What Zoje Resources Investment Co., Ltd.'s (SZSE:002021) 28% Share Price Gain Is Not Telling You

What Zoje Resources Investment Co., Ltd.'s (SZSE:002021) 28% Share Price Gain Is Not Telling You

The Zoje Resources Investment Co., Ltd. (SZSE:002021) share price has done very well over the last month, posting an excellent gain of 28%. The last month tops off a massive increase of 126% in the last year.

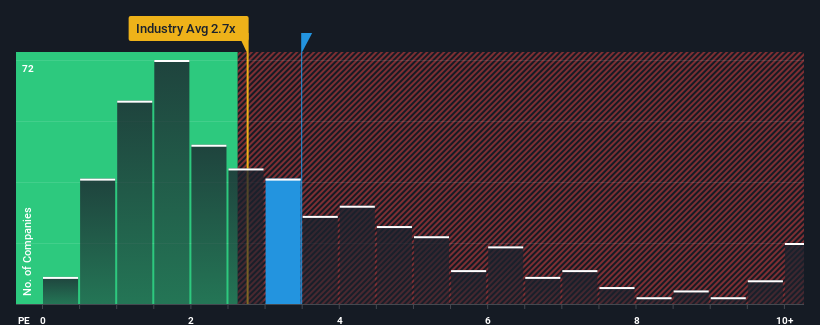

After such a large jump in price, you could be forgiven for thinking Zoje Resources Investment is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in China's Machinery industry have P/S ratios below 2.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does Zoje Resources Investment's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Zoje Resources Investment over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Zoje Resources Investment, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Zoje Resources Investment's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Zoje Resources Investment's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 1.0% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 18% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that Zoje Resources Investment's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Zoje Resources Investment's P/S

The large bounce in Zoje Resources Investment's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Zoje Resources Investment currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Zoje Resources Investment with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.