | 2.48 億元人民幣 |

| 增長率估算來源 | 美國東部標準時間 @ -21.52% | 美國東部標準時間 @ -14.18% | 美國東部標準時間 @ -9.05% | 美國東部標準時間 @ -5.45% | 美國東部標準時間 @ -2.93% | 美國東部時間 @ -1.17% | Est @ 0.06% | Est @ 0.93% | 美國東部時間 @ 1.53% | 東部標準時間 @ 1.95% |

| 現值(人民幣,百萬)折現 @ 9.0% | CN¥307 | CN¥242 | CN¥202 | CN¥175 | CN¥156 | CN¥141 | CN¥129 | 120 元人民幣 | CN¥112 | CN¥104 |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = CN¥1.7b

(“Est” = Simply Wall St估計的FCF增長率)

10年期現金流(PVCF)的現值 = 17億元人民幣

The second stage is also known as Terminal Value, this is the business's cash flow after the first stage. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (2.9%) to estimate future growth. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 9.0%.

第二階段也稱爲終值,這是企業在第一階段之後的現金流。出於多種原因,使用的增長率非常保守,不能超過一個國家的GDP增長率。在這種情況下,我們使用10年期國債收益率的5年平均值(2.9%)來估計未來的增長。與10年 “增長” 期一樣,我們使用9.0%的權益成本將未來的現金流折現爲今天的價值。

Terminal Value (TV)= FCF2033 × (1 + g) ÷ (r – g) = CN¥248m× (1 + 2.9%) ÷ (9.0%– 2.9%) = CN¥4.2b

終端價值 (TV) = FCF2033 × (1 + g) ÷ (r — g) = 人民幣2.48億元× (1 + 2.9%) ÷ (9.0% — 2.9%) = 42億人民幣

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= CN¥4.2b÷ ( 1 + 9.0%)10= CN¥1.8b

終端價值的現值 (PVTV) = 電視/ (1 + r)10= CN¥4.2b÷ (1 + 9.0%)10= 人民幣 18b

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is CN¥3.4b. To get the intrinsic value per share, we divide this by the total number of shares outstanding. Compared to the current share price of CN¥1.6, the company appears about fair value at a 5.7% discount to where the stock price trades currently. Valuations are imprecise instruments though, rather like a telescope - move a few degrees and end up in a different galaxy. Do keep this in mind.

因此,總價值或權益價值是未來現金流現值的總和,在本例中爲34億元人民幣。爲了得出每股內在價值,我們將其除以已發行股票總數。與目前1.6元人民幣的股價相比,該公司的公允價值似乎比目前的股價折扣了5.7%。但是,估值是不精確的工具,就像望遠鏡一樣——移動幾度,最終進入另一個星系。請記住這一點。

Important Assumptions

重要假設

We would point out that the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows. You don't have to agree with these inputs, I recommend redoing the calculations yourself and playing with them. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Shenzhen Worldunion Group as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 9.0%, which is based on a levered beta of 1.085. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

我們要指出的是,貼現現金流的最重要投入是貼現率,當然還有實際的現金流。你不必同意這些輸入,我建議你自己重做計算然後試一試。DCF也沒有考慮一個行業可能的週期性,也沒有考慮公司未來的資本需求,因此它沒有全面反映公司的潛在表現。鑑於我們將深圳世聯集團視爲潛在股東,因此使用股本成本作爲貼現率,而不是構成債務的資本成本(或加權平均資本成本,WACC)。在此計算中,我們使用了9.0%,這是基於1.085的槓桿測試版。Beta是衡量股票與整個市場相比波動性的指標。我們的測試版來自全球可比公司的行業平均貝塔值,設定在0.8到2.0之間,這是一個穩定的業務的合理範圍。

Moving On:

繼續前進:

Although the valuation of a company is important, it ideally won't be the sole piece of analysis you scrutinize for a company. DCF models are not the be-all and end-all of investment valuation. Preferably you'd apply different cases and assumptions and see how they would impact the company's valuation. If a company grows at a different rate, or if its cost of equity or risk free rate changes sharply, the output can look very different. For Shenzhen Worldunion Group, there are three essential items you should further research:

儘管公司的估值很重要,但理想情況下,它不會是你仔細檢查公司的唯一分析內容。DCF模型並不是投資估值的萬能藥。最好你運用不同的案例和假設,看看它們將如何影響公司的估值。如果一家公司以不同的速度增長,或者其股本成本或無風險利率急劇變化,則產出可能會大不相同。對於深圳世聯集團來說,您應該進一步研究三個基本項目:

- Risks: To that end, you should be aware of the 1 warning sign we've spotted with Shenzhen Worldunion Group .

- Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

- Other Environmentally-Friendly Companies: Concerned about the environment and think consumers will buy eco-friendly products more and more? Browse through our interactive list of companies that are thinking about a greener future to discover some stocks you may not have thought of!

- 風險:爲此,你應該注意我們在深圳世聯集團發現的1個警告信號。

- 其他高質量的替代品:你喜歡一個優秀的全能選手嗎?瀏覽我們的高品質股票互動清單,了解您可能還會錯過什麼!

- 其他環保公司:擔心環境並認爲消費者會越來越多地購買環保產品?瀏覽我們正在考慮更綠色未來的公司的互動名單,發現一些你可能沒有想到的股票!

PS. Simply Wall St updates its DCF calculation for every Chinese stock every day, so if you want to find the intrinsic value of any other stock just search here.

PS。Simply Wall St每天都會更新每隻中國股票的差價合約計算結果,因此,如果您想找到任何其他股票的內在價值,請在此處搜索。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

Generally we assume that a dollar today is more valuable than a dollar in the future, so we need to discount the sum of these future cash flows to arrive at a present value estimate:

Generally we assume that a dollar today is more valuable than a dollar in the future, so we need to discount the sum of these future cash flows to arrive at a present value estimate: