Hongda High-Tech HoldingLtd's (SZSE:002144) Solid Earnings Have Been Accounted For Conservatively

Hongda High-Tech HoldingLtd's (SZSE:002144) Solid Earnings Have Been Accounted For Conservatively

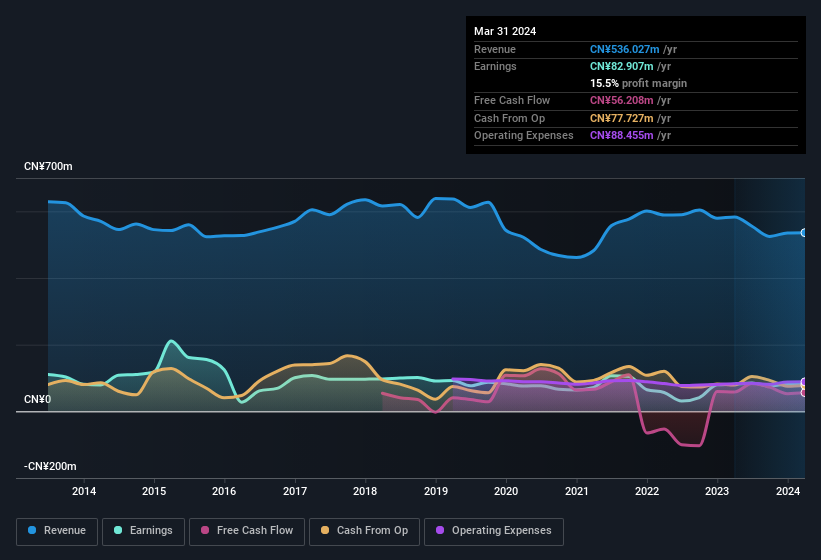

The market seemed underwhelmed by last week's earnings announcement from Hongda High-Tech Holding Co.,Ltd. (SZSE:002144) despite the healthy numbers. We did some digging, and we think that investors are missing some encouraging factors in the underlying numbers.

儘管公司營業收入屬於健康水平,但深交所(股票代碼:002144)上市公司宏達高科控股有限公司上週的收益公告似乎並未引起市場熱情。我們進行了一些挖掘,發現投資者們忽略了一些底層數字中鼓舞人心的因素。

How Do Unusual Items Influence Profit?

非常規項目如何影響利潤?

Importantly, our data indicates that Hongda High-Tech HoldingLtd's profit was reduced by CN¥38m, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Hongda High-Tech HoldingLtd took a rather significant hit from unusual items in the year to March 2024. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

重要的是,我們的數據表明,在過去一年中,宏達高科控股有限公司開銷了3800萬元人民幣,最終淨利潤受到了特殊項目的影響。雖然由於特殊項目的減損並不讓人滿意,但有一線希望。在我們分析了全球大部分上市公司後,我們發現特殊項目的支出通常不會重複出現。畢竟,這正是會計術語的含義。在截至2024年3月底的一年中,宏達高科控股有限公司受到了特殊項目的相當大的衝擊。因此,我們可以推測,特殊項目使該公司的法定淨利潤大大削弱。

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hongda High-Tech HoldingLtd.

注意:我們始終建議投資者檢查資產負債表的強度。點擊此處查看我們對宏達高科控股有限公司資產負債表分析的詳細內容。

Our Take On Hongda High-Tech HoldingLtd's Profit Performance

我們對宏達高科控股有限公司盈利表現的看法

As we mentioned previously, the Hongda High-Tech HoldingLtd's profit was hampered by unusual items in the last year. Because of this, we think Hongda High-Tech HoldingLtd's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! And on top of that, its earnings per share have grown at 15% per year over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. To help with this, we've discovered 3 warning signs (1 is a bit unpleasant!) that you ought to be aware of before buying any shares in Hongda High-Tech HoldingLtd.

正如我們之前提到的,宏達高科控股有限公司去年的利潤受到特殊項目的影響。因此,我們認爲宏達高科控股有限公司的潛在盈利能力與法定淨利潤表現一樣優秀,甚至可能更好!此外,它的每股收益在過去三年中增長了15%。當然,在分析其盈利的時候,我們剛剛觸及到了表面,還可以考慮利潤率、預測增長、投資回報率等其他因素。鑑於此,如果您想更多地了解該公司,了解其所涉及的風險是至關重要的。爲幫助您做出判斷,我們發現了3個警示信號(其中有1個有點不愉快!),您在購買宏達高科控股有限公司的任何股票之前都應該了解。

This note has only looked at a single factor that sheds light on the nature of Hongda High-Tech HoldingLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

本文只涵蓋揭示宏達高科控股有限公司利潤情況的單一因素。但如果您能關注細節,肯定可以發現更多。有些人認爲高淨值回報率是優質企業的良好信號。儘管這需要您進行一些研究,但您可能會發現這些高淨值回報率公司的免費收藏或股票內部人員購買的股票清單很有用。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或者,發送電子郵件至editorial-team (at) simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

As we mentioned previously, the Hongda High-Tech HoldingLtd's profit was hampered by unusual items in the last year. Because of this, we think Hongda High-Tech HoldingLtd's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! And on top of that, its earnings per share have grown at 15% per year over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. To help with this, we've discovered 3 warning signs (1 is a bit unpleasant!) that you ought to be aware of before buying any shares in Hongda High-Tech HoldingLtd.

As we mentioned previously, the Hongda High-Tech HoldingLtd's profit was hampered by unusual items in the last year. Because of this, we think Hongda High-Tech HoldingLtd's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! And on top of that, its earnings per share have grown at 15% per year over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. To help with this, we've discovered 3 warning signs (1 is a bit unpleasant!) that you ought to be aware of before buying any shares in Hongda High-Tech HoldingLtd.