Options: Boeing Sees Smart Money Betting Big on the Stock

Options: Boeing Sees Smart Money Betting Big on the Stock

Financial giants have made a conspicuous bearish move on Boeing. Our analysis of options history for $Boeing (BA.US)$ revealed 8 unusual trades.

金融巨頭對波音採取了明顯的看跌舉動。我們對期權歷史的分析 $波音 (BA.US)$ 透露了8筆不尋常的交易。

Delving into the details, we found 25% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $299,540, and 2 were calls, valued at $149,391.

深入研究細節後,我們發現25%的交易者看漲,而62%的交易者表現出看跌趨勢。在我們發現的所有交易中,有6筆是看跌期權,價值爲299,540美元,2筆是看漲期權,價值149,391美元。

Predicted Price Range

預測的價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $160.0 to $250.0 for Boeing over the recent three months.

根據交易活動,看來主要投資者的目標是波音在最近三個月的價格區間內從160.0美元到250.0美元不等。

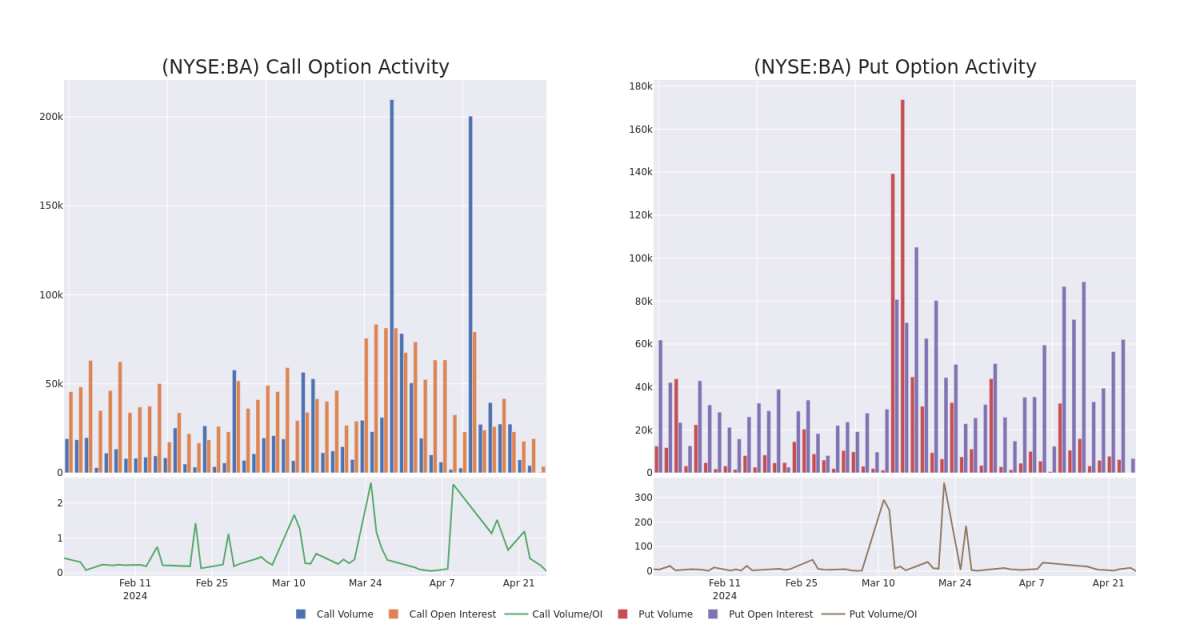

Volume & Open Interest Development

交易量和未平倉合約的發展

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Boeing's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Boeing's whale trades within a strike price range from $160.0 to $250.0 in the last 30 days.

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤給定行使價下波音期權的流動性和利息。下面,我們可以觀察到過去30天內波音所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的變化,其行使價在160.0美元至250.0美元之間。

Boeing Call and Put Volume: 30-Day Overview

波音看漲期權和看跌期權交易量:30 天概述

Noteworthy Options Activity:

值得注意的期權活動:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

BA |

PUT |

TRADE |

NEUTRAL |

11/15/24 |

$50.2 |

$49.05 |

$49.65 |

$215.00 |

$99.3K |

307 |

0 |

BA |

CALL |

TRADE |

BEARISH |

12/18/26 |

$50.2 |

$49.2 |

$49.2 |

$160.00 |

$78.7K |

107 |

1 |

BA |

CALL |

SWEEP |

BEARISH |

05/03/24 |

$1.16 |

$1.1 |

$1.15 |

$170.00 |

$70.6K |

3.5K |

198 |

BA |

PUT |

TRADE |

BEARISH |

10/18/24 |

$39.0 |

$38.95 |

$39.0 |

$205.00 |

$62.4K |

79 |

0 |

BA |

PUT |

SWEEP |

BEARISH |

08/16/24 |

$19.2 |

$18.2 |

$18.25 |

$180.00 |

$40.1K |

1.2K |

0 |

符號 |

看跌/看漲 |

交易類型 |

情緒 |

Exp。日期 |

問 |

出價 |

價格 |

行使價 |

總交易價格 |

未平倉合約 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

BA |

放 |

貿易 |

中立 |

11/15/24 |

50.2 美元 |

49.05 美元 |

49.65 美元 |

215.00 美元 |

99.3 萬美元 |

307 |

0 |

BA |

打電話 |

貿易 |

粗魯的 |

12/18/26 |

50.2 美元 |

49.2 美元 |

49.2 美元 |

160.00 美元 |

78.7 萬美元 |

107 |

1 |

BA |

打電話 |

掃 |

粗魯的 |

05/03/24 |

1.16 美元 |

1.1 美元 |

1.15 美元 |

170.00 美元 |

70.6K |

3.5K |

198 |

BA |

放 |

貿易 |

粗魯的 |

10/18/24 |

39.0 美元 |

38.95 美元 |

39.0 美元 |

205.00 美元 |

62.4 萬美元 |

79 |

0 |

BA |

放 |

掃 |

粗魯的 |

08/16/24 |

19.2 美元 |

18.2 美元 |

18.25 美元 |

180.00 美元 |

40.1 萬美元 |

1.2K |

0 |

About Boeing

關於波音

Boeing is a major aerospace and defense firm. It operates in three segments: commercial airplanes; defense, space, and security; and global services. Boeing's commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing's defense, space, and security segment competes with Lockheed, Northrop, and several other firms to create military aircraft and weaponry. Global services provides aftermarket support to airlines.

波音是一家大型航空航天和國防公司。它分爲三個部門:商用飛機;國防、太空和安全;以及全球服務。波音的商用飛機部門在生產可運載超過130名乘客的飛機方面與空中客車公司競爭。波音的國防、太空和安全部門與洛克希德、諾斯羅普和其他幾家公司競爭,以製造軍用飛機和武器。全球服務爲航空公司提供售後支持。

Boeing's Current Market Status

波音目前的市場地位

With a volume of 162,518, the price of BA is down -0.5% at $165.97.

RSI indicators hint that the underlying stock may be oversold.

Next earnings are expected to be released in 89 days.

英國航空的交易量爲162,518美元,下跌了0.5%,至165.97美元。

RSI 指標暗示標的股票可能被超賣。

下一份業績預計將在89天后公佈。

What Analysts Are Saying About Boeing

分析師對波音的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $220.0.

5位市場專家最近發佈了該股的評級,共識目標價爲220.0美元。

An analyst from Deutsche Bank persists with their Buy rating on Boeing, maintaining a target price of $225.

Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Boeing with a target price of $260.

An analyst from JP Morgan has decided to maintain their Overweight rating on Boeing, which currently sits at a price target of $210.

An analyst from RBC Capital persists with their Outperform rating on Boeing, maintaining a target price of $215.

Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Boeing with a target price of $190.

德意志銀行的一位分析師堅持對波音的買入評級,維持225美元的目標價格。

Stifel的一位分析師在評估中保持了對波音的買入評級,目標價爲260美元。

摩根大通的一位分析師已決定維持對波音的增持評級,目前波音的目標股價爲210美元。

加拿大皇家銀行資本的一位分析師堅持對波音的跑贏大盤評級,維持215美元的目標價格。

巴克萊銀行的一位分析師在評估中保持對波音的同等權重評級,目標價爲190美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Boeing with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解波音的最新期權交易,獲取實時警報。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Boeing's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Boeing's whale trades within a strike price range from $160.0 to $250.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Boeing's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Boeing's whale trades within a strike price range from $160.0 to $250.0 in the last 30 days.