Should Shareholders Reconsider Golden Wheel Tiandi Holdings Company Limited's (HKG:1232) CEO Compensation Package?

Should Shareholders Reconsider Golden Wheel Tiandi Holdings Company Limited's (HKG:1232) CEO Compensation Package?

Key Insights

關鍵見解

- Golden Wheel Tiandi Holdings will host its Annual General Meeting on 29th of May

- CEO Kam Fai Wong's total compensation includes salary of CN¥3.99m

- Total compensation is 144% above industry average

- Golden Wheel Tiandi Holdings' EPS declined by 30% over the past three years while total shareholder loss over the past three years was 83%

- 金輪天地控股將於5月29日舉辦年度股東大會

- 首席執行官黃錦輝的總薪酬包括399萬元人民幣的工資

- 總薪酬比行業平均水平高144%

- 金輪天地控股的每股收益在過去三年中下降了30%,而過去三年的股東總虧損爲83%

Shareholders will probably not be too impressed with the underwhelming results at Golden Wheel Tiandi Holdings Company Limited (HKG:1232) recently. At the upcoming AGM on 29th of May, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

金輪天地控股有限公司(HKG: 1232)最近表現不佳,可能不會給股東留下太深刻的印象。在即將於5月29日舉行的股東大會上,股東們可以聽取董事會的意見,包括他們扭轉業績的計劃。他們還將有機會通過對諸如高管薪酬之類的決議進行投票來影響管理決策,這可能會影響企業未來的價值。我們在下面提供的數據解釋了爲什麼我們認爲首席執行官的薪酬與最近的表現不一致。

How Does Total Compensation For Kam Fai Wong Compare With Other Companies In The Industry?

黃錦輝的總薪酬與業內其他公司相比如何?

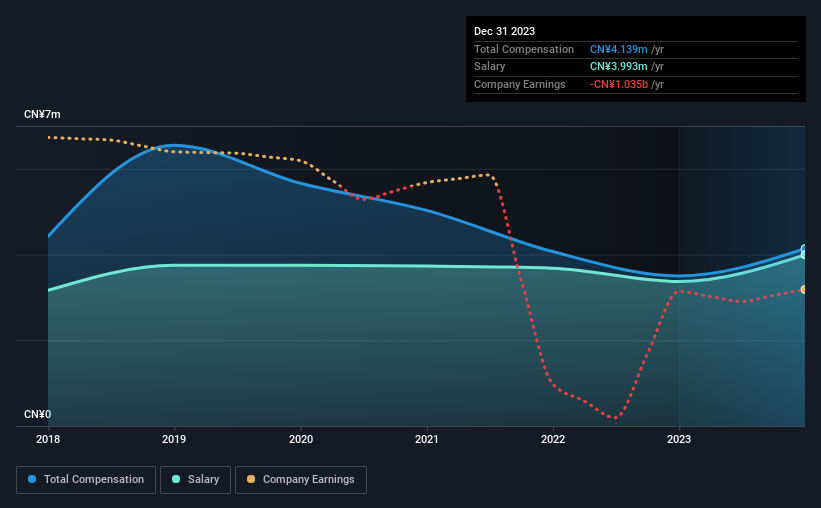

According to our data, Golden Wheel Tiandi Holdings Company Limited has a market capitalization of HK$160m, and paid its CEO total annual compensation worth CN¥4.1m over the year to December 2023. We note that's an increase of 18% above last year. Notably, the salary which is CN¥3.99m, represents most of the total compensation being paid.

根據我們的數據,金輪天地控股有限公司的市值爲1.6億港元,在截至2023年12月的一年中,向其首席執行官支付的年薪總額爲410萬元人民幣。我們注意到這比去年增長了18%。值得注意的是,399萬元人民幣的工資佔總薪酬的大部分。

In comparison with other companies in the Hong Kong Real Estate industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥1.7m. Accordingly, our analysis reveals that Golden Wheel Tiandi Holdings Company Limited pays Kam Fai Wong north of the industry median. Furthermore, Kam Fai Wong directly owns HK$1.3m worth of shares in the company.

與香港房地產行業其他市值低於16億港元的公司相比,報告的首席執行官總薪酬中位數爲170萬元人民幣。因此,我們的分析顯示,金輪天地控股有限公司向黃錦輝支付的薪水位於行業中位數以北。此外,黃錦輝直接擁有該公司價值130萬港元的股份。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥4.0m | CN¥3.4m | 96% |

| Other | CN¥146k | CN¥132k | 4% |

| Total Compensation | CN¥4.1m | CN¥3.5m | 100% |

| 組件 | 2023 | 2022 | 比例 (2023) |

| 工資 | 400 萬元人民幣 | 340 萬元人民幣 | 96% |

| 其他 | 146k 人民幣 | 人民幣 132k | 4% |

| 總薪酬 | 410 萬元人民幣 | 350 萬元人民幣 | 100% |

On an industry level, around 77% of total compensation represents salary and 23% is other remuneration. Golden Wheel Tiandi Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

在行業層面上,總薪酬中約有77%代表工資,23%是其他薪酬。金輪天地控股支付高薪,與非工資薪酬相比,更多地關注薪酬的這一方面。如果總薪酬轉向工資,則表明可變部分(通常與績效掛鉤)較低。

A Look at Golden Wheel Tiandi Holdings Company Limited's Growth Numbers

看看金輪天地控股有限公司的增長數字

Over the last three years, Golden Wheel Tiandi Holdings Company Limited has shrunk its earnings per share by 30% per year. It saw its revenue drop 10% over the last year.

在過去三年中,金輪天地控股有限公司的每股收益每年縮水30%。它的收入比去年下降了10%。

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

總體而言,這對股東來說並不是一個非常積極的結果。收入同比下降這一事實可以說描繪了一幅醜陋的畫面。很難說該公司正在全力以赴,因此股東可能不願接受高額的首席執行官薪酬。雖然我們沒有分析師對公司的預測,但股東們可能需要查看這張詳細的收益、收入和現金流歷史圖表。

Has Golden Wheel Tiandi Holdings Company Limited Been A Good Investment?

金輪天地控股有限公司是一項不錯的投資嗎?

The return of -83% over three years would not have pleased Golden Wheel Tiandi Holdings Company Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

三年內-83%的回報率不會讓金輪天地控股有限公司的股東感到高興。這表明該公司向首席執行官支付過於慷慨的薪水是不明智的。

In Summary...

總而言之...

Golden Wheel Tiandi Holdings pays its CEO a majority of compensation through a salary. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

金輪天地控股通過工資向其首席執行官支付大部分薪酬。股東不僅沒有獲得可觀的投資回報,而且業務表現也不佳。很少有股東願意向首席執行官加薪。在即將舉行的股東周年大會上,他們可以質疑管理層扭轉業績的計劃和策略,並重新評估他們對公司的投資理念。

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Golden Wheel Tiandi Holdings (2 are significant!) that you should be aware of before investing here.

首席執行官的薪酬只是考察業務績效時需要考慮的衆多因素之一。我們爲金輪天地控股確定了3個警告信號(2個很重要!)在這裏投資之前,您應該注意這一點。

Switching gears from Golden Wheel Tiandi Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

從金輪天地控股轉型,如果你正在尋找良好的資產負債表和溢價回報,那麼這份免費的高回報、低負債公司清單是一個不錯的選擇。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

On an industry level, around 77% of total compensation represents salary and 23% is other remuneration. Golden Wheel Tiandi Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

On an industry level, around 77% of total compensation represents salary and 23% is other remuneration. Golden Wheel Tiandi Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.