We Think Some Shareholders May Hesitate To Increase Founder Holdings Limited's (HKG:418) CEO Compensation

We Think Some Shareholders May Hesitate To Increase Founder Holdings Limited's (HKG:418) CEO Compensation

Key Insights

關鍵見解

- Founder Holdings will host its Annual General Meeting on 28th of May

- Total pay for CEO Xing Shao includes HK$1.18m salary

- The total compensation is 66% higher than the average for the industry

- Founder Holdings' three-year loss to shareholders was 31% while its EPS grew by 3.5% over the past three years

- 方正控股將於5月28日舉辦年度股東大會

- 首席執行官邵星的總薪酬包括118萬港元的薪水

- 總薪酬比該行業的平均水平高66%

- 方正控股三年股東虧損爲31%,而其每股收益在過去三年中增長了3.5%

In the past three years, the share price of Founder Holdings Limited (HKG:418) has struggled to grow and now shareholders are sitting on a loss. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 28th of May could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

在過去的三年中,方正控股有限公司(HKG: 418)的股價一直難以增長,現在股東們處於虧損狀態。令人擔憂的是,儘管每股收益正增長,但股價並未跟上基本面趨勢。5月28日舉行的股東周年大會可能是股東提請董事會注意這些擔憂的機會。他們還可以嘗試通過對高管薪酬和其他公司事務等決議進行表決,影響管理層和公司方向。以下是我們對股東目前在批准首席執行官加薪時可能需要謹慎行事的看法。

How Does Total Compensation For Xing Shao Compare With Other Companies In The Industry?

星少的總薪酬與業內其他公司相比如何?

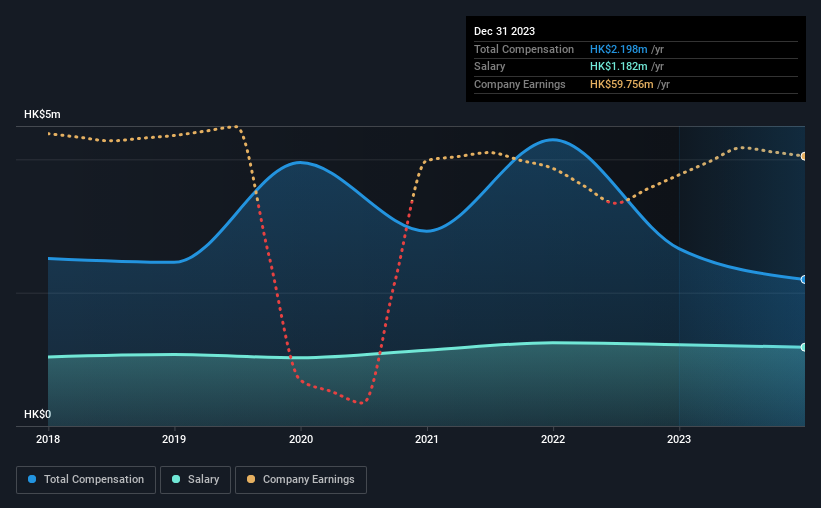

According to our data, Founder Holdings Limited has a market capitalization of HK$624m, and paid its CEO total annual compensation worth HK$2.2m over the year to December 2023. We note that's a decrease of 17% compared to last year. In particular, the salary of HK$1.18m, makes up a fairly large portion of the total compensation being paid to the CEO.

根據我們的數據,方正控股有限公司的市值爲6.24億港元,在截至2023年12月的一年中,向其首席執行官支付的年薪總額爲220萬港元。我們注意到,與去年相比下降了17%。特別是,118萬港元的薪水在支付給首席執行官的總薪酬中佔相當大的比例。

For comparison, other companies in the Hong Kong Software industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.3m. Accordingly, our analysis reveals that Founder Holdings Limited pays Xing Shao north of the industry median. Moreover, Xing Shao also holds HK$6.6m worth of Founder Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

相比之下,香港軟件行業其他市值低於16億港元的公司報告稱,首席執行官的總薪酬中位數爲130萬港元。因此,我們的分析顯示,方正控股有限公司向邢少支付的薪酬低於行業中位數。此外,邵星還直接以自己的名義持有價值660萬港元的方正控股股票,這向我們表明他們在該公司擁有大量個人股份。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$1.2m | HK$1.2m | 54% |

| Other | HK$1.0m | HK$1.4m | 46% |

| Total Compensation | HK$2.2m | HK$2.7m | 100% |

| 組件 | 2023 | 2022 | 比例 (2023) |

| 工資 | 120 萬港元 | 120 萬港元 | 54% |

| 其他 | 100 萬港元 | 140 萬港元 | 46% |

| 總薪酬 | 220 萬港元 | 270 萬港元 | 100% |

On an industry level, roughly 59% of total compensation represents salary and 41% is other remuneration. Founder Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

在行業層面上,總薪酬中約有59%代表工資,41%是其他薪酬。就工資在總薪酬中所佔份額而言,方正控股在很大程度上反映了行業平均水平。如果工資是總薪酬的主要組成部分,則表明無論業績如何,首席執行官在總薪酬中獲得的固定比例更高。

Founder Holdings Limited's Growth

方正控股有限公司的成長

Founder Holdings Limited has seen its earnings per share (EPS) increase by 3.5% a year over the past three years. It achieved revenue growth of 2.6% over the last year.

在過去三年中,方正控股有限公司的每股收益(EPS)每年增長3.5%。去年,它實現了2.6%的收入增長。

We're not particularly impressed by the revenue growth, but we're happy with the modest EPS growth. So there are some positives here, but not enough to earn high praise. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

收入增長並沒有給我們留下特別深刻的印象,但我們對每股收益的溫和增長感到滿意。因此,這裏有一些積極的方面,但還不足以贏得高度讚揚。儘管我們沒有分析師的預測,但您可能需要評估這種數據豐富的收益、收入和現金流可視化。

Has Founder Holdings Limited Been A Good Investment?

方正控股有限公司是一項不錯的投資嗎?

With a total shareholder return of -31% over three years, Founder Holdings Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

三年內股東總回報率爲-31%,方正控股有限公司的股東基本上會感到失望。這表明該公司向首席執行官支付過於慷慨的薪水是不明智的。

In Summary...

總而言之...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

儘管其收益有所增長,但過去三年股價的下跌無疑令人擔憂。當收益增長時,股價增長的巨大滯後可能表明目前市場關注的還有其他問題正在影響公司。股東們可能很想知道還有哪些其他因素可能壓制該股。即將舉行的股東周年大會將是股東有機會就關鍵問題向董事會提問,例如首席執行官薪酬或他們可能遇到的任何其他問題,並重新審視與公司有關的投資論點。

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for Founder Holdings that you should be aware of before investing.

首席執行官薪酬可以對績效產生巨大影響,但這只是一個因素。這就是爲什麼我們進行了一些挖掘並確定了方正控股的3個警告信號,在投資之前你應該注意這些信號。

Important note: Founder Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

重要提示:方正控股是一隻令人興奮的股票,但我們知道投資者可能正在尋找未支配的資產負債表和豐厚的回報。你可能會在這份投資回報率高、負債低的有趣公司清單中找到更好的東西。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

On an industry level, roughly 59% of total compensation represents salary and 41% is other remuneration. Founder Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

On an industry level, roughly 59% of total compensation represents salary and 41% is other remuneration. Founder Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.