A Closer Look at Carvana's Options Market Dynamics

A Closer Look at Carvana's Options Market Dynamics

Financial giants have made a conspicuous bullish move on Carvana. Our analysis of options history for Carvana (NYSE:CVNA) revealed 17 unusual trades.

金融巨頭對Carvana採取了明顯的看漲舉動。我們對Carvana(紐約證券交易所代碼:CVNA)期權歷史的分析顯示了17筆不尋常的交易。

Delving into the details, we found 41% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $749,972, and 4 were calls, valued at $322,415.

深入研究細節,我們發現41%的交易者看漲,而41%的交易者表現出看跌傾向。在我們發現的所有交易中,有13筆是看跌期權,價值749,972美元,4筆是看漲期權,價值322,415美元。

Predicted Price Range

預測的價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $20.0 to $130.0 for Carvana over the recent three months.

根據交易活動,看來重要投資者的目標是在最近三個月中將Carvana的價格範圍從20.0美元擴大到130.0美元。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

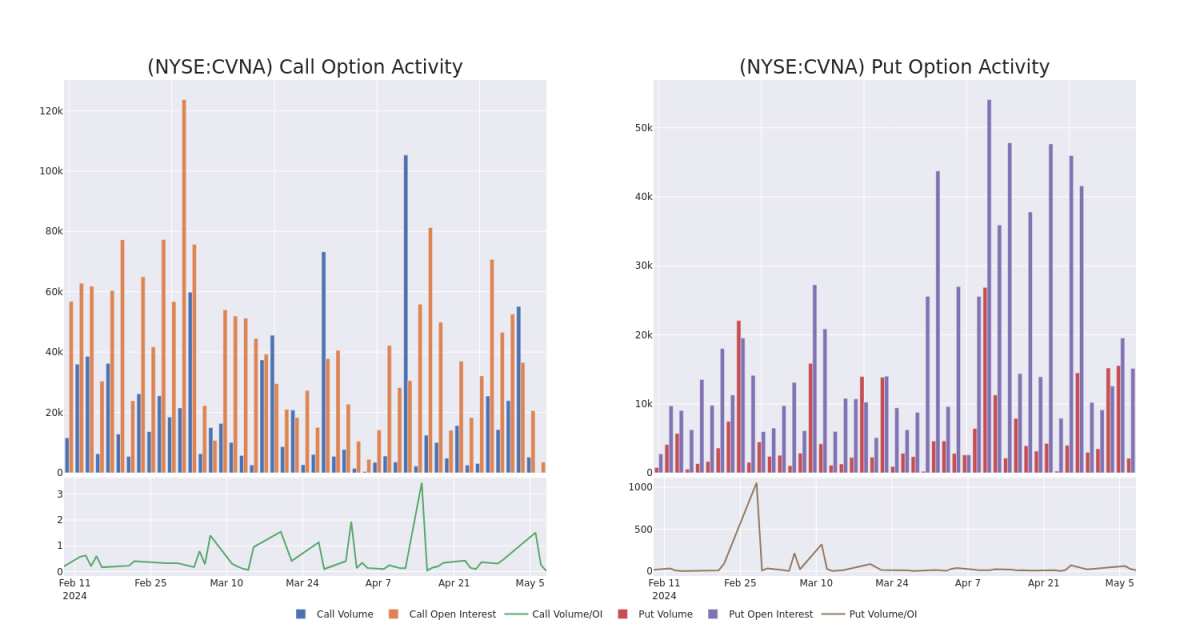

In today's trading context, the average open interest for options of Carvana stands at 1100.88, with a total volume reaching 2,168.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Carvana, situated within the strike price corridor from $20.0 to $130.0, throughout the last 30 days.

在今天的交易背景下,Carvana期權的平均未平倉合約爲1100.88,總成交量達到2,168.00。隨附的圖表描繪了過去30天內Carvana高價值交易的看漲期權和看跌期權交易量以及未平倉合約的變化,行使價走勢從20.0美元到130.0美元不等。

Carvana Call and Put Volume: 30-Day Overview

Carvana 看漲和看跌交易量:30 天概述

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | PUT | SWEEP | BULLISH | 11/15/24 | $18.9 | $18.55 | $18.55 | $100.00 | $159.5K | 246 | 92 |

| CVNA | PUT | TRADE | BULLISH | 11/15/24 | $21.65 | $21.05 | $21.05 | $105.00 | $151.5K | 9 | 72 |

| CVNA | CALL | TRADE | BULLISH | 09/20/24 | $48.5 | $48.35 | $48.5 | $70.00 | $106.7K | 200 | 22 |

| CVNA | CALL | TRADE | NEUTRAL | 01/17/25 | $97.15 | $93.4 | $95.22 | $20.00 | $95.2K | 1.4K | 0 |

| CVNA | CALL | SWEEP | BEARISH | 05/17/24 | $1.91 | $1.69 | $1.73 | $125.00 | $86.9K | 1.0K | 43 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | 放 | 掃 | 看漲 | 11/15/24 | 18.9 美元 | 18.55 美元 | 18.55 美元 | 100.00 美元 | 159.5 萬美元 | 246 | 92 |

| CVNA | 放 | 貿易 | 看漲 | 11/15/24 | 21.65 美元 | 21.05 美元 | 21.05 美元 | 105.00 美元 | 151.5 萬美元 | 9 | 72 |

| CVNA | 打電話 | 貿易 | 看漲 | 09/20/24 | 48.5 美元 | 48.35 美元 | 48.5 美元 | 70.00 美元 | 106.7 萬美元 | 200 | 22 |

| CVNA | 打電話 | 貿易 | 中立 | 01/17/25 | 97.15 美元 | 93.4 美元 | 95.22 美元 | 20.00 美元 | 95.2 萬美元 | 1.4K | 0 |

| CVNA | 打電話 | 掃 | 粗魯的 | 05/17/24 | 1.91 | 1.69 美元 | 1.73 美元 | 125.00 美元 | 86.9 萬美元 | 1.0K | 43 |

About Carvana

關於 Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

Carvana Co是一個用於買賣二手車的電子商務平台。該公司的收入來自二手車銷售、批發汽車銷售以及其他銷售和收入。其他銷售和收入包括在證券化交易中發放和出售的貸款或向融資合作伙伴出售的貸款、從VSC獲得的佣金和GAP豁免保險的銷售。該業務的基礎是零售車輛的銷售。這推動了大部分收入,使公司能夠獲得與融資、VSC、汽車保險和GAP豁免保險以及以舊換新車輛相關的額外收入來源。

In light of the recent options history for Carvana, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於Carvana最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Where Is Carvana Standing Right Now?

Carvana 現在站在哪裏?

- With a trading volume of 1,514,310, the price of CVNA is down by -1.19%, reaching $115.27.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 70 days from now.

- CVNA的交易量爲1,514,310美元,下跌了-1.19%,至115.27美元。

- 當前的RSI值表明該股可能已被超買。

- 下一份收益報告定於70天后發佈。

Professional Analyst Ratings for Carvana

Carvana的專業分析師評級

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $89.4.

在過去的30天中,共有5位專業分析師對該股發表了看法,將平均目標股價定爲89.4美元。

- Consistent in their evaluation, an analyst from TD Cowen keeps a Hold rating on Carvana with a target price of $110.

- An analyst from Evercore ISI Group has decided to maintain their In-Line rating on Carvana, which currently sits at a price target of $77.

- Consistent in their evaluation, an analyst from Baird keeps a Neutral rating on Carvana with a target price of $110.

- An analyst from Wedbush has revised its rating downward to Neutral, adjusting the price target to $80.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Carvana, which currently sits at a price target of $70.

- 道明考恩的一位分析師在評估中保持對Carvana的持有評級,目標價爲110美元。

- Evercore ISI集團的一位分析師已決定維持對Carvana的在線評級,目前的目標股價爲77美元。

- 貝爾德的一位分析師在評估中保持對Carvana的中性評級,目標價爲110美元。

- Wedbush的一位分析師已將其評級下調至中性,將目標股價調整爲80美元。

- 摩根大通的一位分析師決定維持對Carvana的中性評級,目前的目標股價爲70美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

In today's trading context, the average open interest for options of Carvana stands at 1100.88, with a total volume reaching 2,168.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Carvana, situated within the strike price corridor from $20.0 to $130.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Carvana stands at 1100.88, with a total volume reaching 2,168.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Carvana, situated within the strike price corridor from $20.0 to $130.0, throughout the last 30 days.