Shareholders May Be Wary Of Increasing Shenzhou International Group Holdings Limited's (HKG:2313) CEO Compensation Package

Shareholders May Be Wary Of Increasing Shenzhou International Group Holdings Limited's (HKG:2313) CEO Compensation Package

Key Insights

關鍵見解

- Shenzhou International Group Holdings will host its Annual General Meeting on 28th of May

- Salary of CN¥4.38m is part of CEO Guanlin Huang's total remuneration

- Total compensation is similar to the industry average

- Shenzhou International Group Holdings' EPS declined by 3.7% over the past three years while total shareholder loss over the past three years was 58%

- 神州國際集團控股公司將於5月28日舉辦年度股東大會

- 438萬元人民幣的薪水是首席執行官黃冠林總薪酬的一部分

- 總薪酬與行業平均水平相似

- 神州國際集團控股的每股收益在過去三年中下降了3.7%,而過去三年的股東總虧損爲58%

Shenzhou International Group Holdings Limited (HKG:2313) has not performed well recently and CEO Guanlin Huang will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 28th of May. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

神州國際集團控股有限公司(HKG: 2313)最近表現不佳,首席執行官黃冠林可能需要加緊努力。股東們將對董事會在5月28日的下一次股東周年大會上對扭轉業績的看法感興趣。這也將是股東通過對高管薪酬等公司決議進行投票來影響管理層的機會,這可能會對公司產生重大影響。我們在下面提供的數據解釋了爲什麼我們認爲首席執行官的薪酬與最近的表現不一致。

Comparing Shenzhou International Group Holdings Limited's CEO Compensation With The Industry

將神州國際集團控股有限公司的首席執行官薪酬與業界進行比較

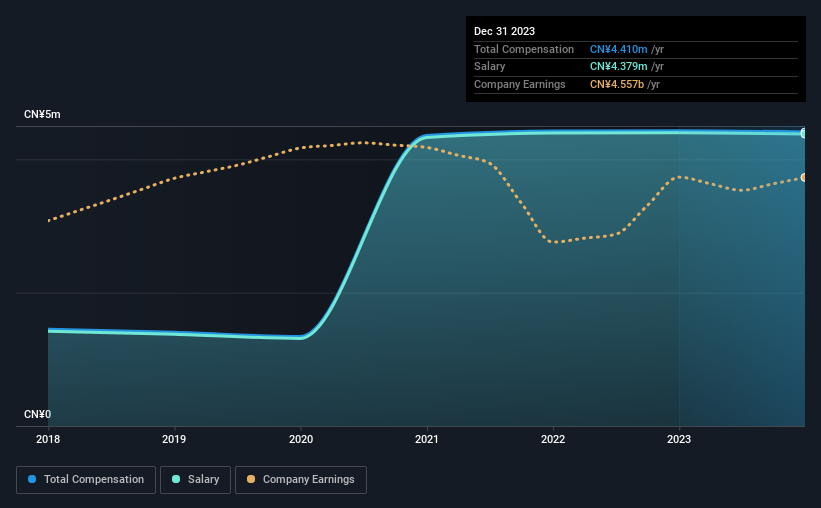

Our data indicates that Shenzhou International Group Holdings Limited has a market capitalization of HK$121b, and total annual CEO compensation was reported as CN¥4.4m for the year to December 2023. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is CN¥4.38m, represents most of the total compensation being paid.

我們的數據顯示,神州國際集團控股有限公司的市值爲121億港元,截至2023年12月的一年中,首席執行官的年度總薪酬爲440萬元人民幣。與去年的薪酬相比,這基本持平。值得注意的是,438萬元人民幣的工資佔總薪酬的大部分。

For comparison, other companies in the Hong Kong Luxury industry with market capitalizations above HK$62b, reported a median total CEO compensation of CN¥5.1m. This suggests that Shenzhou International Group Holdings remunerates its CEO largely in line with the industry average.

相比之下,香港奢侈品行業其他市值超過620億港元的公司報告稱,首席執行官的總薪酬中位數爲510萬元人民幣。這表明神州國際集團控股公司首席執行官的薪酬基本符合行業平均水平。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥4.4m | CN¥4.4m | 99% |

| Other | CN¥31k | CN¥30k | 1% |

| Total Compensation | CN¥4.4m | CN¥4.4m | 100% |

| 組件 | 2023 | 2022 | 比例 (2023) |

| 工資 | 440 萬元人民幣 | 440 萬元人民幣 | 99% |

| 其他 | 3.1萬元人民幣 | 人民幣 30,000 元 | 1% |

| 總薪酬 | 440 萬元人民幣 | 440 萬元人民幣 | 100% |

Talking in terms of the industry, salary represented approximately 94% of total compensation out of all the companies we analyzed, while other remuneration made up 6% of the pie. Investors will find it interesting that Shenzhou International Group Holdings pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

就行業而言,在我們分析的所有公司中,工資約佔總薪酬的94%,而其他薪酬佔總薪酬的6%。投資者會發現有趣的是,神州國際集團控股通過傳統的薪資而不是非工資福利來支付其大部分回報。如果總薪酬轉向工資,則表明可變部分(通常與績效掛鉤)較低。

A Look at Shenzhou International Group Holdings Limited's Growth Numbers

看看神州國際集團控股有限公司的增長數字

Over the last three years, Shenzhou International Group Holdings Limited has shrunk its earnings per share by 3.7% per year. Its revenue is down 10% over the previous year.

在過去三年中,神州國際集團控股有限公司的每股收益每年縮水3.7%。其收入比上年下降了10%。

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

總體而言,這對股東來說並不是一個非常積極的結果。當你考慮到收入同比下降時,印象會更糟。這些因素表明,業務表現並不能真正證明首席執行官的高薪是合理的。展望未來,您可能需要查看這份關於分析師對公司未來收益預測的免費可視化報告。

Has Shenzhou International Group Holdings Limited Been A Good Investment?

神州國際集團控股有限公司是一項不錯的投資嗎?

With a total shareholder return of -58% over three years, Shenzhou International Group Holdings Limited shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

三年內股東總回報率爲-58%,神州國際集團控股有限公司的股東基本上會感到失望。因此,如果首席執行官獲得豐厚的報酬,可能會讓股東感到不安。

To Conclude...

總而言之...

Guanlin receives almost all of their compensation through a salary. Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

關林幾乎所有的薪酬都是通過工資獲得的。除了業務表現不佳外,股東的投資股價回報率也很差,這表明他們支持首席執行官加薪的可能性微乎其微。在即將舉行的股東周年大會上,他們可以質疑管理層扭轉業績的計劃和策略,並重新評估他們對公司的投資理念。

Whatever your view on compensation, you might want to check if insiders are buying or selling Shenzhou International Group Holdings shares (free trial).

無論你對薪酬有何看法,你都可能需要檢查內部人士是否在買入或賣出神州國際集團控股的股票(免費試用)。

Important note: Shenzhou International Group Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

重要提示:神州國際集團控股是一隻令人興奮的股票,但我們知道投資者可能正在尋找未支配的資產負債表和豐厚的回報。你可能會在這份投資回報率高、負債低的有趣公司清單中找到更好的東西。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。