Mianyang Fulin Precision Co.,Ltd.'s (SZSE:300432) Last Week's 5.3% Decline Must Have Disappointed Retail Investors Who Have a Significant Stake

Mianyang Fulin Precision Co.,Ltd.'s (SZSE:300432) Last Week's 5.3% Decline Must Have Disappointed Retail Investors Who Have a Significant Stake

Key Insights

主要見解

- The considerable ownership by retail investors in Mianyang Fulin PrecisionLtd indicates that they collectively have a greater say in management and business strategy

- The top 25 shareholders own 40% of the company

- Ownership research, combined with past performance data can help provide a good understanding of opportunities in a stock

- 綿陽富臨精工有大量散戶股東,這意味着他們在公司的管理和業務策略中共同具有更大的發言權。

- 前 25 名股東擁有該公司的 40%。

- 所有權研究結合過去的表現數據可以幫助更好地理解股票的機會。

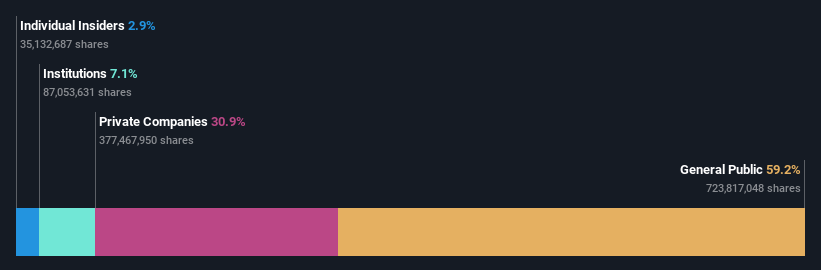

A look at the shareholders of Mianyang Fulin Precision Co.,Ltd. (SZSE:300432) can tell us which group is most powerful. We can see that retail investors own the lion's share in the company with 59% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

看一下綿陽富臨精工股份有限公司(SZSE:300432)的股東就可以知道哪個集團最強大。我們可以看到,散戶持有公司的大部分股權,佔比達到59%。換句話說,該集團將獲得最多(或損失最多)的是他們對該公司的投資。

As market cap fell to CN¥9.0b last week, retail investors would have faced the highest losses than any other shareholder groups of the company.

隨着市值上週紛紛下跌至90億元,綿陽富臨精工的散戶股東將面臨最大的損失。

In the chart below, we zoom in on the different ownership groups of Mianyang Fulin PrecisionLtd.

在下圖中,我們可以看到綿陽富臨精工有不同的股權所有人。

What Does The Institutional Ownership Tell Us About Mianyang Fulin PrecisionLtd?

機構投資者對綿陽富臨精工有何看法?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

機構投資者通常將自己的回報與常見的指數回報進行比較。因此,他們通常會考慮購買包括在相關基準指數中的較大公司。

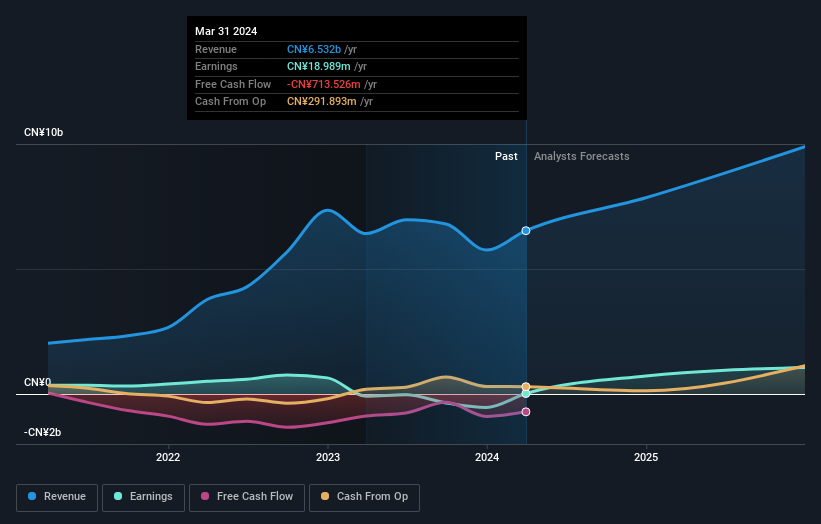

As you can see, institutional investors have a fair amount of stake in Mianyang Fulin PrecisionLtd. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Mianyang Fulin PrecisionLtd's earnings history below. Of course, the future is what really matters.

如您所見,機構投資者在綿陽富臨精工擁有相當的股份。這意味着那些機構的分析師已經看過這支股票並看好了它,但就像其他任何人一樣,他們也可能是錯的。如果多家機構同時改變他們對一個股票的看法,您可能會看到股價迅速下跌。因此,值得看一下綿陽富臨精工以下的營收歷史。當然,未來才是真正重要的。

We note that hedge funds don't have a meaningful investment in Mianyang Fulin PrecisionLtd. Looking at our data, we can see that the largest shareholder is Sichuan Fulin Industrial Group Co., Ltd. with 30% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 1.2% and 0.8%, of the shares outstanding, respectively.

我們注意到對綿陽富臨精工的對沖基金沒有實質性的投資。從我們的數據來看,最大的股東是四川富臨實業集團有限公司,持有30%的流通股。同時,第二大和第三大股東分別持有流通股的1.2%和0.8%。

Our studies suggest that the top 25 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

我們的研究表明,前25大股東共控制了公司股份的不到一半,這意味着公司的股份廣泛分散,沒有主導股東。

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

雖然研究公司的機構持股數據是有意義的,但研究分析師情緒來了解風向也是有意義的。雖然有些股票受到分析師的關注,但該公司可能並未受到廣泛關注。因此,它可能在路上獲得更多關注。

Insider Ownership Of Mianyang Fulin PrecisionLtd

綿陽富臨精工有內部股東持股。這是一家大公司,所以看到這種程度的一致性是好的。內部人持有價值2580萬人民幣的股份(按當前價格計算)。如果您想探討內部人員的一致性問題,可以單擊此處查看內部人員是否一直在購買或出售。

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

雖然內部人員的具體定義可能是主觀的,但幾乎所有人都認爲董事會成員是內部人員。公司管理層應向董事會回答問題,後者應代表股東的利益。值得注意的是,有時高層管理人員也會成爲董事會成員。

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

我通常認爲內部人士持股是一件好事。但是,在某些情況下,它會使其他股東更難以對董事會的決定進行問責。

We can see that insiders own shares in Mianyang Fulin Precision Co.,Ltd.. This is a big company, so it is good to see this level of alignment. Insiders own CN¥258m worth of shares (at current prices). If you would like to explore the question of insider alignment, you can click here to see if insiders have been buying or selling.

普通大衆,通常是個人投資者,持有綿陽富臨精工的大量股權,表明這是一隻相當受歡迎的股票。這種所有權水平使得來自更廣泛公衆的投資者在關鍵政策決策方面具有一定的影響力,例如董事會構成、高管薪酬和股息支付比率。

General Public Ownership

一般大衆所有權

The general public, who are usually individual investors, hold a substantial 59% stake in Mianyang Fulin PrecisionLtd, suggesting it is a fairly popular stock. This level of ownership gives investors from the wider public some power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

雖然考慮擁有公司的不同團體是值得的,但還有更重要的因素。例如,我們已經認定了綿陽富臨精工的1個警告信號,您應該注意一下。

Private Company Ownership

私有公司的所有權

Our data indicates that Private Companies hold 31%, of the company's shares. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

我們的數據顯示,私營企業持有公司的31%股份。僅憑這一事實很難得出任何結論,因此值得調查誰擁有這些私營企業。有時,內部人員或其他相關方可能通過單獨的私營企業對一家公共公司的股份產生利益。

Next Steps:

下一步:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. For instance, we've identified 1 warning sign for Mianyang Fulin PrecisionLtd that you should be aware of.

雖然考慮擁有公司的不同團體是值得的,但還有更重要的因素。例如,我們已經認定了綿陽富臨精工的1個警告信號,您應該注意一下。

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

但最終,決定該業務所有者將獲得多大利益的是未來而非過去。因此,我們認爲最好查看此免費報告,以了解分析師是否預測更光明的未來。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注:本文中的數據是使用最後一個財務報表日期結束的爲期12個月的數據計算的。這可能與全年年度報告數據不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?關於內容有所顧慮?直接和我們聯繫。或電郵 editorial-team (at) simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。