Revenues Working Against Eastern Pioneer Driving School Co., Ltd's (SHSE:603377) Share Price Following 33% Dive

Revenues Working Against Eastern Pioneer Driving School Co., Ltd's (SHSE:603377) Share Price Following 33% Dive

Eastern Pioneer Driving School Co., Ltd (SHSE:603377) shares have had a horrible month, losing 33% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 73% share price decline.

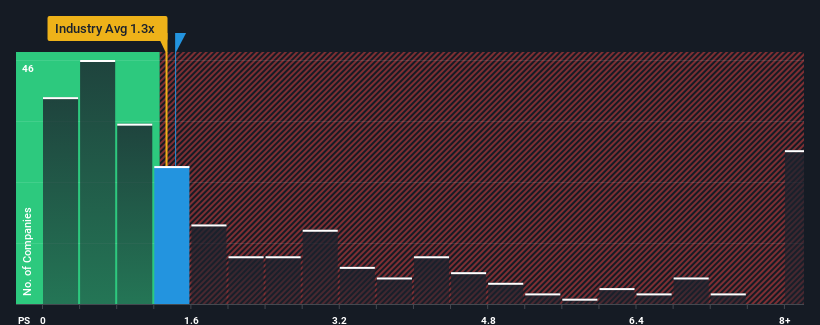

After such a large drop in price, Eastern Pioneer Driving School's price-to-sales (or "P/S") ratio of 1.4x might make it look like a strong buy right now compared to the wider Consumer Services industry in China, where around half of the companies have P/S ratios above 3.7x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Eastern Pioneer Driving School's P/S Mean For Shareholders?

The recent revenue growth at Eastern Pioneer Driving School would have to be considered satisfactory if not spectacular. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Eastern Pioneer Driving School's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Eastern Pioneer Driving School?

The only time you'd be truly comfortable seeing a P/S as depressed as Eastern Pioneer Driving School's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 7.4%. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 35% shows it's noticeably less attractive.

With this information, we can see why Eastern Pioneer Driving School is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Having almost fallen off a cliff, Eastern Pioneer Driving School's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

In line with expectations, Eastern Pioneer Driving School maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Before you settle on your opinion, we've discovered 3 warning signs for Eastern Pioneer Driving School (2 are concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Eastern Pioneer Driving School, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.